Chapter 4

Forecasting Financial Statements

By Boundless

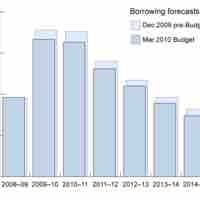

The financial forecast is a key input to strategic planning, a firm's process of defining strategy and making decisions about allocating resources.

AFN is "additional funds needed," and refers to the additional resources that will be needed for a company to expand its operations.

Capacity adjustment takes into account maximum production levels and the alteration of this level depending on how the firm wants to grow.

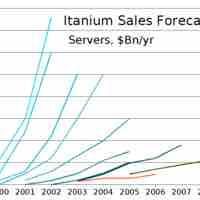

Target volume, price, and contribution margin per unit are the key inputs to a sales forecast.

Production schedule can be divided into raw materials, work in process, finished goods and goods for resale.

COGS is difficult to forecast due to the sheer amount of expenses included and differing methods of estimating each.

Other expenses include SG&A, depreciation, amortization, R&D, finance costs, income tax expense, discontinued operations expenses.

A pro forma income statement is planned and prepared in advance to of a transaction to project the future status of the company.

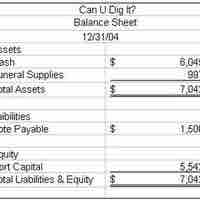

A pro forma balance sheet summarizes the projected future status of a company after a planned transaction, based on the current financial statements.

Balance sheet analysis is process of understanding the risk and profitability of a firm through analysis of reported financial information.

Forecasting incoming cash flows via receipts is a useful tool for organizations to determine the amount of cash that will be available on hand.

Cash payments describe cash flowing out of a business resulting from operating activities, investment activities and financing activities.

Understanding cash and liquidity needs is critical for organizations to capture opportunities and ensure all profitable processes are funded.

Ratio analysis and EPS are used to compare the strengths and weaknesses of various companies with industry or company benchmarks.

Since actual business activities are planned in relation to forecasting, it is very important that realistic expectations and estimations be undertaken.

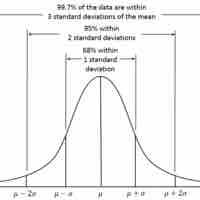

Regression Analysis is a causal / econometric forecasting method that is widely used for prediction and forecasting improvement.

Modifying inputs such as accounts receivable, inventory, and accounts payable will significantly influence forecasting and business operations.