Financial instrumentsContracts for the payment of money; securities., sometimes called financial securitiesAnother term for financial instruments., are legal contracts that detail the obligations of their makersThe issuers or initial sellers of a financial instrument; the entities promising payment., the individuals, governments, or businesses that issue (initially sell) them and promise to make payment, and the rights of their holderThe owners or possessors of a financial instrument; the entities entitled to payment.s, the individuals, governments, or businesses that currently own them and expect to receive payment. Their major function is to specify who owes what to whom, when or under what conditions payment is due, and how and where payment should be made.

Financial instruments come in three major varieties—debtA financial instrument in which a type of maker called a borrower promises to pay a fixed sum on a fixed date to a holder called a lender (or bondholder)., equityA financial instrument in which a type of maker called an issuer promises to pay a portion of its profits to a holder called an owner (or stockholder or shareholder)., and hybridA financial instrument that has some of the characteristics of debt and some of the characteristics of equity.. Debt instruments, such as bonds, indicate a lender–borrower relationship in which the borrower promises to pay a fixed sum and interest to the lender at a specific date or over some period of time. Equity instruments, such as stocks, represent an ownership stake in which the holder of the instrument receives some portion of the issuerThe maker or initial seller of a financial instrument.’s profits. Hybrid instruments, such as preferred stock, have some of the characteristics of both debt and equity instruments. Like a bond, preferred stock instruments promise fixed payments on specific dates but, like a common stock, only if the issuer’s profits warrant. Convertible bonds, by contrast, are hybrid instruments because they provide holders with the option of converting debt instruments into equities.

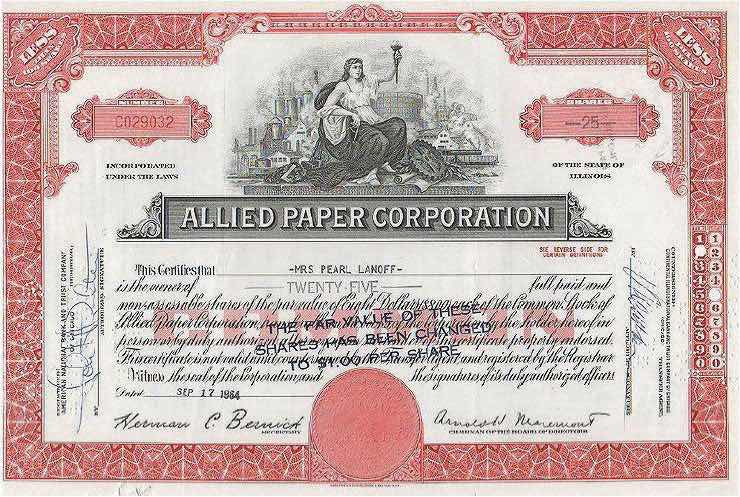

Today, many financial instruments are merely electronic accounting entries—numbers in a spreadsheet linked to a contract. In the past, however, they took corporeal form as in the case of stock certificates, like that pictured in Figure 2.2 "Allied Paper stock certificate, 1964".

Figure 2.2 Allied Paper stock certificate, 1964

Compliments Wikimedia Commons: http://wikimediafoundation.org/wiki/File:Allied_Paper_Corporation_Stock_Certificate_1964.jpg.

How would you characterize financial instruments in the following forms?

The first instrument is a debt because Joe promises to pay Jane a fixed sum on a certain date. Joe is a simple borrower and Jane, his creditor/lender. The second instrument is an equity because Joe promises to pay Jane a percentage of profit, making Jane a part owner of the business. The third instrument is a hybrid because Joe promises to pay Jane a fixed sum but only if his taco stand is profitable. Parallel to the first instrument, Jane will receive a fixed sum on a fixed date (as in a loan), but like the second instrument, payment of the sum is contingent on the taco stand’s profits (as in an ownership stake).