Ratio Analysis

A financial ratio (or accounting ratio) is a relative magnitude of two selected numerical values taken from an enterprise's financial statements. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization. Financial ratios may be used by managers within a firm, by current and potential shareholders (owners) of a firm, and by a firm's creditors. Financial analysts use financial ratios to compare the strengths and weaknesses in various companies. If shares in a company are traded in a financial market, the market price of the shares is used in certain financial ratios.

Values used in calculating financial ratios are taken from the balance sheet, income statement, statement of cash flows or (sometimes) the statement of retained earnings. These comprise the firm's "accounting statements" or financial statements. The statements' data is based on the accounting method and accounting standards used by the organization.

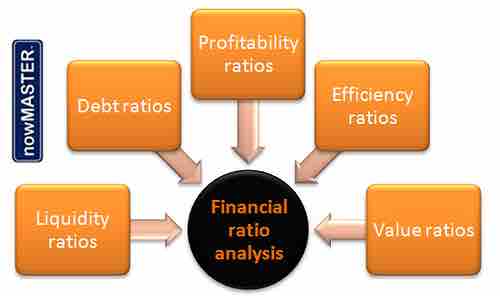

Financial ratios quantify many aspects of a business and are an integral part of the financial statement analysis. Financial ratios are categorized according to the financial aspect of the business which the ratio measures .

Ratio analysis

Ratio analysis includes profitability ratios, activity (efficiency) ratios, debt ratios, liquidity ratios and market (value) ratios

Liquidity ratios:

Liquidity ratios measure the availability of cash to pay debt .

Current ratio (Working Capital Ratio): Current assets / Current liabilities

Acid-test ratio (Quick ratio): (Current assets - Inventory - Prepayments) / Current liabilities

Activity ratios:

Activity ratios measure how quickly a firm converts non-cash assets to cash assets.

Average collection period: Accounts receivable / (Annual credit sales / 365 days)

Average payment period: Accounts payable / (Annual credit purchases / 365 days)

Inventory conversion ratio: 365 days / Inventory turnover

Cash Conversion Cycle: Inventory conversion period + Receivables conversion period - Payables conversion period

Debt ratios

Debt ratios measure the firm's ability to repay long-term debt.

Debt ratio: Total liabilities / Total assets

Times interest earned ratio (Interest Coverage Ratio): EBIT / Annual interest expense

Profitability ratios

Profitability ratios measure the firm's use of its assets and control of its expenses to generate an acceptable rate of return .

Gross margin, Gross profit margin or Gross Profit Rate: Gross profit / Net sales

Profit margin, net margin or net profit margin: Net profit / Net sales

Return on equity (ROE): Net income / Average shareholders equity

Return on assets (ROA ratio or Du Pont Ratio): Net income / Average total assets

Market ratios

Market ratios measure investor response to owning a company's stock and also the cost of issuing stock. These are concerned with the return on investment for shareholders, and with the relationship between return and the value of an investment in company's shares.

Earnings per share (EPS): Net earnings / Number of shares

Payout ratio: Dividends / Earnings

P/E ratio: Market price per share / Diluted EPS

Ratios generally are not useful unless they are benchmarked against something else, like past performance or another company. Thus, the ratios of firms in different industries, which face different risks, capital requirements, and competition are usually hard to compare.

Earnings per share (EPS)

Earnings per share (EPS) is the amount of earnings per each outstanding share of a company's stock. In the United States, the Financial Accounting Standards Board (FASB) requires companies' income statements to report EPS for each of the major categories of the income statement: continuing operations, discontinued operations, extraordinary items, and net income.

The EPS formula does not include preferred dividends for categories outside of continued operations and net income. Earnings per share for continuing operations and net income are more complicated in that any preferred dividends are removed from net income before calculating EPS. This is because preferred stock rights have precedence over common stock.

Earnings Per Share (Basic Formula):

Earnings per Share = Profit / Weighted average common shares

Ratios generally are not useful unless they are benchmarked against something else, like past performance or another company. Thus, the ratios of firms in different industries, which face different risks, capital requirements, and competition are usually hard to compare.