When pursuing financing, organizations encounter a variety of factors that impact the weighted average cost of capital. Some of these factors are within the firm's strategic control, while others are external forces outside the firm's control. As a financial professional or upper level strategist, understanding what capital structure options are available to a firm plays a critical role in financial management.

Capital Structure

Capital structure refers to the way in which an organization finances operations. This is generally illustrated via a balance sheet, where the overall assets are offset by the capital structure of liabilities and equity. It is through the decisions to acquire various forms of debt and equity that an organization can derive a weighted average cost of capital (WACC) that is sustainable within the context of organizational profitability. If the cost of capital is higher than the returns from those investments, the organization lacks the profitability required to justify itself. WACC is calculated as follows:

In the above equation, the first segment is measuring the cost of equity coupled with the percentage of the capital structure that is funded by equity. The second segment is making the same calculation, but this time with the cost of debt and the relative percentage of capital structure which is funded via this source. The final segment (1 - t) is the application of a corporate tax rate (depending on the country of operation.

Understanding the cost of each input of the capital structure, firms can control (to some degree) how they fund their operations and acquisitions of assets.

Internal Rate of Return

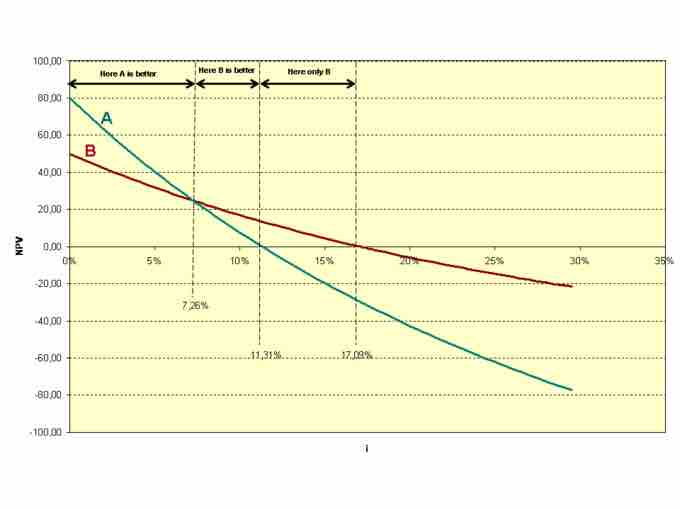

Another important decision made by financial professionals in relation to the cost of capital revolves around the required rates of return of various projects. Investing capital into an operation always incurs the opportunity cost of investing in something else. As a result, organizations can control their operations by measuring and projecting the rate of return on each project, and investing strategically in the most profitable projects.

An internal rate of return (IRR) calculation can be useful when doing this. The IRR is going to look at the net present value (NPV) of a given project, and calculate it for a break even point (i.e. set the equation to zero, when taking cost into account). By doing so, the organization can identify the anticipated rate of return on the project. take a look at the equation below:

In this equation, n is the number of periods in a project (i.e. number of anticipated cash flows over the life of the project), C is the cash flow amount (which can vary for each period, hence the summation), r is the rate of return being solved for, and N is total number of periods (n). When solving for zero, the organization will identify what the rate of return is for each project. Deciding upon projects that provide returns greater than the WACC derived from the capital structure will set the organization down a profitable path (assuming forecasts are reliable!).

Exclusive_investments.png

When weighed different projects over time, the IRR calculation can be useful in determining which investment of capital is best over the lifetime of each project. When taking the WACC into account (derived from capital structure decisions), the organization can measure operational options against the required rate of return.