Analyzing Long-Term Liabilities

Long-term liabilities are obligations that are due at least one year into the future, and include debt instruments such as bonds and mortgages. Analyzing long-term liabilities is done for assessing the likelihood the long-term liability's terms will be met by the borrower. After analyzing long-term liabilities, an analyst should have a reasonable basis for a determining a company's financial strength. Analyzing long-term liabilities is necessary to avoid buying the bonds of, or lending to, a company that may potentially become insolvent.

How is Long-Term Liability Analysis Performed?

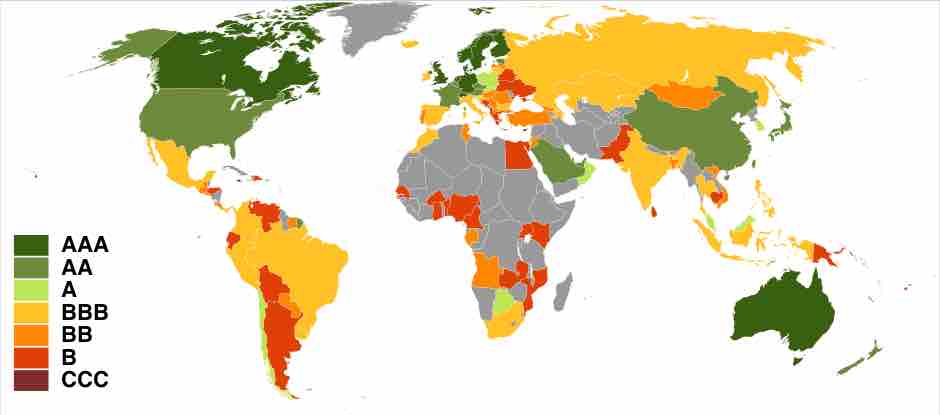

Analyzing long-term liabilities often includes an assessment of how creditworthy a borrower is, i.e. their ability and willingness to pay their debt. Standard & Poor's is a credit rating agency that issues credit ratings for the debt of public and private companies. As part of their analysis Standard & Poor's will issue a credit rating that is designed to give lenders and investors an idea of the creditworthiness of the borrower. The best rating is AAA with the worst being D. Please consult the figure as an example of Standard & Poor's credit ratings issued for debt issued by governments all over the world.

World countries Standard & Poor's ratings

An example of the credit ratings prescribed by Standard & Poor's as a result of their respective long-term liability analysis for debt issued at the national government level. Countries issue debt to build national infrastructure. Look how expensive it is to raise capital for such projects based on geographic region.

In addition to credit rating agencies such as Standard & Poor's, analysts can use debt ratios to help benchmark a company to it's industry peers. Comparing a company to its peers will give an analyst perspective about what is considered normal or abnormal for a respective industry. Popular debt ratios include: debt ratio, debt to equity, long-term debt to equity, times interest earned ratio (interest coverage ratio), and debt service coverage ratio. Data used to calculate these ratios are provided on a company's balance sheet, income statement, and statement of changes in equity. Typically, company's present liabilities with the earliest due dates first.

Debt Ratio:

Debt to Equity Ratio:

Long-Term Debt to Equity Ratio:

Times Interest Earned Ratio (aka Coverage Ratio):

Debt Service Coverage Ratio:

There is more to analyzing long-term liabilities than simply reading a company's credit rating and performing independent debt ratio analysis. In addition, an analyst needs to consider the overall economy, industry trends and management's experience when forming a conclusion about the strength or weakness of a company's financial position. When gathering information, an analyst should always read the footnotes contained in financial statements to determine if there are any disclosures related to long-term liabilities or other factors that may impact the company's ability to pay it's long-term obligations.