Chapter 11

Reporting of Long-Term Liabilities

By Boundless

In finance, bonds are a form of debt: the creditor is the bond holder, the debtor is the bond issuer, and the interest is the coupon.

In finance, there are many different types of bonds that vary in term agreements, duration, structure, source, and other characteristics.

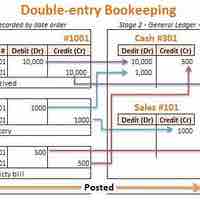

On issuance, the journal entry to record the bond is a debit to cash and a credit to bonds payable.

Journal entries are required to record initial value and subsequent interest expense as the issuer pays coupon payments to the bondholder.

A bond's book value is affected by its term, face value, coupon rate, and discount rate.

A bond's value is measured by its sale price, but a business can estimate a bond's price before issuance by calculating its present value.

To record a bond issued at par value, credit the "bond payable" liability account for the total face value of the bonds and debit cash for the same amount.

When a business sells a bond at a discount, it must record a discount balance in its records and amortize that amount over the bond's term.

When a bond is sold at a premium, the difference between the sales price and face value of the bond must be amortized over the bond's term.

The value of a zero-coupon bond equals the present value of its face value discounted by the bond's contract rate.

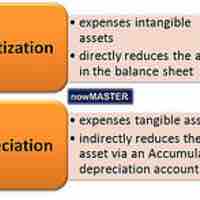

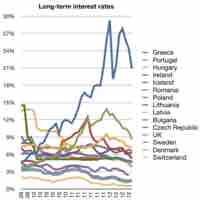

Debts that become due more than one year into the future are reported as long-term liabilities on the balance sheet.

Analyzing long-term liabilities combines debt ratio analysis, credit analysis and market analysis to assess a company's financial strength.

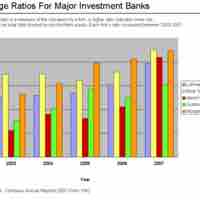

The Debt-to-Equity Ratio is a financial ratio that compares the debt of a company to its equity and is closely related to leveraging.

Times Interest Earned Ratio = (EBIT or EBITDA) / (Required Interest Payments), and is indicative of a company's financial strength.

Off-Balance-Sheet-Financing represents rights to use assets or obligations that are not reported on balance sheets to pay liabilities.