This is “Aggregate Supply and Demand, the Growth Diamond, and Financial Shocks”, chapter 23 from the book Finance, Banking, and Money (v. 1.0).

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. You may also download a PDF copy of this book (8 MB) or just this chapter (566 KB), suitable for printing or most e-readers, or a .zip file containing this book's HTML files (for use in a web browser offline).

Chapter 23 Aggregate Supply and Demand, the Growth Diamond, and Financial Shocks

Chapter Objectives

By the end of this chapter, students should be able to:

- Describe the aggregate demand (AD) curve and explain why it slopes downward.

- Describe what shifts the AD curve and explain why.

- Describe the short-run aggregate supply (AS) curve and explain why it slopes upward.

- Describe what shifts the short-run AS curve and explain why.

- Describe the long-run aggregate supply (ASL) curve, and explain why it is vertical and what shifts it.

- Explain the term long term and its importance for policymakers.

- Describe the growth diamond model of economic growth and its importance.

- Explain how financial shocks affect the real economy.

23.1 Aggregate Demand

Learning Objectives

- What is the AD curve and why does it slope downward?

- What shifts the AD curve and why?

We learned in Chapter 22 "IS-LM in Action" that the IS-LM model isn’t entirely agreeable to policymakers because it examines only the short term, and when pressed into service for the long-term, or changes in the price level, it suggests that policy initiatives are more likely to mess matters up than to improve them. In response, economists developed a new theory, aggregate demand and supply, that relates the price level to the total final goods and services demanded (aggregate demand [AD]) and the total supplied (aggregate supply [AS]). This new framework is attractive for several reasons: (1) it can be used to examine both the short and the long run; (2) it takes a form similar to the microeconomic price theory model of supply and demand, so it is familiar; and (3) it gives policymakers some grounds for implementing activist economic policies. To understand aggregate demand and supply theory, we need to understand how each of the curves is derived.

The aggregate demand curve can be derived three ways, through the IS-LM model as described at the end of Chapter 22 "IS-LM in Action", with help from the quantity theory of money, or directly from its components. Remember that Y = C + I + G + NX. As the price level falls, ceteris paribus, real money balances are higher. That spells a lower interest rate, as we learned in Chapter 5 "The Economics of Interest-Rate Fluctuations". A lower interest rate, in turn, means an increase in I (and hence Y). A lower interest rate also means a lower exchange rate and, as explained in Chapter 18 "Foreign Exchange", more exports and fewer imports. So NX also increases. (C might be positively affected by lower i as well.) As the price level increases, the opposite occurs. So the AD curve slopes downward.

