Chapter 10

Introduction to the Cost of Capital

By Boundless

Risk, return, and the time value of money are central inputs in distilling the cost of capital as an investor or borrower.

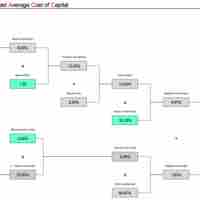

The average cost of capital is calculated via combining the overall average required rate on debt stakeholders and equity stakeholders

Financial policy, not cost of capital, must be utilized to determine which investments to pursue, given that resources are limited.

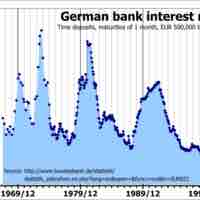

The cost of debt is a calculation taking into account the risk premium, the risk-free rate and taxes.

The cost of preferred stock is equal to the preferred dividend divided by the preferred stock price, plus the expected growth rate.

The cost of common equity is an imperfect calculation, an estimation based upon valuing the firms risk relative to the market.

Due to the relationship between retained earnings and dividends, the cost of retained earnings as a source of capital is relative to the overall cost of equity.

Issuing new common stock is a time intensive process that gives access to capital with various direct and indirect costs.

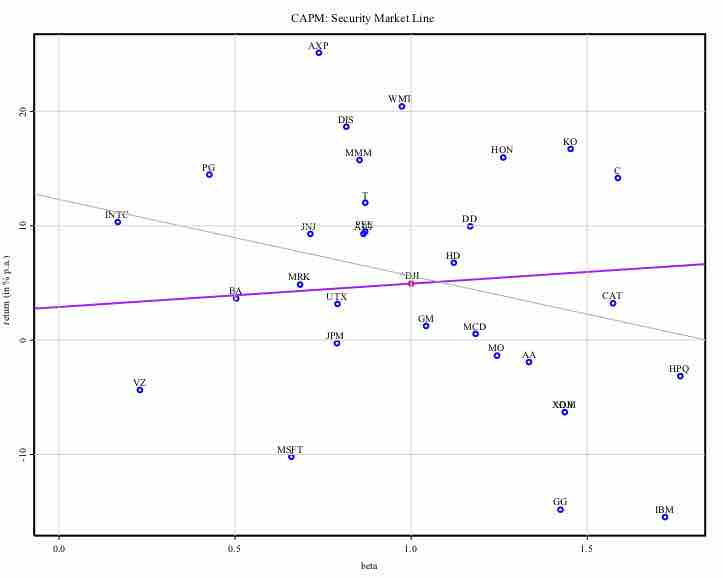

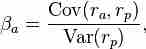

The capital asset pricing model helps investors assess the required rate of return on a given asset by measuring sensitivity to risk.

The SML is the graphical representation of CAPM used to determine if an asset is priced to offer a reasonable expected return for the risk.

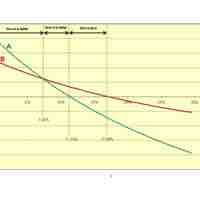

A discounted cash flow analysis is a highly useful tool for calculating the net present value of a given product, process, asset, or organization.

We can estimate the value of a company's equity by adding its risk premium to the yield to maturity on the company's long-term debt.

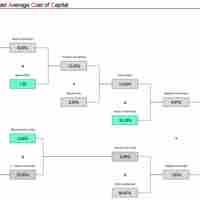

The weighted average cost of capital (WACC) is a calculation that reflects how much an organization pays in interest when acquiring financing options.

The weightings used in the WACC are ratios of the market values of various forms of debt and equity used in a company's financing.

Decisions about capital structure (ratio of debt and equity) alongside projecting rates of return can give firms some internal control over capital costs.

The weighted average cost of capital is vulnerable to market risks, interest rate changes, inflation, economic factors, and tax rates.

New projects sometimes require taking on risks outside of a company's current scope, resulting in the need to adjust risk in the WACC.

Problems arise in calculating components of WACC because differing methods and proxy values result in widely varying costs of capital.