Collection from delinquent payables

In finance, the term "debt compliance" describes various legal measures taken to ensure that debtors, whether individuals, businesses, or governments, honor their debts and make an honest effort to repay the money that they owe. Generally, regarded as a subdivision of tax law, debt compliance is most often enforced through a combination of audits and legal restrictions. For example, a provision of the Federal Debt Collection Procedure Act states that a person or organization indebted to the United States, against whom a judgment lien has been filed, is ineligible to receive a government grant. Noncompliance, depending on severity and frequency, may be punished by fine or even incarceration. A charge-off is the declaration by a creditor (usually a credit card account) that an amount of debt is unlikely to be collected. This occurs when a consumer becomes severely delinquent on a debt. Traditionally, creditors will make this declaration at the point of six months without payment. In the United States, Federal regulations require creditors to charge-off installment loans after 120 days of delinquency, while revolving credit accounts must be charged-off after 180 days.Figure 1

The purpose of making such a declaration is to give the bank a tax exemption on the debt. Bad debts and even fraud are simply part of the cost of doing business. The charge-off, though, does not free the debtor of having to pay the debt. A charge-off is one of the most adverse factors that can be listed on an individual's credit report, greatly impacting an individual's ability to get credit in the future.

While a charge-off is considered to be "written off as uncollectible" by the bank, the debt is still legally valid, and remains as such after the fact. The creditor legally has the right to collect the full amount for time periods permitted by the laws of places of the location of the bank and where the consumer resides. Depending on the location, this amount of time may be a certain number of years (e.g., 3 to 7 years), or in some places, indefinitely.

Methods of collection that can be used include contacts from internal collections staff, outside collection agencies, or if the amount is large (generally over $1500–$2000), there is the possibility of a lawsuit or arbitration. In the United States, as the charge off number climbs or becomes erratic, officials from the Federal Reserve take a close look at the finances of the bank and may impose various operating strictures on the bank and in the most extreme cases, may close the bank entirely.

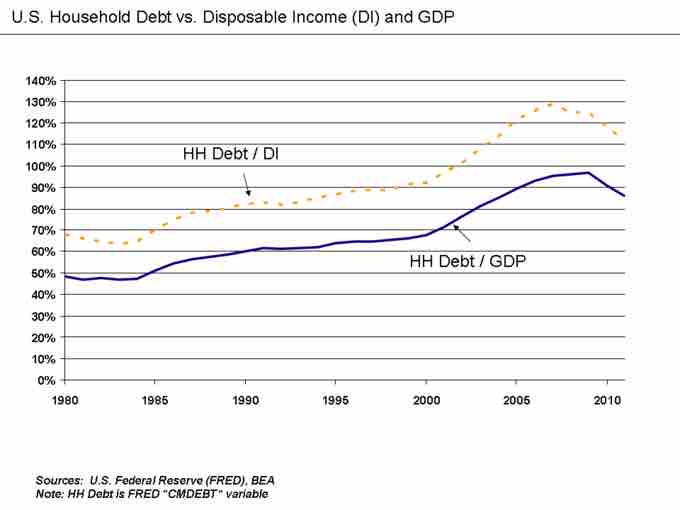

U.S. Household Debt Relative to Disposable Income and GDP 1980-2011

A charge-off is the declaration by a creditor (usually a credit card account) that an amount of debt is unlikely to be collected.