Credit Ratings

A credit rating evaluates the credit worthiness of a debtor, especially a business (company) or a government. It is an evaluation made by a credit rating agency of the debtor's ability to pay back the debt and the likelihood of default. Credit ratings are determined by credit ratings agencies. The credit rating represents the credit rating agency's evaluation of qualitative and quantitative information for a company or government; including non-public information obtained by the credit rating agencies analysts. Credit ratings are not based on mathematical formulas. Instead, credit rating agencies use their judgment and experience in determining what public and private information should be considered in giving a rating to a particular company or government. The credit rating is used by individuals and entities that purchase the bonds issued by companies and governments to determine the likelihood that the government will pay its bond obligations.

A poor credit rating indicates a credit rating agency's opinion that the company or government has a high risk of defaulting, based on the agency's analysis of the entity's history and analysis of long term economic prospects.

Sovereign Credit Ratings

A sovereign credit rating is the credit rating of a sovereign entity like a national government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors looking to invest abroad. Ratings are broken down into components including political and economic risk. Euromoney's bi-annual country risk index monitors the political and economic stability of 185 sovereign countries. Results focus foremost on economics, specifically sovereign default risk and/or payment default risk for exporters (a.k.a. trade credit risk).

The top 10 least risky countries, as of June 2011 are as follows:

- Norway

- Luxembourg

- Switzerland

- Denmark

- Sweden

- Singapore

- Finland

- Canada

- Netherlands

- Germany

Corporate Ratings

A short-term rating is a probability factor of an individual going into default within a year. This is in contrast to a long-term rating, which is evaluated over a long time frame. First, the Basel II agreement requires banks to report their one-year probability if they applied internal ratings-based approach for capital requirements. Second, many institutional investors can easily manage their credit/bond portfolios with derivatives on monthly or quarterly basis. Therefore, some rating agencies simply report short-term ratings.

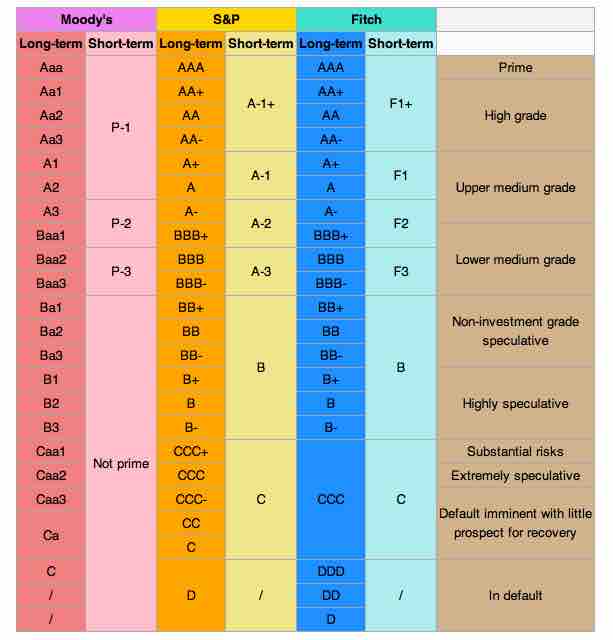

The credit rating of a corporation is a financial indicator to potential investors of debt securities, such as bonds. The corporate credit rating is usually of a financial instrument such as a bond, rather than the whole corporation. These are assigned by credit rating agencies such as A. M. Best, Dun & Bradstreet, Standard & Poor's, Moody's, or Fitch. Ratings have letter designations such as A, B, C. Bond ratings below BBB/Baa are considered to be not investment grade and are colloquially called junk bonds.

Ratings play a critical role in determining how much companies and other entities that issue debt, including sovereign governments, have to pay to access credit markets, such as the amount of interest they pay on their issued debt. The threshold between investment-grade and speculative-grade ratings has important market implications for issuers' borrowing costs.

Bonds that are not rated as investment-grade bonds are known as high yield bonds or more derisively as junk bonds. The risks associated with investment-grade bonds (or investment-grade corporate debt) are considered significantly higher than those associated with first-class government bonds. The difference between rates for first-class government bonds and investment-grade bonds is called investment-grade spread. The range of this spread is an indicator of the market's belief in the stability of the economy. The higher these investment-grade spreads (or risk premiums) are, the weaker the economy is considered.

Individual Ratings

In the United States, a credit score is a number based on a statistical analysis of a person's credit files, that in theory represents the creditworthiness of that person, which is the likelihood that people will pay their bills. A credit score is primarily based on credit report information, typically from one of the three major credit bureaus: Experian, TransUnion, and Equifax. Income is not considered by the major credit bureaus when calculating a credit score.

There are different methods of calculating credit scores. FICO, the most widely known type of credit score, is a credit score developed by FICO, previously known as Fair Isaac Corporation. It is used by many mortgage lenders that use a risk-based system to determine the possibility that the borrower may default on financial obligations to the mortgage lender. All credit scores have to be subject to availability.

The credit bureaus all have their own credit scores: Equifax's ScorePower, Experian's PLUS score, and TransUnion's credit score, and each also sells the VantageScore credit score. In addition, many large lenders, including the major credit card issuers, have developed their own proprietary scoring models.

Studies have shown scores to be predictive of risk in the underwriting of both credit and insurance. Some studies even suggest that most consumers are the beneficiaries of lower credit costs and insurance premiums due to the use of credit scores.

Bond Credit Ratings

Each credit rating agency designates the quality of bonds with letters. This table shows each agency and their respective rating systems.