Why is cash flow forecasting important? If a business runs out of cash and is not able to obtain new financing, it will become insolvent. It is no excuse for management to claim that they didn't see a cash flow crisis coming. So in business, "cash is king".

Cash Payments

Cash payments describe cash flowing out of a business. These cash payments can result from operating activities, investment activities and financing activities.

Generally speaking, normal operating activities refer to the cash effects of transactions involving revenues and expenses that impact net income. Cash payments must be made for relevant expenses. Typical payments include those to:

- Suppliers for inventory or other supplies

- Employees for wages

- Government for taxes

- Lenders for interest on borrowed money

Typical cash outflows from investing activities include:

- Purchase of capital assets

- Purchase of bonds/notes or shares of other entities

- Loans to other entities

Typical cash outflows from financing activities include:

- Payments of dividends to the company's own shareholders

- Redemption (repurchase) of company's own shares

- Repayment of principal and interest on company's own bonds or notes

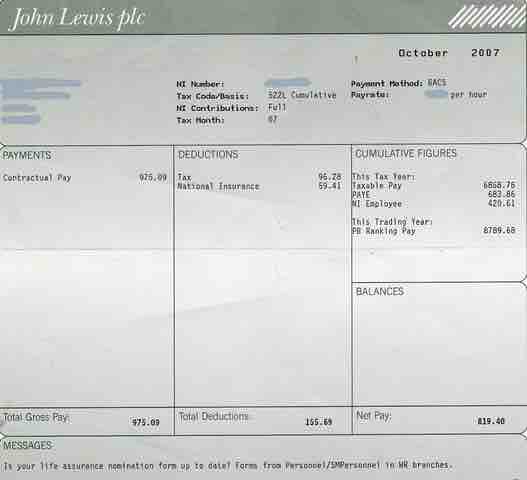

Sample Paystub

This is an example of a paystub to an employee, one of the most significant cash disbursements necessary for a company.

Disbursement Cycle

The cash disbursement cycle is important to consider when analyzing cash payments. This is the total time between when an obligation occurs and when the payment clears the bank. A company's objective regarding the cash disbursement cycle should be to increase the cycle time, or delay making payments until they are due. A firm may delay payments by:

- Mailing checks from locations not close to customers. This will increase the mail time, or mail float, within the disbursement cycle.

- Disbursing checks from a remote bank. This will increase the time required for the payment to clear the bank.

- Purchasing with credit cards so that the time required for making payment is much longer. By using a credit card, you will receive a bill at the end of the month payable in 30 days. This creates more processing time or processing float.

Therefore, when a company manages cash flow cycles, it tries to control three types of float times:

- Mail float, or the time spent for a payment in the mail.

- Clearance float, or the time spent for a payment to clear the bank.

- Processing float, or the time required to process cash flow transactions.