Issuing Bonds at a Discount

For the issuer, recording a bond issued at a discount can be a little more difficult than recording a bond issued at par value. Because the issuer receives less cash for the bond than the face value, this difference must be recorded in the company records as a discount expense. When a bond is sold at a discount, the market rate of the bond exceeds the contract rate. As a result, the bond must be sold at an amount less than its face value. In addition, that discounted amount must be amortized over the term of the bond. When the company amortizes the discount associated with the bond, it increases its interest expense beyond what it actually pays to the bondholder.

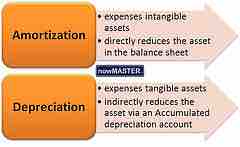

Amortization & depreciation in the accounting cycle

A bond's discount amount must be amortized over the term of the bond.

Recording the Bond Sale

When a bond is sold, the company records a liability by crediting the "bonds payable" account for the bond's total face value. Next, the company debits the cash account by the amount of money it receives from the bond sale. The business then debits the difference between the bond's face value and what it receives in cash from the sale. That is the discount amount.

Assume a business sells a 10 year, $100,000 bond for $90,000. The journal entry for that transaction would be as follows:

Cash $90,000 Dr.

Discount on Bond Payable $10,000 Dr.

Bond Payable $100,000 Cr.

Recording Interest Payments

As the company pays interest, the discount on the bond payable is amortized. Generally, the amortization rate is calculated by dividing the discount by the number of periods the company has to pay interest.

Using the example from above, assume the company pays 6% interest on the $100,000 bond annually. That means that the amortization rate on the bond payable equal $1,000 ($100,000/10 years). While the business would only have to pay the bondholder $6,000 in cash, its total interest expense equals $7,000, or the amount of interest it pays plus the amortization rate. The journal entry would be:

Bond Interest Expense $7,000 Dr.

Discount on Bond Payable $1,000 Cr.

Cash $6,000 Cr.

Recording Bond Maturity

When the bond matures, the business must record the repayment of the principal to the bondholder, as well as all final interest payments. At this time, the discount on bond payable and bond payable accounts must be zeroed out, and all cash payments must be recorded.

Using our example from above, the final set of bond journal entries should look like this:

Bond Interest Expense $7,000 Dr.

Discount on Cash Payable $1,000 Cr.

Cash $6,000 Cr.

Bond Payable $100,000 Dr.

Cash $100,000 Cr.