When organizations begin weighing the weighted average cost of capital (WACC) and determining overall capital structure, there are some factors that are within the control of the organization, and some external factors that are not. When it comes to projecting the cost of capital, it's useful to assess some of the external factors that may influence the overall cost.

Interest Rates

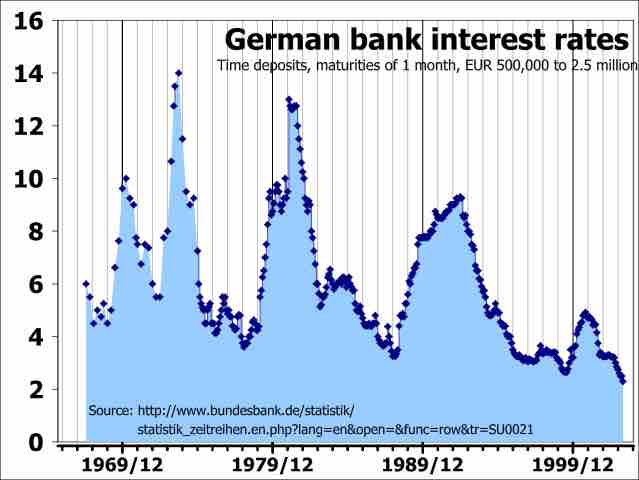

Interest rates fluctuate for a wide variety of reasons, and are a primary tool of monetary policy. Governments and central banks often make alterations to interest rates as a result of investment, unemployment, inflation, and other broader economic factors. Altering interest rates can impact the spending, borrowing, and investing habits within an economy, and therefore tend to fluctuate for economic purposes.

German Bank Interest Rates

This chart illustrates changes in interest rates in Germany over time.

Inflation

Related to interest rates (and a direct impact upon interest rate change) is the natural inflation or deflation of the currency being borrowed or lent. Organizations must take into account the time value of money as it pertains to that capital's actual alterations in value, which is firmly outside the control of the organization.

Market Fluctuations

2008 is a prime example of how market forces can drastically impact equity. As markets rise and fall, the cost of capital as well as the perceived market risk (systematic risk) will naturally and relatively unpredictably fluctuate. When utilizing markets as a source of funding, the intrinsic risk of the market itself is outside of the control of the organization.

Corporate Tax

Depending upon the region of operation, tax implications may have a significant impact on the cost of capital. In many jurisdictions, debt and interest on equity may receive certain tax breaks. Investors may also encounter taxes on returns on their investments and tax on dividends, impacting the perceived risk and return ratio of a prospective investor. Profit beyond the cost of expenses and capital will be taxed as well, which impacts the overall weighted average cost of capital.

Other Factors

The cost of capital is largely a simple trade off between the time value of money, risk, return, and opportunity cost. Any external factors in the form of opportunity costs or unexpected risks can impact the overall cost of capital.