Concept

The price of a security reflects the value of the asset underlying it. Therefore, the market price for a security indicates the consensus value placed on its asset by all the buyers and sellers in the market. It is the result of the valuation of the asset .

Price

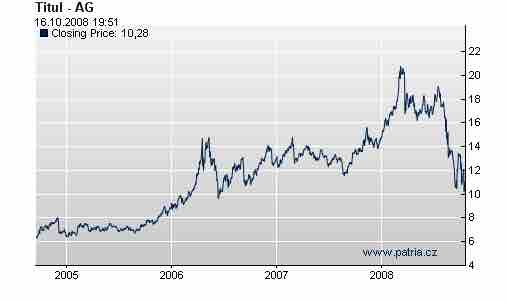

Price fluctuates depending on how the market values the security.

Valuation

In finance, valuation is the process of estimating what something is worth. There are different valuation methods. The choice of which method to use depends in part on what kind of security one is valuing. For instance, some financial instruments such as options are valued using mathematical models which take several variables into account. The price of stocks, on the other hand, depends on the value of the company. There are several methods used to value the company itself.

Present Value

This method estimates the value of an asset based on its expected future cash flows, which are discounted to the present. This concept of discounting future money is commonly known as the time value of money. The time value of money says that if you have an asset that matures in one year and pays $1 at that time, it is worth less than $1 today. This is because if you have a dollar today, you can do all kinds of things with it: invest it, use it to buy something you want, or pay back a debt. On the other hand, if you have to wait a year to get your dollar, you miss out on all these opportunities. Those missed opportunities are called the opportunity cost. Therefore, money you get in the future needs to be reduced to approximate the opportunity cost. The size of the discount is based on the opportunity cost of capital and it is expressed as a percentage. This percentage is the discount rate.

For a valuation using the discounted cash flow method, one first estimates the future cash flows from the investment and then estimates a reasonable discount rate after considering the riskiness of those cash flows and interest rates in the capital markets. Then one makes a calculation to compute the present value of the future cash flows.

Comparable Company Analysis

This method determines the value of a firm by observing the prices of similar companies that sold in the market. Those sales could be shares of stock or sales of entire firms. The observed prices serve as valuation benchmarks. From the prices, one calculates price multiples such as the price-to-earnings or price-to-book value ratios. Next, one or more price multiples are used to value the firm. For example, the average price-to-earnings multiple of the guideline companies is applied to the subject firm's earnings to estimate its value.

Net Asset Value

The third common method of estimating the value of a company looks to the assets and liabilities of the business. At a minimum, a solvent company could shut down operations, sell off the assets, and pay the creditors. Any cash that would remain establishes a floor value for the company. This method is known as the net asset value. Normally, the discounted cash flows of a well-performing company exceed this floor value. However, some companies are "worth more dead than alive," such as weakly performing companies that own many tangible assets. This method can also be used to value heterogeneous portfolios of investments, as well as non-profit companies for which discounted cash flow analysis is not relevant.

Financial Analysis

Financial professionals make their own estimates of the valuations of assets or liabilities that they are interested in. Their calculations are of various kinds including analyses of companies that focus on

- price-to-book

- price-to-earnings

- price-to-cash-flow

- present value calculations

All of these approaches may be thought of as creating estimates of value that compete for credibility with the prevailing stock or bond prices, and may result in buying or selling by market participants.

Price and Valuation

Investors use valuation methods to estimate what a company is worth, but the price of a stock on the market usually does not rest at the book-value of the company. Typically there will be people who are either optimistic about the company--because they anticipate that it will be worth more in the future than it is in the present--or pessimistic--because they think it will do worse in the future. Optimists will buy more of the stock and drive the price up, while pessimists will sell and drive it down. Therefore, a stock's market price also takes into account expectations for the future performance of the company.