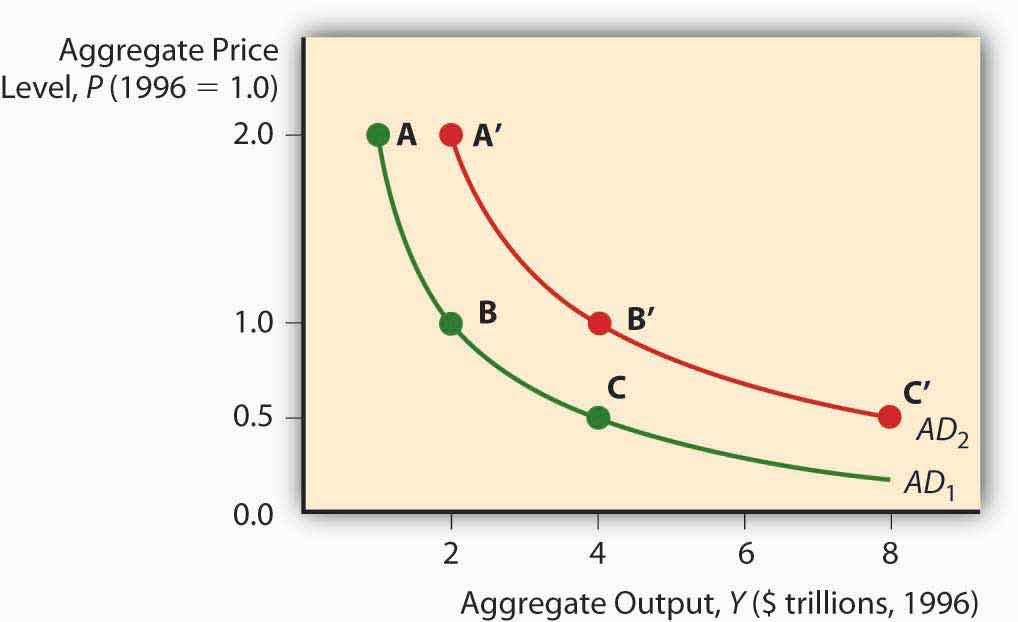

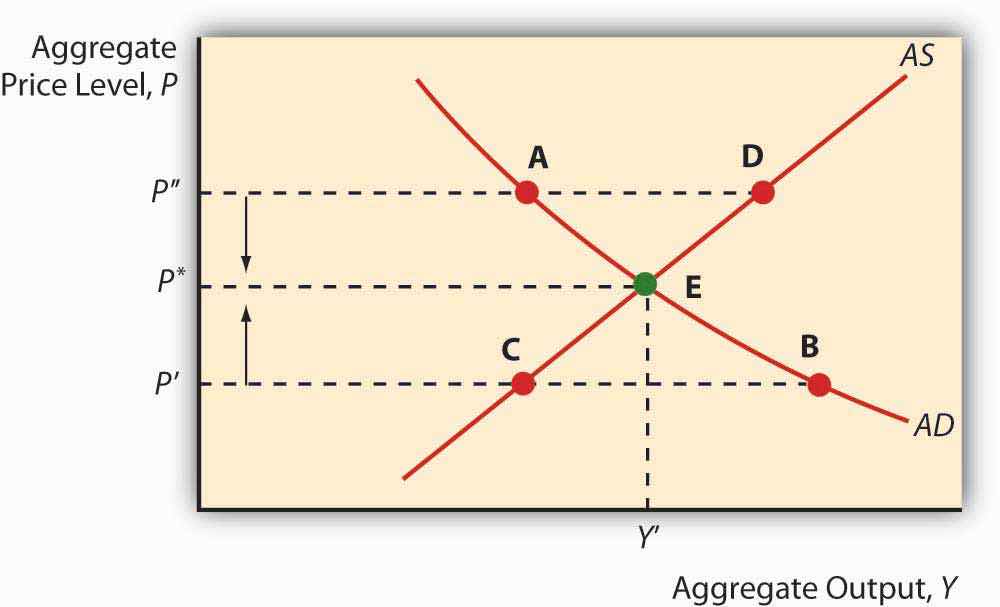

Figure 23.1 Aggregate demand curve

The quantity theory of money also shows that the AD curve should slope downward. Remember that the quantity theory ties money to prices and output via velocity, the average number of times annually a unit of currency is spent on final goods and services, in the so-called equation of exchange:

where

M = money supply

V = velocity of money

P = price level

Y = aggregate output

If M = $100 billion and V = 3, then PY must be $300 billion. If we set P, the price level, equal to 1, Y must equal $300 billion (300/1). If P is 2, then Y is $150 billion (300/2). If it is .5, then Y is $600 billion (300/.5). Plot those points and you get a downward sloping curve, as in Figure 23.1 "Aggregate demand curve". The AD curve shifts right if the MS increases and left if it decreases. Continuing the example above, if we hold P constant at 1.0 but double M to $200 billion, then Y will double to $600 billion (200 × 3). (Recall that the theory suggests that V changes only slowly.) Cut M in half ($50 billion) and Y will fall by half, to $150 billion (50 × 3).

