Chapter 32

Open Economy Macroeconomics

By Boundless

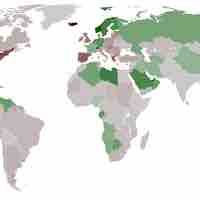

The balance of payments (BOP) is a record of all monetary transactions between a country and the rest of the world.

The current account represents the sum of net exports, factor income, and cash transfers.

The financial account measures the net change in ownership of national assets.

The capital account acts as a sort of miscellaneous account, measuring non-produced and non-financial assets, as well as capital transfers.

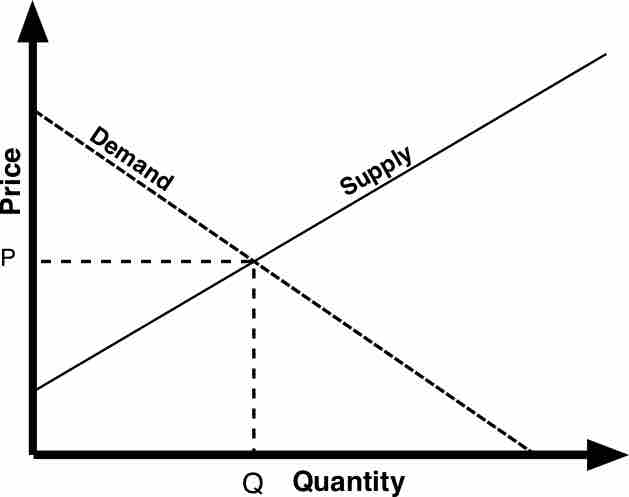

Equilibrium in the market for a country's currency implies that the balance of payments is equal to zero.

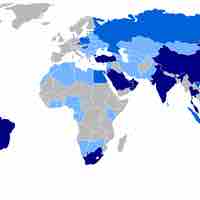

In finance, an exchange rate between two currencies is the rate at which one currency will be exchanged for another.

There are two methods to find the equilibrium exchange rate between currencies; the balance of payment method and the asset market model.

Real exchange rates are nominal rates adjusted for differences in price levels.

A government should consider its economic standing, trade balance, and how it wants to use its policy tools when choosing an exchange rate regime.

The three major types of exchange rate systems are the float, the fixed rate, and the pegged float.

A fixed exchange rate is a type of exchange rate regime where a currency's value is fixed to a measure of value, such as gold or another currency.

Managed float regimes are where exchange rates fluctuate, but central banks attempt to influence the exchange rates by buying and selling currencies.

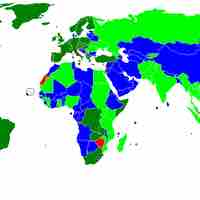

In an open economy, equilibrium is achieved when no external influences are present; the state of equilibrium between the variables will not change.

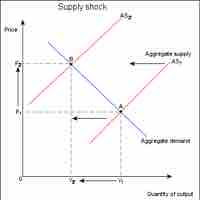

Government policies and outside events may affect the macroeconomic equilibrium by shifting aggregate supply or aggregate demand.

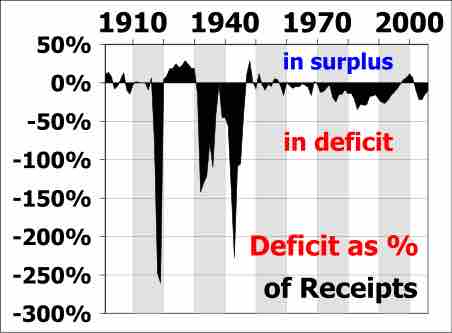

A budget deficit will typically increase the equilibrium output and prices, but this may be offset by crowding out.