Debt-to-Equity Ratio

The Debt-to-Equity Ratio is a financial ratio indicating the relative proportion of shareholder's equity and debt used to finance a company's assets, and is calculated as total debt / total equity.

In order to obtain assets used in operations, a company will raise capital through either issuing shareholder's equity (e.g., publicly traded common stock) or debt (e.g., notes payable). Stakeholders, which include investors and lending institutions, provide companies with capital with an expectation that those companies generate net income through their respective operations.

Debt is typically a long-term liability that represents a company's obligation to pay both principal and interest to purchasers of that debt.

Equity represents ownership of a company, and does not include any agreed upon repayment terms.

Each form of raising capital has its own set of pros and cons. Interest payments on debt are tax deductible, while dividends on equity are not. Returns to purchasers of debt are limited to agreed- upon terms (i.e., interest rates), however, they have greater legal protection in the event of a bankruptcy. The returns an equity holder can achieve have unlimited upside, however, they are typically the last to be paid in the event of a bankruptcy.

Calculating the Debt-to-Equity Ratio

Calculating a company's debt to equity ratio is straight forward, and the debt and equity components can be found on a company's respective balance sheet. For more advanced analysis, financial analysts can calculate a company's debt to equity ratio using market values if both the debt and equity are publicly traded.

When used to calculate a company's financial leverage , the debt-to-equity ratio includes only long-term liabilities in the numerator and can even go a step further to exclude the current portion of the long-term liabilities. This means that other short-term liabilities, such as accounts payable, are excluded when calculating the debt-to-equity ratio.

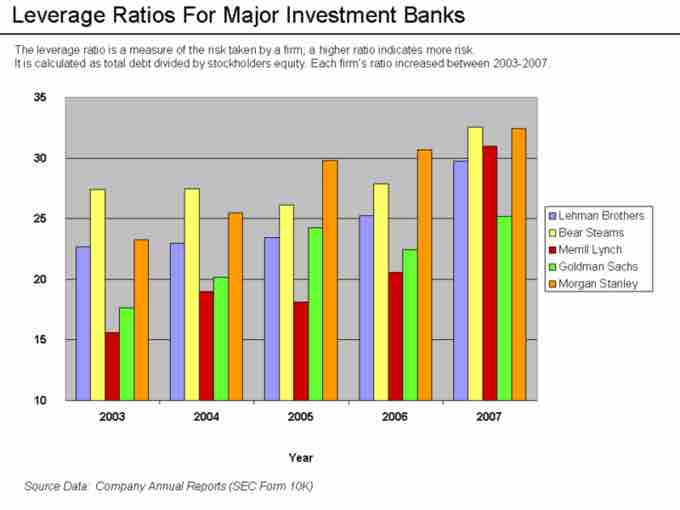

Leverage Ratios

Graph of how infamous investment banks were leveraged prior to the credit crisis of 2008.