Chapter 28

Monetary Policy

By Boundless

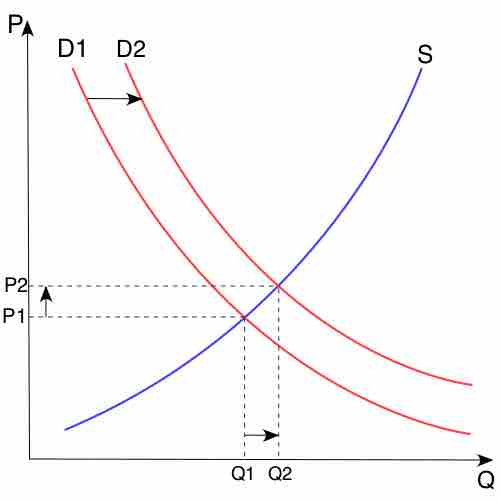

In economics, the demand for money is the desired holding of financial assets in the form of money (cash or bank deposits).

A shift in the money demand curve occurs when there is a change in any non-price determinant of demand, resulting in a new demand curve.

In a economy, equilibrium is reached when the supply of money is equal to the demand for money.

The reserve ratio is the percentage of deposits that a bank is required to hold in reserves, or funds that are not allowed to be loaned.

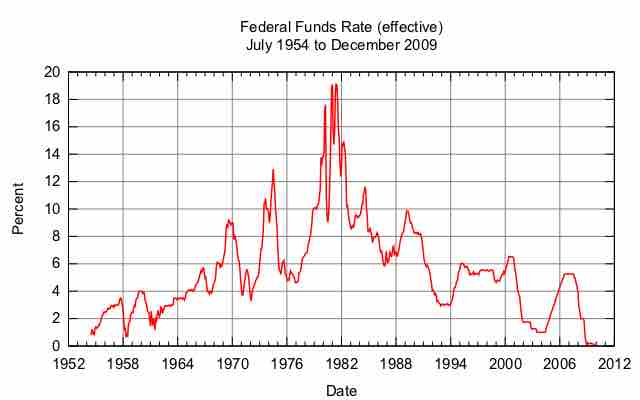

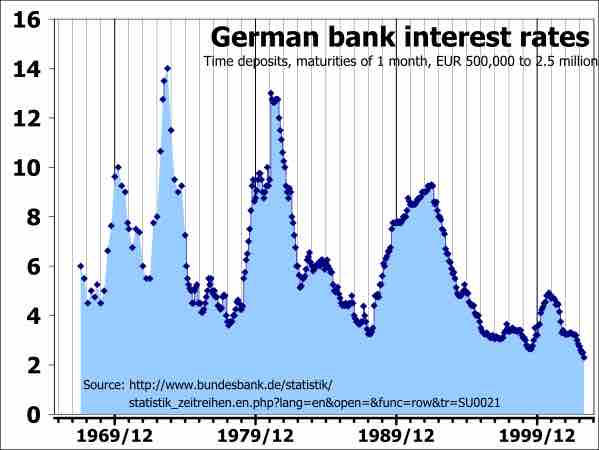

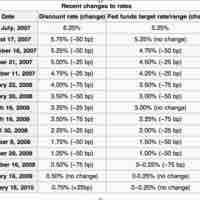

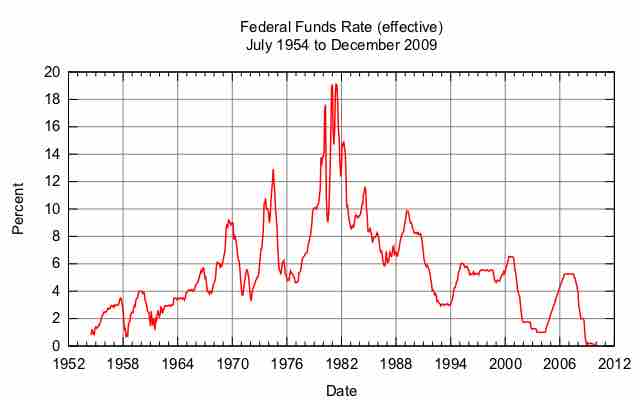

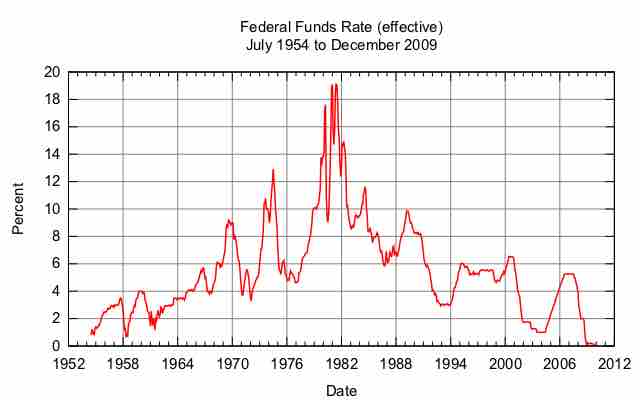

The rate that member banks charge each other is the federal funds rate and the rate the Fed charges is referred to as the discount rate.

The Federal Funds rate is the interest rate at which depository institutions actively trade balances held at the Federal Reserve.

Open market operations (OMOs) are the purchase and sale of securities in the open market by a central bank.

The Federal Reserve (Fed) has an ability to directly influence economic growth and stability through the use of monetary policy.

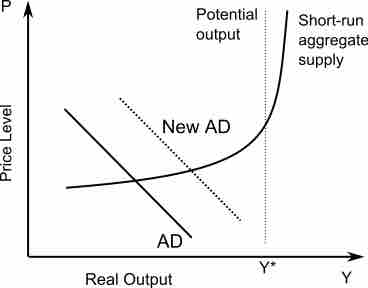