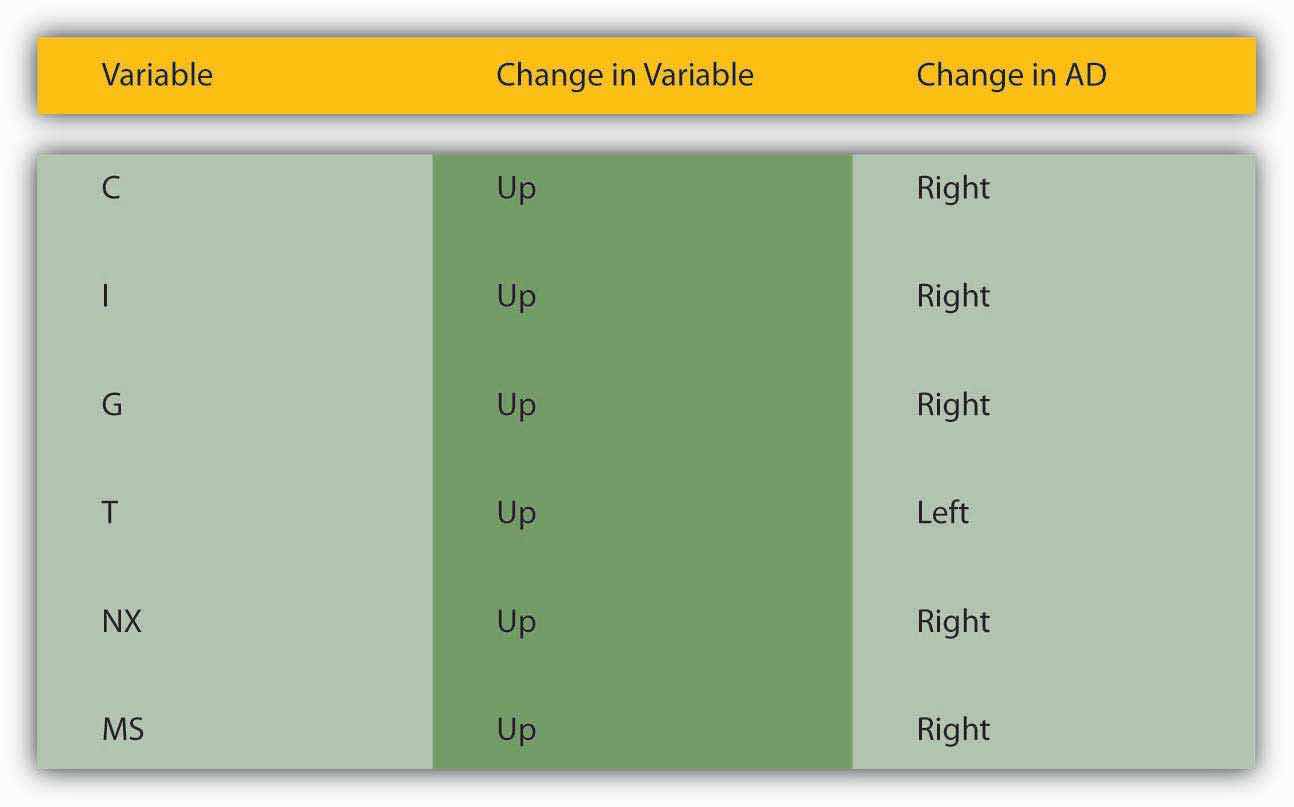

Figure 23.2 Factors that shift the aggregate demand curve

For a summary of the factors that shift the AD curve, review Figure 23.2 "Factors that shift the aggregate demand curve".

Key Takeaways

- The aggregate demand (AD) curve is the total quantity of final goods and services demanded at different price levels.

- It slopes downward because a lower price level, holding MS constant, means higher real money balances.

- Higher real money balances, in turn, mean lower interest rates, which means more investment (I) due to more +NPV projects and more net exports (NX) due to a weaker domestic currency (exports increase and imports decrease).

- The AD curve is positively related to changes in MS, C, I, G, and NX, and is negatively related to T.

- Those variables shift AD for the same reasons they shift Yad and the IS curve, as discussed in Chapter 21 "IS-LM" and Chapter 22 "IS-LM in Action", because all of them except taxes add to output.

- An increase in the MS increases AD (shifts the AD curve to the right) through the quantity theory of money and the equation of exchange MV = PY. Holding velocity and the price level constant, it is clear that increases in M must lead to increases in Y.

23.2 Aggregate Supply

Learning Objectives

- What is the short-run AS curve and why does it slope upward?

