Chapter 14

Obtaining Capital: Methods of Long-Term Financing

By Boundless

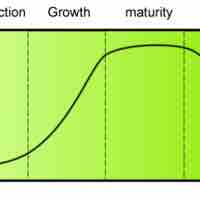

Firms progress through four stages of a developmental life cycle, each with their own funding needs.

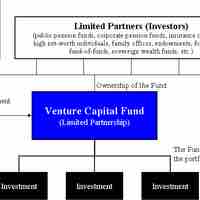

Venture capital is an equity investment in a new company.

Long-term debt is a means of financing that allows firms access to capital without diluting equity; capital & interest is paid off over time.

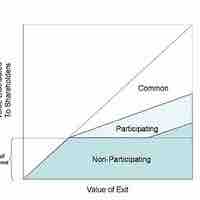

Firms may raise capital by receiving funds from investors in exchange for equity stakes in the form of common and preferred stock.

Early-stage business ventures gain funding and guidance from venture capitalists in exchange for an equity stake in the firm.

While VC financing provides the benefit of significant resources, costs include loss of ownership and autonomy.

Initial public offerings are a primary and potentially lucrative means of exit from investment for venture capitalists.

Capital leases and operating leases are two types of leases with different criteria.

Leasing assets, both as lessee or lessor, has significant impacts on various financial statements.

The main advantage of leasing lies in a business' ability to attain assets without outlaying essential cash.

Investment bank underwriters help securities issuers lessen their risk in exchange for a premium.

Market makers provide liquidity to securities markets by submitting both bids and asks on a security.

The advisory group of an investment bank is primarily concerned with facilitating the mergers and acquisitions of businesses.

In its agency role, an investment bank is tasked with matching companies with investors.

The spread is the difference between the prices for immediate purchase and sale of a stock, which is one measure of market liquidity.

The price of a security is the market determination of the value of the underlying asset.

Shelf registration is a type of public offering in which the issuer is allowed to offer several types of securities in a single prospectus.

The main advantage in seeking public financing is that it offers a larger pool of funding for the company than private financing alone.

Private financing can enhance a firm's capital structure, save on costs, and improve managerial incentive alignment.

LBOs use debt to secure an acquisition and the acquired assets service the debt.