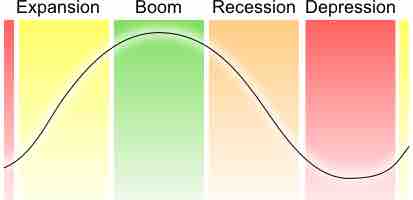

Central banks initiate expansionary policy during periods of economic slowing, increasing the money supply and reducing interest rates.

The central bank may initiate a contractionary or restrictive monetary policy to slow growth.

Taylor's rule was designed to provide monetary policy guidance for how a central bank should set short-term interest rates.

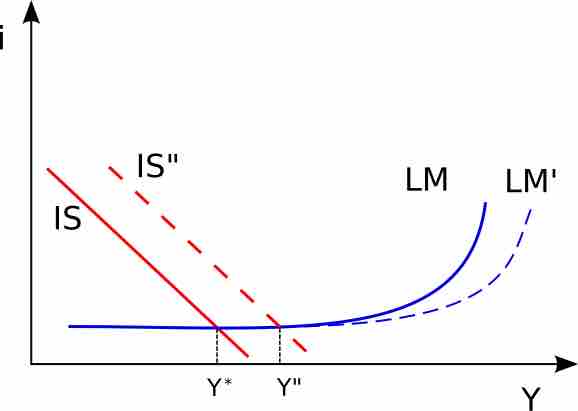

Changes in a country's money supply shifts the country's aggregate demand curve.

An expansionary monetary policy is used to increase economic growth, and generally decreases unemployment and increases inflation.

A restrictive monetary policy will generally increase unemployment and decrease inflation.

Limitations of monetary policy include liquidity traps, deflation, and being canceled out by other factors.

Inflation targeting occurs when a central bank attempts to steer inflation towards a set number using monetary tools.

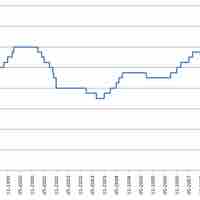

Paul Volcker, the 12th Chairman of the Federal Reserve, became known for lowering the inflation rate and achieving price stability.

Alan Greenspan was Chairman of the Federal Reserve from 1987 to 2006.

The Bernanke Era has included challenges faced by the Federal Reserve such as the financial crisis, strengthening federal policy, and reducing the deficit.