- What shifts the short-run AS curve and why?

The aggregate supply curve is a tad trickier because it is believed to change over time. In the long run, it is thought to be vertical at Ynrl, the natural rate of output concept introduced in Chapter 22 "IS-LM in Action". In the long run, the economy can produce only so much given the state of technology, the natural rate of unemployment, and the amount of physical capital devoted to productive uses.

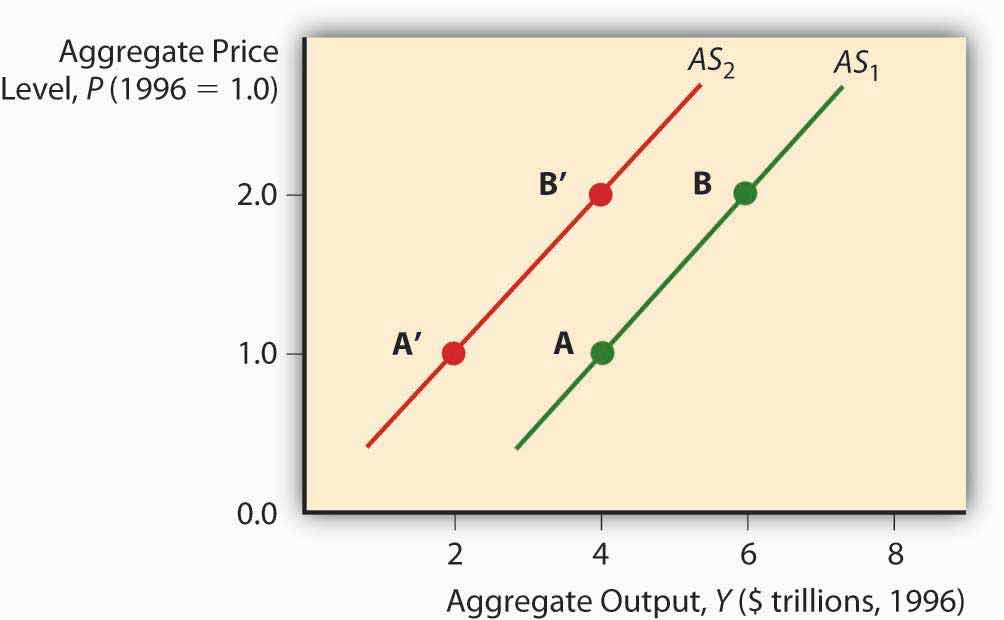

Figure 23.3 Short-run aggregate supply curve

In the short run, by contrast, the total value of goods and services supplied to the economy is a function of business profits, meant here simply as the price goods bear in the market minus all the costs of their production, including wages and raw material costs. Prices of final goods and services generally adjust faster than the cost of inputs like labor and raw materials, which are often “sticky” due to long-term contracts fixing their price. So as the price level rises, ceteris paribus, business profits are higher and hence businesses supply a higher quantity to the market. That is why the aggregate supply (AS) curve slopes upward in the short run, as in Figure 23.3 "Short-run aggregate supply curve".

The short-run AS curve shifts due to changes in costs and hence profits. When the labor market is tight, the wage bill rises, cutting into profits and shifting the AS curve to the left. Any so-called wage push from any source, like unionization, will have the same effect. If economic agents expect the price level to rise, that will also shift the AS curve left because they are going to demand higher wages or higher prices for their wares. Finally, changes in technology and raw materials supplies will shift the AS curve to the right or left, depending on the nature of the shock. Improved productivity (more output from the same input) is a positive shock that moves the AS curve to the right. A shortage due to bad weather, creation of a successful producer monopoly or cartel, and the like, is a negative shock that shifts the AS curve to the left.

