The Value of Competition

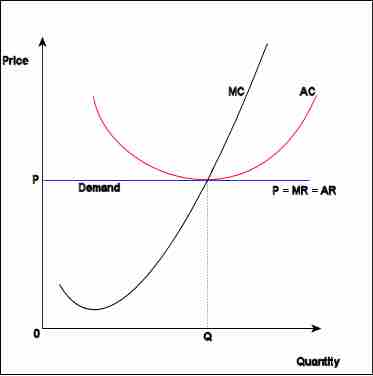

To understand why trends towards consolidation are so dangerous it is useful to frame why competition is of such critical value to equitable markets, particular from a consumer perspective. In a perfectly competitive market, the antithesis of a monopoly, demand is completely elastic and the production quantity and price point align perfectly with marginal costs and actual costs . This allows for revenues, costs, price, and quantity to achieve a balance where the consumer is provided with the optimal amount of a good at the most equitable price.

Perfect Competition Economics

This is a graphical illustration of economics within the context of a perfectly competitive market (theoretically). Note that the overall returns derived, costs incurred, quantity produced, and price point all align perfectly to generate an equitable market position. While this is an idealistic representation of markets, it is useful as a frame of reference to identify departures from ideal competitive circumstances.

However, perfect competition is more of a theoretical competitive framework because markets will naturally deviate to varying degrees (in order to capture profitable returns). As such, the perfect competition model is most useful in identifying and measuring deviations or departures from the competitive ideal. The farther an industry or market moves from a perfectly competitive model the more value is potentially migrating from the consumers to the suppliers. In order to ensure that suppliers do not take on too much power (such as the case of monopolies and oligopolies), government regulations and antitrust laws are a necessary component of the economic perspective.

Societal Risks of Monopolies

The accumulation of power and leverage on behalf of the suppliers largely revolves around the fact that monopolies can ultimately control supply in its entirety for a specified product or service. Through utilizing this control strategically, a profit-maximizing monopoly could create the following societal risks:

- Price Discrimination:This concept is often strongly emphasized as a potential economic risk of monopolies and the economic justification is easily illustrated. Picture a supply and demand chart, where supply and demand intersect to generate a fair price point and overall quantity provided. Now assume one company has the entire supply under it's control, and can discriminate prices along the demand curve to capture higher prices than the available supply should allow. This allows monopolies to charge customers with a higher willingness to pay a higher price, while still charging consumers with a lower willingness to pay the standard prices. This is unfair to consumers, who will be forced to pay whatever is asked as a result of no alternative options.

- Reduced Efficiency: A less direct societal risk of monopolies is the fact that competition is closely linked to incentives. As a result, no competition will provide the monopoly very little reason to improve internal inefficiencies or cut costs. A competitive market will see constant strives to reduce costs in order to capture higher market share and provide goods at lower prices, while monopolies do not have this incentive.

- Reduced Innovation: A monopoly will also have limited motivation to innovate, as there is little value in differentiation in a thoroughly controlled market (for the only incumbent). As a result there is reduced improvements that could substantially improve the ability of the firm to fulfill the needs of the consumer.

- Deadweight Loss: A monopoly will choose to produce less and charge more than would occur in a perfectly competitive market. As a result, a monopoly causes deadweight loss, an inefficient economic outcome.

In summarizing these various societal drawbacks, monopolies pose the risk of reducing consumer choice and consumer power to incentivize companies to innovate and reduce costs, as there is limited prospective returns on investment. A monopoly with total control over the supply can charge any price that the consumer is willing to pay, and therefore can generate excessive margins while doing very little to improve their product/service or relevant processes.