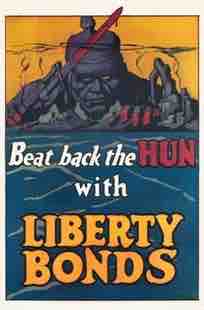

"Beat Back the Hun with Liberty Bonds"

After war was declared, the moral imperative of liberty and the Allied cause was touted in official, government-sponsored propaganda.

A zero-coupon bond is one that does not pay interest over the term of the bond. Instead, the entity will sell the bond at lower than face value. When the bond's term is over, the issuing business will repay the bond at its face value. The bondholder generates a return paying less than what he receives in payment at the end of the bond's term.

While the business may not make periodic interest payments, interest income is still generated. The interest income is merely accumulated and paid at the end of the bond's term.

Formula for Calculating Value of Zero-Coupon Bond

Zero-Coupon Bond Value = Face Value of Bond / (1+ interest Rate)

Generally, the price of a zero-coupon bond is based on the present value of the amount the issuing business will pay the bondholder when the bond matures. The amount the company pays at the end of the term equals the bond's face value. The present value is determined using the interest rate stated on the bond. The bond's term is used as the time period in the present value calculation.

It is important when completing the zero-coupon bond calculation to ensure the time period and term of the bond are expressed in similar terms. If the interest rate of the bond is expressed as a monthly rate and the term of the bond is 10 years, the bond term should be expressed as 120 months when making the calculation.

Example Calculation

Assume a business issues a 2 year note, paying 5% interest with a face value of $100,000. To calculate its present value, you would raise 1.05 to the tenth power. This equals 1.1025. You then divide $100,000 by 1.1025. The result is that the bond would have a present value of $90,702.95.