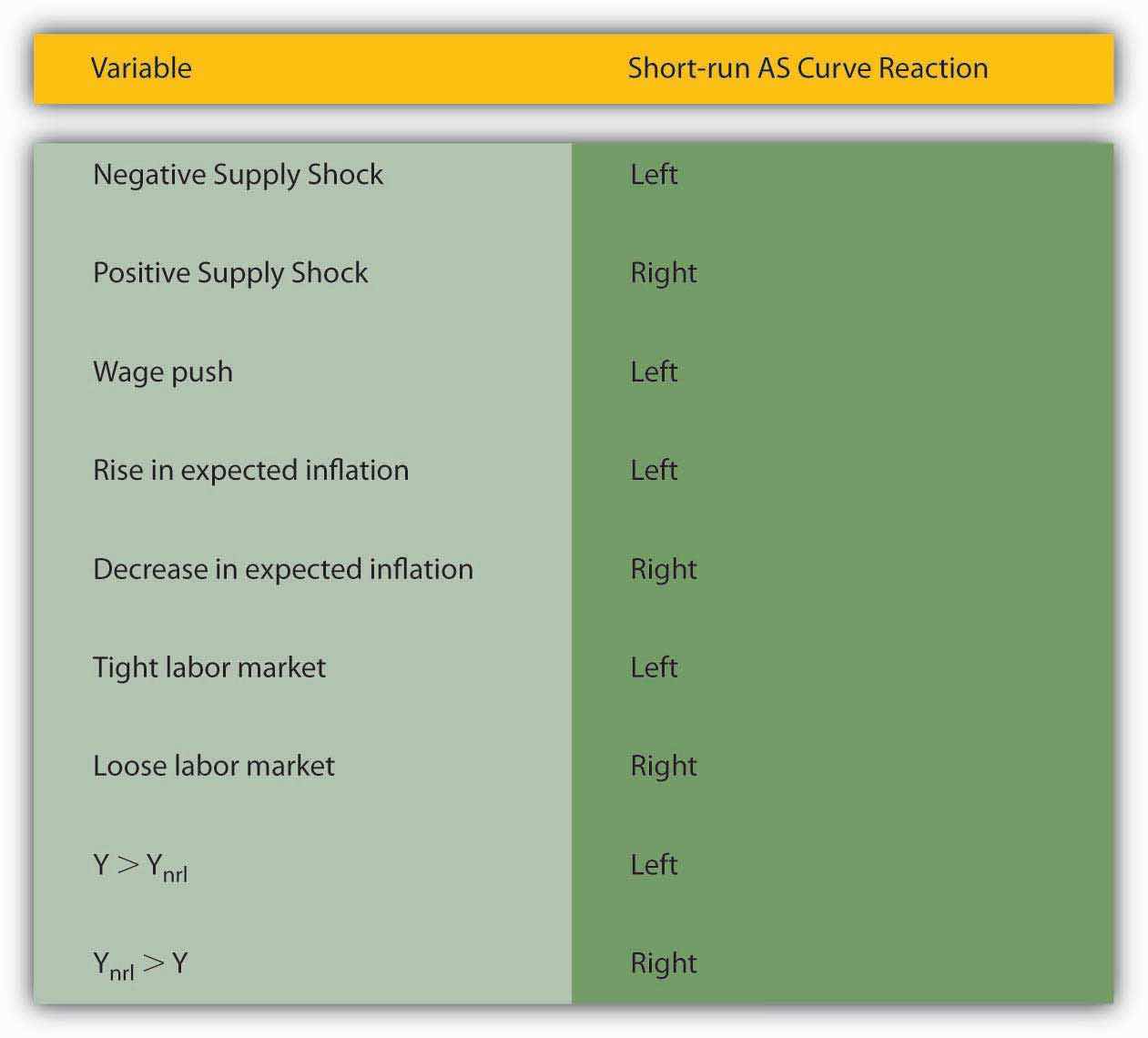

Figure 23.4 Factors that shift the short-run aggregate supply curve

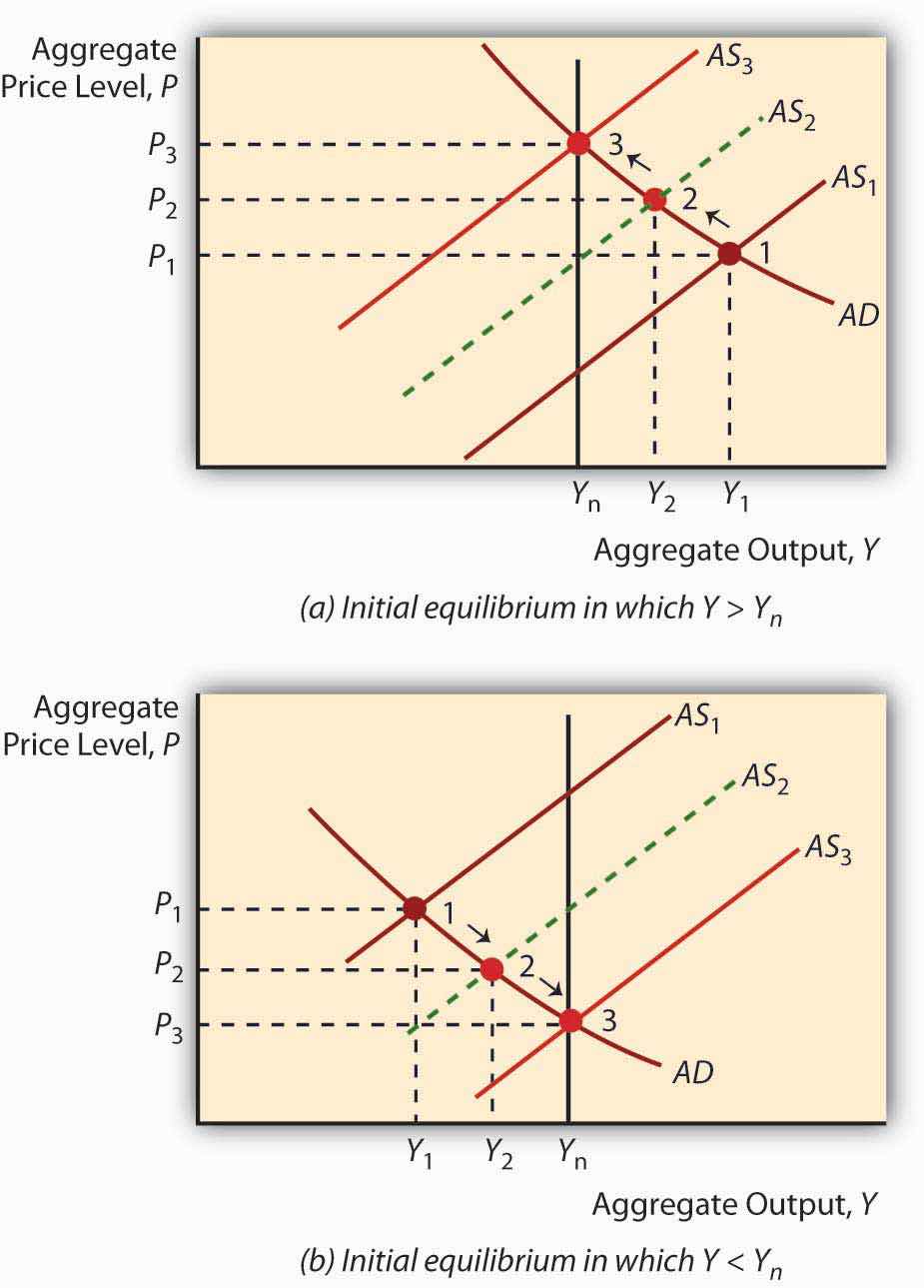

Also, whenever Y exceeds Ynrl, the AS curve shifts left. That is because when Y exceeds Ynrl, the labor market gets tighter and expectations of inflation grow. Reversing that reasoning, the AS curve shifts right whenever Ynrl exceeds Y. Figure 23.4 "Factors that shift the short-run aggregate supply curve" summarizes the discussion of the short-run AS curve.

Key Takeaways

- The aggregate supply (AS) curve is the total quantity of final goods and services supplied at different price levels.

- It slopes upward because wages and other costs are sticky in the short run, so higher prices mean more profits (prices minus costs), which means a higher quantity supplied.

- The AS curve shifts left when Y* exceeds Ynrl, and it shifts right when Y* is less than Ynrl.

