On a company's balance sheet, accounts receivable is the money owed to that company by entities outside of the company. The receivables owed by the company's customers are called trade receivables. Account receivables are classified as current assets, assuming that they are due within one calendar year or fiscal year.

A foreign currency transaction requires settlement in a currency other than the functional currency. A change in exchange rates between the functional currency and the currency in which a transaction is denominated increases or decreases the expected amount of functional currency cash flows upon settlement of the transaction. This change in expected functional currency cash flows is a "foreign currency transaction gain or loss" that typically is included in arriving at earnings in the income statement for the period in which the exchange rate is changed.

To deal with bad debts, companies have two methods available to them for measuring the net value of accounts receivable, which is generally computed by subtracting the balance of an allowance account from the accounts receivable account.

The first method is the allowance method, which establishes a contra-asset account, allowance for doubtful accounts, or bad debt provision, that has the effect of reducing the balance for accounts receivable. The allowance for bad debt/doubtful accounts is a permanent account. While the corresponding bad debt expense account is a temporary account that is zeroed out annually.

The amount of the bad debt provision can be computed in two ways: either by reviewing each individual debt and deciding whether it is doubtful (a specific provision), or by providing for a fixed percentage (e.g. 2%) of total debtors (a general provision). The change in the bad debt provision from year to year is posted to the bad debt expense account in the income statement .

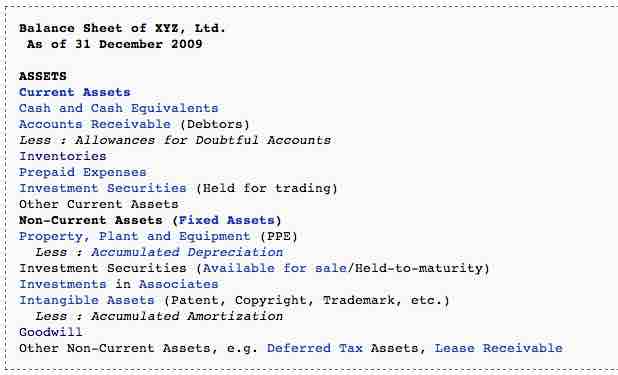

Allowance for Doubtful Accounts

Allowance for Doubtful Accounts (the allowance method)

The second method is the direct write-off method. It is simpler than the allowance method in that it allows for one simple entry to reduce accounts receivable to its net realizable value. The entry would consist of debiting a bad debt expense account and crediting the respective accounts receivable in the sales ledger.