The macroeconomic equilibrium is determined by aggregate supply and aggregate demand. Much of economics focuses on the determinants of aggregate supply and demand that are endogenous - that is, internal to the economic system. These include factors such as consumer preferences, the price of inputs, and the level of technology. However, there are many factors that affect the macroeconomic equilibrium that are exogenous to the economic system - that is, external to the economic model.

Supply Shock

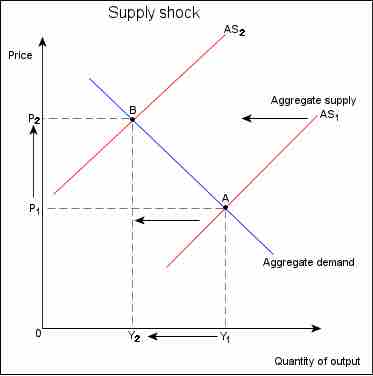

One type of event that can shift the equilibrium is a supply shock. This is an event that suddenly changes the price of a commodity or service. It may be caused by a sudden increase or decrease in the supply of a particular good, which in turn affects the equilibrium price. A negative supply shock (sudden supply decrease) will raise prices and shift the aggregate supply curve to the left. A negative supply shock can cause stagflation due to a combination of raising prices and falling output . A positive supply shock (an increase in supply) will lower the price of said good by shifting the aggregate supply curve to the right. A positive supply shock could be an advance in technology (a technology shock) which makes production more efficient, thus increasing output.

Supply Shock and Equilibrium

A supply shock shifts the aggregate supply curve. In this case, a negative supply shock raises prices and lowers output in equilibrium.

One extreme case of a supply shock is the 1973 Oil Crisis. When the U.S. chose to support Israel during the Yom Kippur War, the Organization of Arab Petroleum Exporting Countries (OAPEC) responded with an oil embargo, which increased the market price of a barrel of oil by 400%. This supply shock in turn contributed to stagflation and persistent economic disarray.

Inflation

Inflation can result from increased aggregate demand, but can also be caused by expansionary monetary policy or supply shocks that cause large price changes. Changes in prices can shift aggregate demand, and therefore the macroeconomic equilibrium, as a result of three different effects:

- The wealth effect refers to the change in demand that results from changes in consumers' perceived wealth. When individuals feel (or are) wealthier, they spend more and aggregate demand increases. Since inflation causes real wealth to shrink and deflation causes real wealth to increase, the wealth effect of inflation will cause lower demand and the wealth effect of deflation will cause higher demand.

- The interest rate effect refers to the way in which a change in the interest rate affects consumer spending. When prices rise, a nominal amount of money becomes a smaller real amount of money, which means that the real value of money in the economy falls and the interest rate (i.e. the price of money) rises. A higher interest rate means that fewer people borrow and consumer spending (aggregate demand) falls.

- Finally, the exchange rate effectrelates changes in the exchange rate to changes in aggregate demand. As above, inflation typically causes the interest rate to rise. When the domestic interest rate is high compared to that in other countries, capital flows into the country, the international supply of the domestic currency falls, and the price (i.e. exchange rate) of the domestic currency rises. An increase in the exchange rate has the effect of increasing imports and decreasing exports, since domestic goods are relatively more expensive. A decrease in net exports leads to a decrease in aggregate demand, since net exports is one of the components of aggregate demand.

Trade Policies

Trade policies can shift aggregate demand. Protectionism, for example, is a policy that interferes with the free workings of the international marketplace. By implementing protectionism policies such as tariffs and quotas, a government can make foreign goods relatively more expensive and domestic goods relatively cheaper, increasing net exports and therefore aggregate demand. Since the world demands more goods produced in the home country, the demand for the domestic currency increases and the exchange rate rises.

Capital Flight

Capital flight occurs when assets or money rapidly flow out of a country due to an event of economic consequence. Such events could be an increase in taxes on capital or capital holders, or the government of the country defaulting on its debt that disturbs investors and causes them to lower their valuation of the assets in that country, or otherwise to lose confidence in its economic strength.

This leads to an increase in the supply of the local currency and is usually accompanied by a sharp drop in the exchange rate of the affected country. This leads to dramatic decreases in the purchasing power of the country's assets and makes it increasingly expensive to import goods. Net exports rise as a component of aggregate demand.