The current account represents the sum of the balance of trade (net earnings on exports minus payments for imports), factor income (earnings on foreign investments minus payments made to foreign investors), and cash transfers. It is called the current account as it covers transactions in the "here and now" – those that don't give rise to future claims.

The balance of trade is the difference between a nation's exports of goods and services and its imports of goods and services. A nation has a trade deficit if its imports exceed its exports. Because the trade balance is typically the largest component of the current account, a current account surplus is usually associated with positive net exports. This, however, is not always the case. Secluded economies like Australia are more likely to feature income deficits larger than their trade surplus.

The net factor income records a country's inflow of income and outflow of payments. Income refers not only to the money received from investments made abroad (note: the investments themselves are recorded in the capital account but income from investments is recorded in the current account) but also to the money sent by individuals working abroad, known as remittances, to their families back home. If the income account is negative, the country is paying more than it is taking in interest, dividends, etc.

Cash transfers take place when a certain foreign country simply provides currency to another country with nothing received as a return. Typically, such transfers are done in the form of donations, aids, or official assistance.

Calculating the Current Account

Normally, the current account is calculated by adding up the 4 components of current account: goods, services, income and cash transfers.

Goods are traded by countries all over the world. When ownership of a good is transferred from a local country to a foreign country, this is called an export. When a good's ownership is transferred from a foreign country to a local country, this is called an import. In calculating the current account, exports are marked as a credit (inflow of money) and imports are marked as a debit (outflow of money).

Services can also be traded by countries. This happens frequently in the case of tourism. When a tourist from a local country visits a foreign country, the local country is consuming the foreign services and this is counted as an import. Likewise, when a foreign tourist comes and enjoys the services of a local country, this is counted as an export. Other services can also be transferred between countries, such as when a financial adviser in one country assists clients in another.

A credit of income happens when a domestic individual or company receives money from a foreign individual or company. This would typically take place when a domestic investor receives dividends from an investment made in a foreign country, or when a worker abroad sends remittances back to the local country. Likewise, a debit in the income account takes place when a foreign entity receives money from an investment in the local economy.

Finally, a credit in the cash transfers column would be a gift of aid from a foreign country to the domestic country. Similarly, a debit in the cash transfers column might be the provision of official assistance by the local economy to a foreign economy.

Thus, a country's current account can by calculated by the following formula:

CA = (X-M)+NY+NCT

Where CA is the current account, X and M and the export and import of goods and services respectively, NY is net income from abroad, and NCT is the net current transfers. When the sum of these four components is positive, the current account has a surplus.

Global Current Accounts

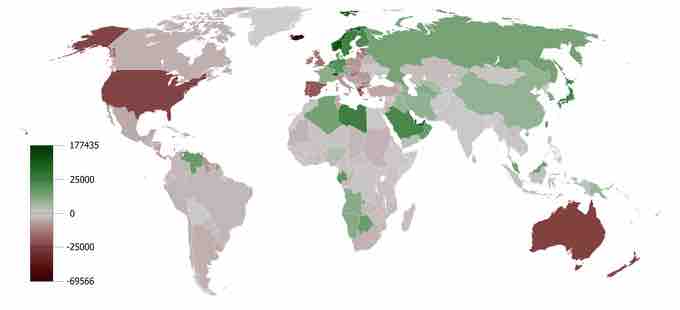

The map shows the per capita current accounts surpluses and deficits of countries around the world from 1980 to 2008. Deeper red implies a higher per capita deficit, while deeper green implies a higher per capita surplus.