A monopoly is a business or organization that maintains exclusivity of the supply of a particular product or service, and can evolve naturally or be designed specifically based on the nature of a particular market or industry. Monopolies on the whole are governed under antitrust laws, both on a national level in most countries and on an international level via institutions such as the World Trade Organization (WTO).

The evolution of a monopoly is a critical component in recognizing which industries are at high risk of monopolization, and how these risks may be realized operationally. A natural monopoly is defined by an incumbent in an industry where the largest supplier can theoretically create the lowest production prices, generally through economies of scale or economies of scope . In this type of circumstance, the industry naturally lends itself to providing advantages for the single largest provider at the cost of allowing for competitive forces. Natural monopolistic conditions are therefore at high risk of creating actual monopolies, and society benefits from regulating these situations to even the playing field.

Price Advantage for Natural Monopolies

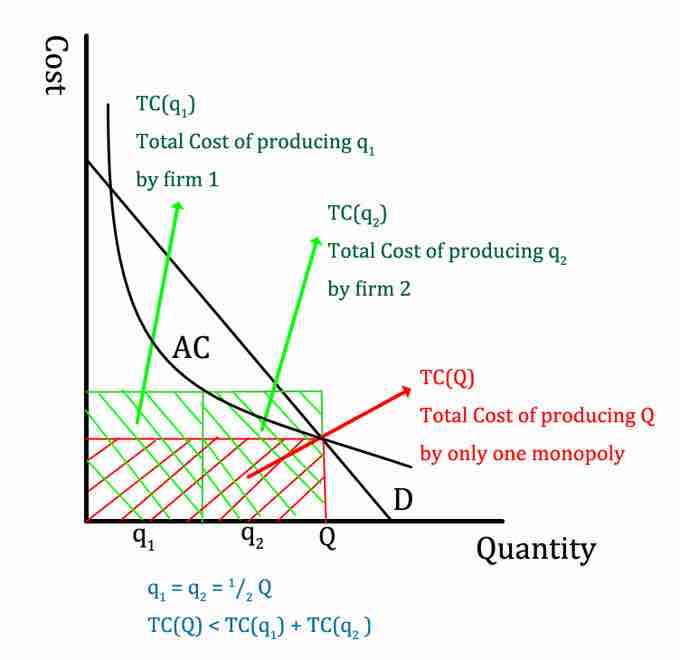

While monopolies are generally poor economic constructs for creating value, natural monopolies are predicated on the fact that a single supplier can achieve the greatest economies of scale (cost advantages). This graph demonstrates this concept.

Regulating Natural Monopolies

The consolidation of an industry into one sole supplier can represent a substantial threat to free markets and their consumers, as price can be easily manipulated through a thorough control of the supply. As a result, monopolies are generally viewed as illegal entities. Regulating industries to minimize monopolization and maintain competitive equality can be pursued in a number of ways:

- Average cost pricing: As the name implies, this regulatory approach is defined as enforcing a price point for a given product or service that matches the overall costs incurred by the company producing or providing. This reduces the pricing flexibility of a company and ensures that the monopoly cannot capture margins above and beyond what is reasonable.

- Price ceiling:Another way a natural monopoly may be regulated is through the enforcement of a maximum potential price being charged. A price ceiling is a regulatory strategy of stating a specific product or service cannot be sold for above a certain price.

- Rate of return regulations: This is quite similar to average cost pricing, but deviates via allowing a model that can create consistent returns for the company involved. The percentage net profit brought in a by company must be below a government specified percentage to insure compliance with this regulatory approach (i.e. 5%).

- Tax or subsidy:The last way a governmental body can alleviate a natural monopoly is through higher taxes on larger players or subsidies for smaller players. In short, the government can provide financial support via subsidies to new entrants to ensure the competitive environment is more equitable.

As with most regulatory approaches, none of these are perfect solutions and consolidation within industries conducive to a natural monopoly will continue to arise. Antitrust laws and the careful control of mergers, acquisitions, joint ventures, and other strategic alliances are critical in the regulation of natural monopolies. In extreme circumstances it is also a viable option for governments to break up monopolies through the legal processes.

When A Monopoly Works

While the concept of a monopoly is generally perceived as a threat to free markets, there are specific circumstances where natural monopolies are either pragmatically useful (cost effective) or virtually unavoidable. In these circumstances the regulatory approaches above (price ceilings, average cost pricing, etc.) are even more critical to ensuring consumers are protected. AT&T is a classic example of a government-backed monopoly in the middle of the 20th century, as the fixed investment of land lines for phones at that time was substantial. It was not practical to foster competition as a result, and the government recognized the necessity for a monopoly (until 1984, when AT&T was divested).