One of the key economic decisions a nation must make is how it will value its currency in comparison to other currencies. An exchange rate regime is how a nation manages its currency in the foreign exchange market. An exchange rate regime is closely related to that country's monetary policy. There are three basic types of exchange regimes: floating exchange, fixed exchange, and pegged float exchange .

Foreign Exchange Regimes

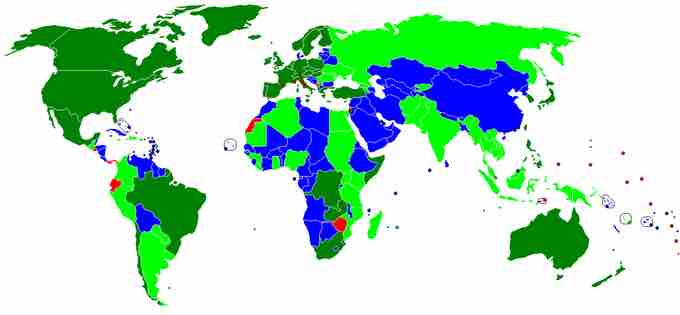

The above map shows which countries have adopted which exchange rate regime. Dark green is for free float, neon green is for managed float, blue is for currency peg, and red is for countries that use another country's currency.

The Floating Exchange Rate

A floating exchange rate, or fluctuating exchange rate, is a type of exchange rate regime wherein a currency's value is allowed to fluctuate according to the foreign exchange market. A currency that uses a floating exchange rate is known as a floating currency. The dollar is an example of a floating currency.

Many economists believe floating exchange rates are the best possible exchange rate regime because these regimes automatically adjust to economic circumstances. These regimes enable a country to dampen the impact of shocks and foreign business cycles, and to preempt the possibility of having a balance of payments crisis. However, they also engender unpredictability as the result of their dynamism.

The Fixed Exchange Rate

A fixed exchange rate system, or pegged exchange rate system, is a currency system in which governments try to maintain a currency value that is constant against a specific currency or good. In a fixed exchange-rate system, a country's government decides the worth of its currency in terms of either a fixed weight of an asset, another currency, or a basket of other currencies. The central bank of a country remains committed at all times to buy and sell its currency at a fixed price.

To ensure that a currency will maintain its "pegged" value, the country's central bank maintain reserves of foreign currencies and gold. They can sell these reserves in order to intervene in the foreign exchange market to make up excess demand or take up excess supply of the country's currency.

The most famous fixed rate system is the gold standard, where a unit of currency is pegged to a specific measure of gold. Regimes also peg to other currencies. These countries can either choose a single currency to peg to, or a "basket" consisting of the currencies of the country's major trading partners.

The Pegged Float Exchange Rate

Pegged floating currencies are pegged to some band or value, which is either fixed or periodically adjusted. These are a hybrid of fixed and floating regimes. There are three types of pegged float regimes:

- Crawling bands: The market value of a national currency is permitted to fluctuate within a range specified by a band of fluctuation. This band is determined by international agreements or by unilateral decision by a central bank. The bands are adjusted periodically by the country's central bank. Generally the bands are adjusted in response to economic circumstances and indicators.

- Crawling pegs:A crawling peg is an exchange rate regime, usually seen as a part of fixed exchange rate regimes, that allows gradual depreciation or appreciation in an exchange rate. The system is a method to fully utilize the peg under the fixed exchange regimes, as well as the flexibility under the floating exchange rate regime. The system is designed to peg at a certain value but, at the same time, to "glide" in response to external market uncertainties. In dealing with external pressure to appreciate or depreciate the exchange rate (such as interest rate differentials or changes in foreign exchange reserves), the system can meet frequent but moderate exchange rate changes to ensure that the economic dislocation is minimized.

- Pegged with horizontal bands:This system is similar to crawling bands, but the currency is allowed to fluctuate within a larger band of greater than one percent of the currency's value.