Antitrust laws perform the critical task of ensuring that competitive environments are preserved in order to maintain an efficient and equitable capitalistic system for firms to operate in. The concept of antitrust largely revolves around governmental restrictions that limit incumbents in any given industry from consolidating too much power.

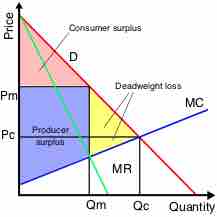

The worst case scenario of consolidation results in a monopoly, which is when one company or organization becomes the sole supplier of a given product or service. In such a situation it is relatively easy for that provider to erect barriers to entry for new entrants and dictate price points through manipulating the supply. The adverse effects of these manipulations can be seen in , which underlines the economic threat monopolies pose the end consumer. Antitrust law is in place to ensure such circumstances do not arise, or when they do that they are regulated appropriate to minimize adverse societal effects.

Monopolistic Effects on Price

This graph illustrates the way in which monopolistic incumbents can control economic factors, ultimately creating surpluses or shortages to garner advantage.

Regulating Competition

The regulation of competitive markets has roots as far back as the Roman Empire, resulting in increasingly complex models as capitalism has evolved over time. Indeed, due to the increasingly international focus for many large corporations, antitrust laws and other competitive regulations must function not only at the country level but on a global level. Organizations such as the World Trade Organization (WTO) attempt to garner international support for the establishment of global standards in competitive markets in conjunction with the internal competitive laws which govern each nation individually. While these antitrust laws differ from nation to nation, they can loosely be summarized in three components:

- Actively ensuring that no agreements in place are counter to a competitive market. This revolves largely around avoiding cartels, or collaboration between the big players which would allow for market manipulation.

- Regulating against strategic actions that may result in diminishing the competitive elements of a market. This is usually targeted at dominate players in an industry, who may have a tendency to price gauge or other manipulations.

- Overseeing mergers, acquisitions, joint ventures and other strategic alliances to avoid consolidation that may be damaging to free markets.

Relevant Statutes

European Union (EU) - In the EU, competition law began in 1951 with the European Coal and Steel Community (ECSC), which included France, Italy, Belgium and the Netherlands. The purpose of this was to reduce the ability for one country/region to gain a monopoly on critical natural resources. Shortly after, in 1957, the European Economic Community (ECC) was established as a part of the Treaty of Rome. This document enacted provisions to eliminate anti-competitive agreements. This was more recently updated via the Treaty of Lisbon, which further addresses mergers and acquisitions and bans price fixing and collusion.

United States (U.S.) - In the U.S., antitrust policy finds its roots in 1890 with the Sherman Antitrust Act. While the basic premise was the same as modern day competitive law, it was fairly rudimentary in scale and scope. The Sherman Act dealt with avoiding or limiting the power of trusts, or essentially the creation of price-controlling cartels. This act was expanded upon in 1914, with two more competitive laws: The Clayton Antitrust Act and the Federal Trade Commission Act. Both of these acts sought to organize a governmental body equipped to protect consumers from unfair competitive practices.