Demand for Money

In economics, the demand for money is the desired holding of financial assets in the form of money. The nominal demand for money generally increases with the level of nominal output (the price level multiplied by real output). The interest rate is the price of money. The quantity of money demanded increases and decreases with the fluctuation of the interest rate. The real demand for money is defined as the nominal amount of money demanded divided by the price level. A demand curve is used to graph and analyze the demand for money.

Factors that Cause Demand to Shift

A demand curve has the price on the vertical axis (y) and the quantity on the horizontal axis (x). The shift of the money demand curve occurs when there is a change in any non-price determinant of demand, resulting in a new demand curve. Non-price determinants are changes cause demand to change even if prices remain the same. Factors that influence prices include:

- Changes in disposable income

- Changes in tastes and preferences

- Changes in expectations

- Changes in price of related goods

- Population size

Factors that change the demand include:

- Decrease in the price of a substitute

- Increase in the price of a complement

- Decrease in consumer income if the good is a normal good

- Increase in consumer income if the good is an inferior good

The demand for money shifts out when the nominal level of output increases. It shifts in with the nominal interest rate.

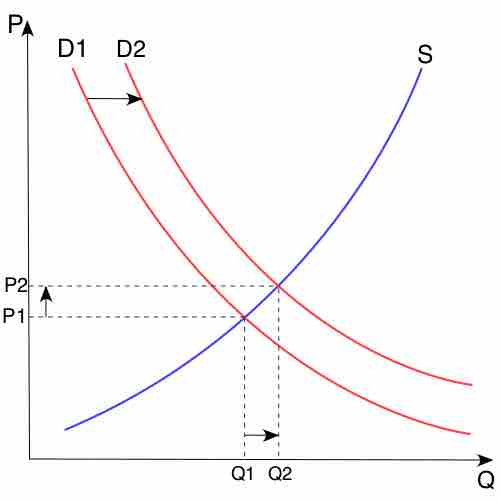

Shift of the Demand Curve

The graph shows both the supply and demand curve, with quantity of money on the x-axis (Q) and the price of money as interest rates on the y-axis (P). When the quantity of money demanded increase, the price of money (interest rates) also increases, and causes the demand curve to increase and shift to the right. A decrease in demand would shift the curve to the left.

Implications of Demand Curve Shift

The demand for money is a result of the trade-off between the liquidity advantage of holding money and the interest advantage of holding other assets. The demand for money determines how a person's wealth should be held. When the demand curve shifts to the right and increases, the demand for money increases and individuals are more likely to hold on to money. The level of nominal output has increased and there is a liquidity advantage in holding on to money. Likewise, when the demand curve shifts to the left, it shows a decrease in the demand for money. The nominal interest rate declines and there is a greater interest advantage in holding other assets instead of money.