A Top-notch Team is Needed for Corporate Success

Typically, the chief executive officer (CEO) directs the fortunes of the company. It helps that the CEO has a good team that includes the chief operating officer (COO) who leads the operations of a company, and chief financial officer (CFO) who manages the finances. Also important in different companies are the chief marketing officer (CMO) and the chief information officer (CIO), who manages the information systems. When looking at the long-term prospects of the company, a good CEO will assemble and maintain a top-notch management team and nurture leaders to take over.

Controversy Over Executive Compensation

Executive pay (also known as executive compensation) is financial compensation received by an officer of a firm. It is typically a mixture of salary, bonuses, shares of and call options on the company stock, benefits, and perquisites, ideally configured to take into account government regulations, tax law, the desires of the organization and the executive, and rewards for performance.

Many policy makers are concerned about the huge growth in executive compensation and the lack of a relationship between performance and compensation. An example from the recent financial crisis are the CEOs who led their companies into insolvency and bankruptcy yet were still given huge pay packages .

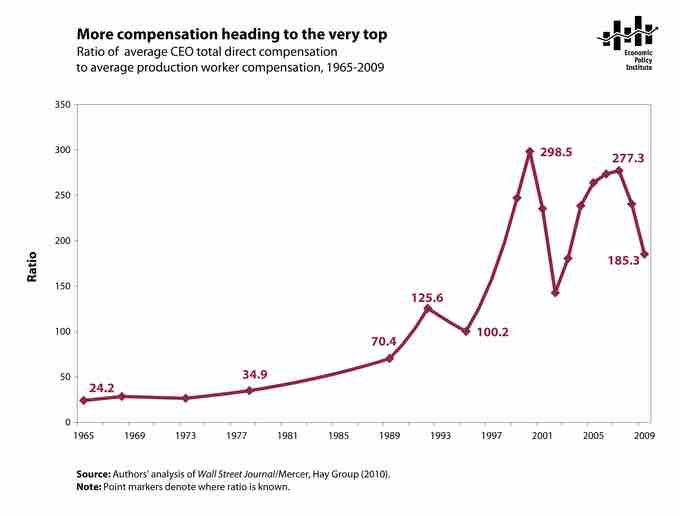

More Compensation Heading to the Very Top

During the financial crisis of 2008, many CEOs led their companies into insolvency and bankruptcy yet were still given huge pay packages.

In general, the compensation of CEOs in the United States has risen to over 400 times the salary of the average U.S. worker, compared to about 30 times only a few decades ago . This is different from other countries where the disparity is not so great.

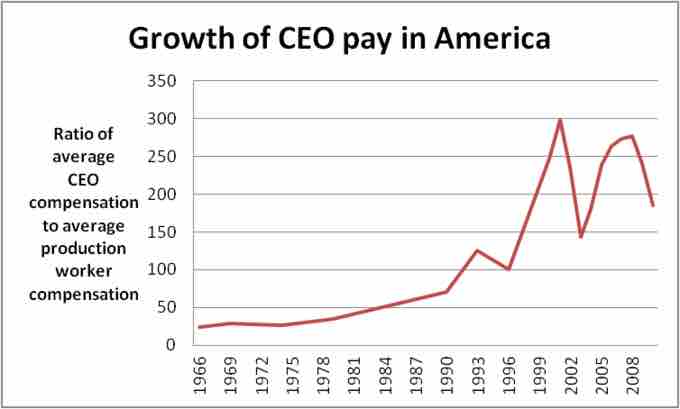

Growth of CEO Pay In America

The compensation of CEOs in the United States has risen to over 400 times the salary of the average U.S. worker, compared to about 30 times only a few decades ago.

The explosion in executive pay has become controversial, criticized by not only leftists but conservative establishmentarians such as Ben Bernanke, Peter Drucker, John Bogle, and Warren Buffet. The idea that stock options and other alleged pay-for-performance are driven by economics has also been questioned. A 2001 article in Fortune, "The Great CEO Pay Heist" drew criticism for this line of thinking: instead of arguing that "the stock isn't moving, so the CEO shouldn't be rewarded", it instead argued that "the stock isn't moving, so we've got to find some other basis for rewarding the CEO. " This line of thinking is exactly why executive compensation has come under so much criticism.

Defenders of high executive pay say that the global war for talent and the rise of private equity firms can explain much of the increase in executive pay. For example, while in conservative Japan a senior executive has few alternatives to his current employer, in the United States it is acceptable and even admirable for a senior executive to jump to a competitor, to a private equity firm, or to a private equity portfolio company. Portfolio company executives take a pay cut but are routinely granted stock options for ownership of 10% of the portfolio company, contingent on a successful tenure. Rather than signaling a conspiracy, defenders argue, the increase in executive pay is a mere byproduct of supply and demand for executive talent. However, U.S. executives make substantially more than their European and Asian counterparts.

As of 20120, the current ratio of CEO pay to average worker pay was:

- Japan 11

- Germany 12

- France 15

- Italy 20

- Canada 20

- South Africa 21

- Britain 22

- Hong Kong 41

- Mexico 47

- Venezuela 50

- United States 475