Problems with WACC

The primary variables to be determined in order to calculate weighted average cost of capital are the relative debt and equity values, the cost of debt, and the cost of equity. While the relative debt and equity values can be easily determined, calculating the costs of debt and equity can be problematic. In calculating each component, we are given many different options and proxy values. For example, to calculate the cost of equity we have at least three methods we can use - the dividend growth model, the capital asset pricing model, and the bond yield plus risk premium method. The problem inherent in each of these methods is that at least one component is an estimate. Therefore, their calculated values will vary depending on differing estimates, which will subsequently give us varying cost of capital calculations.

While calculating cost of debt is more simplistic, relative to calculating cost of equity, there are still problems that arise. To calculate cost of debt, we add a default premium to the risk-free rate. This default premium is the return in excess of the risk free rate that a bond must yield. It will rise as the amount of debt increases (since, all other things being equal, the risk rises as the amount of debt rises) .

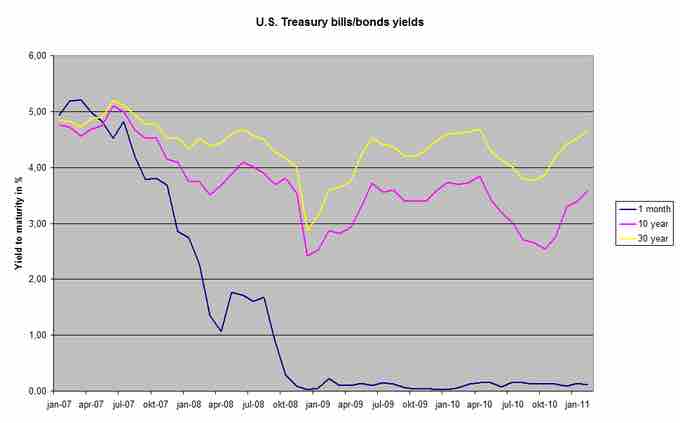

U.S. Treasuries Yield

Yields on 1-mont, 10-year, and 30-year U.S. government debt.

To produce the most accurate result, we must take this risk-free rate from a bond containing a similar term structure to our company's debt. Risk-free rates are typically approximated from U.S. Treasury bills, notes, and bonds. Problems can arise because these are issued only in terms of 2, 3, 5, 10, and 30 years. These terms may not always adequately match the term of our company's debt.