Business planning and forecasting refers to the set of activities where business operations are planned against the business strategy, and what forecast activities or results may occur from operational execution during a particular time period. In preparing financial forecasts, firms should always assume they will be reviewed by a bank manager, regulatory agency, or investor. With this goal in mind, the firm should be guided to keep forecasts tidy and easy to understand by grouping cash inflows and outflows in simple ways that are easy to understand quickly.

Forecasting financial statements comprises the estimation of several values - including sales, costs, and expected interest rates. Since actual business activities are planned in relation to these estimations, it is very important that realistic expectations and estimations be undertaken. With this in mind, there are specific points of interest to lenders and investors that need to be addressed. The profitability of a business reflects a sound relationship between market-driven sales projections and accurate cost estimates.

- Have you planned to have sufficient cash to meet your regular bills and also non-regular costs (like annual insurance premiums)?

- Does the financial position of the business remain sound when growth is forecast (this is what the balance sheet is for)?

- Is there a sensible balance between borrowings and the amount contributed by the owner (when the business is raising capital in its own right)?

- Are short and long-term obligations matched with relevant finance options?

- Do key business ratios remain within sensible bounds?

It is always easier to forecast future performance of a business when the business is already up and running because there are past trading results to look at. When a completely new venture is being planned a certain amount of imagination and estimation is required. However, this is in no way a license to be overly optimistic.

Forecasting has applications in many situations and impacts multiple aspects of a business. One such aspect is Supply Chain Management. Forecasting can be used in Supply Chain Management to make sure that the right product is at the right place at the right time. Accurate forecasting will help retailers reduce excess inventory and therefore increase the profit margin. Accurate forecasting will also help them meet consumer demand. On a broader level, economic forecasting is the process of making predictions about the economy as a whole. Forecasts can be carried out at a high level of aggregation -- for GDP, inflation, unemployment or the fiscal deficit -- or at a more disaggregated level -- for specific sectors of the economy or even specific firms .

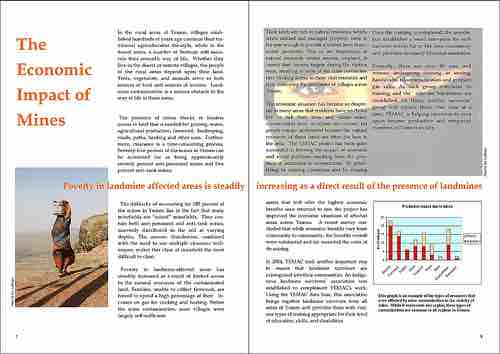

Economic Impact

Studies on the economic impact of business operations should be taken into account when forecasting financial statements and business activities. For example, a mining company may take into account a study such as the one pictured here.

Other important areas of forecasting include:

- Egain Forecasting

- Land use forecasting

- Player and team performance in sports

- Political Forecasting

- Product forecasting

- Sales Forecasting

- Technology forecasting

- Telecommunications forecasting

- Transport planning and Transportation forecasting

- Weather forecasting