Section 3

Approaches to Calculating the Cost of Capital

Book

Version 3

By Boundless

By Boundless

Boundless Finance

Finance

by Boundless

4 concepts

The Capital Asset Pricing Model

The capital asset pricing model helps investors assess the required rate of return on a given asset by measuring sensitivity to risk.

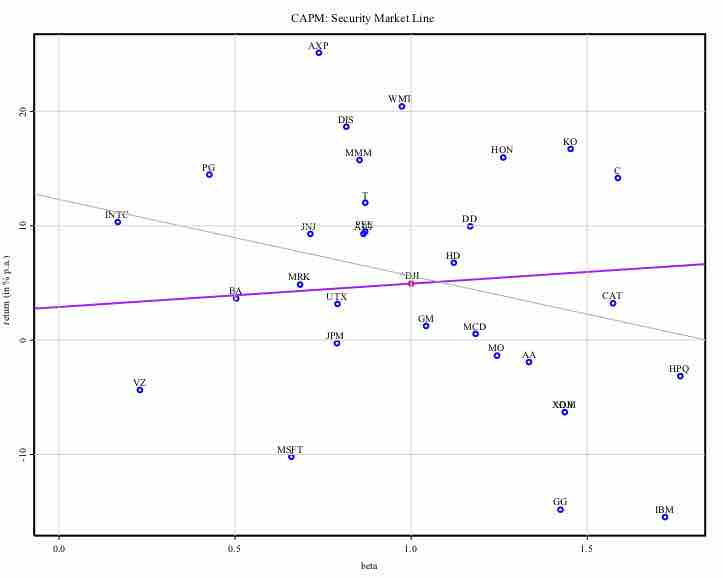

The SML Approach

The SML is the graphical representation of CAPM used to determine if an asset is priced to offer a reasonable expected return for the risk.

Discounted Cash Flow Approach

A discounted cash flow analysis is a highly useful tool for calculating the net present value of a given product, process, asset, or organization.

The "Bond Yield Plus Risk Premium" Approach

We can estimate the value of a company's equity by adding its risk premium to the yield to maturity on the company's long-term debt.