The Federal Reserve has several tools at its disposal to reach its monetary policy objectives. These include the discount rate, the fed funds target rate, and the reserve requirement, and open market operations (OMOs). OMOs are considered to be the most flexible option for the Federal Reserve out of all of these.

On a general level, OMO are the purchase and sale of securities in the open market by a central bank, as a means of controlling the money supply and the related prevailing interest rate.

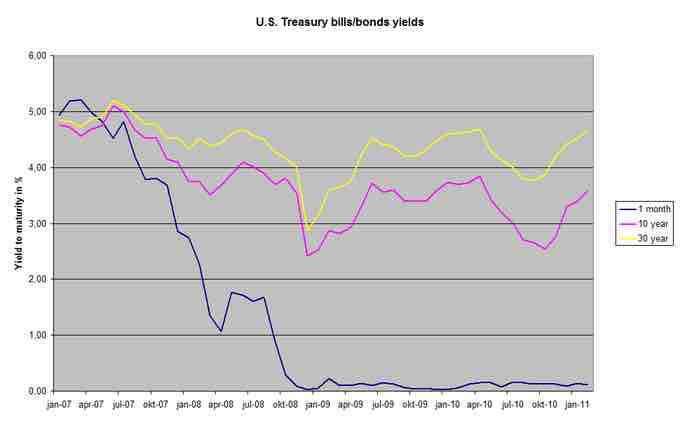

US Treasury Bill Yields

By buying and selling US Treasury bills on the open market, the Federal Reserve hopes to change their yields, which will then affect the interest rates in the broader market.

In the United States, the Federal Reserve Bank of New York conducts open market operations. They are under the oversight of the Federal Reserve Open Market Committee (FOMC). The FOMC makes a plan for open market operations over the short term, and publicly announce it after their regularly scheduled meetings.

Historically, the Federal Reserve has used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate--the interest rate at which depository institutions lend reserve balances to other depository institutions overnight--around the target established by the FOMC.

OMO Mechanism

OMOs are typically either expansionary or contractionary in nature. In an expansionary platform, the OMO will seek to increase the money supply and reduce interest rates in order to promote economic growth. In a contractionary scheme, the OMO will seek to reduce the money supply and increase interest rates in an effort to deter economic growth. Therefore, the implementation of contractionary policy will result in the selling of bonds (cash in exchange for debt holding) and an expansionary policy (buy bonds in exchange for cash) will result in an increase in the money supply at a lower interest rate as a means to enhance growth opportunities and revitalize the economy.

The interest rate targeted through the OMO manipulation of the money supply is the fed funds target rate or the rate that member Fed banks charge one another for overnight loans. The target rate is important monetary tool from the perspective that the higher the fed funds rate relative to the return on loanable funds, the greater the incentive for banks to meet their reserve requirement (the bank will lose money) thereby placing limits on the growth of the money supply through the loanable funds market. In addition to this direct interest rate channel, the fed funds rate influences many other interest rates in the economy and by so doing contributed to either incentivizing borrowing for growth or disincentivizing the same.