- In other words, Ynrl is achieved via shifts in the AS curve, particularly through labor market “tightness” and inflation expectations.

- When Y* is > Ynrl, the labor market is tight, pushing wages up and strengthening inflation expectations; when Ynrl is > *Y, the labor market is loose, keeping wages low and inflation expectations weak.

- Supply shocks, both positive and negative, also shift the AS curve.

- Anything (like a so-called wage push or higher raw materials prices) that decreases business profits shifts AS to the left, while anything that increases business profits moves it to the right.

23.3 Equilibrium Analysis

Learning Objectives

- What is the ASL curve?

- Why is it vertical, and what shifts it?

- How long is the long term and why is the answer important for policymakers?

Of course, this is all just a prelude to the main event: slapping these three curves—AD, AS, and ASL—on the same graph at the same time. Let’s start, as in Figure 23.5 "Short-run equilibrium in the macroeconomy", with just the short-run AS and AD curves. Their intersection indicates both the price level P* (not to be confused with the microeconomic price theory model’s p*) and Y* (again not to be confused with q*). Equilibrium is achieved because at any P > P*, there will be a glut (excess supply), so prices (of all goods and services) will fall toward P*. At any P < P*, there will be excess demand, many bidders for each automobile, sandwich, haircut, and what not, who will bid prices up to P*. We can also now examine what happens to P* and Y* in the short run by moving the curves to and fro.

Figure 23.5 Short-run equilibrium in the macroeconomy

To study long-run changes in the economy, we need to add the vertical long-run aggregate supply curve (ASL), to the graph. As discussed above, if Y* is > or < Ynrl, the AS curve will shift (via the labor market and/or inflation expectations) until it Y* = Ynrl, as in Figure 23.6 "Long-run equilibrium in the macroeconomy". So attempts to increase output above its natural rate will cause inflation and recession. Attempts to keep it below its natural rate will lead to deflation and expansion.

Figure 23.6 Long-run equilibrium in the macroeconomy

The so-called self-correcting mechanism described above makes many policymakers uneasy, so the most activist among them argue that the long-run analysis holds only over very long periods. In fact, the great granddaddy, intellectually speaking, of today’s activist policymakers, John Maynard Keynes,http://en.wikipedia.org/wiki/John_Maynard_Keynes once remarked, “[The l]ong run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again.”http://www.bartleby.com/66/8/32508.html Other economists (nonactivists, including monetarists like Milton Friedman) think that the short run is short indeed and the long run is right around the corner. Figuring out how short and long the short and long runs are is important because if the nonactivists are correct, policymakers are wasting their time trying to increase output by shifting AD to the right: the AS curve will soon shift left, leaving the economy with a higher price level but the same level of output. Similarly, policymakers need do nothing in response to a negative supply shock (which, as noted above, shifts AS to the left) because the AS curve will soon shift back to the right on its own, restoring both the price level and output. If the activists are right, on the other hand, policymakers can improve people’s lives by regularly shifting AD to the right and countering the effects of negative supply shocks by helping the AS curve to return to its original position or beyond.

The holy grail of economic growthReal per capita GDP. theory is to figure out how to shift Ynrl to the right because, if policymakers can do that, it doesn’t matter how short the long term is. Policymakers can make a difference—and for the better. The real business cycle theory of Edward Prescott suggests that real aggregate supply shocks can affect Ynrl.http://www.minneapolisfed.org/research/prescott/ This is an active area of research, and not just because Prescott took home the Nobel Prize in 2004 for his contributions to “dynamic macroeconomics: the time consistency of economic policy and the driving forces behind business cycles.”http://nobelprize.org/nobel_prizes/economics/laureates/2004/prescott-autobio.html Other economists believe that activist policies designed to shift AD to the right can influence Ynrl through a process called hysteresis.http://economics.about.com/library/glossary/bldef-hysteresis.htm It’s still all very confusing and complicated, so the authors of this book and numerous others prefer bringing an institutional analysis to Ynrl, one that concentrates on providing economic actors with incentives to labor, to develop and implement new technologies, and to build new plant and infrastructure.

Stop and Think Box

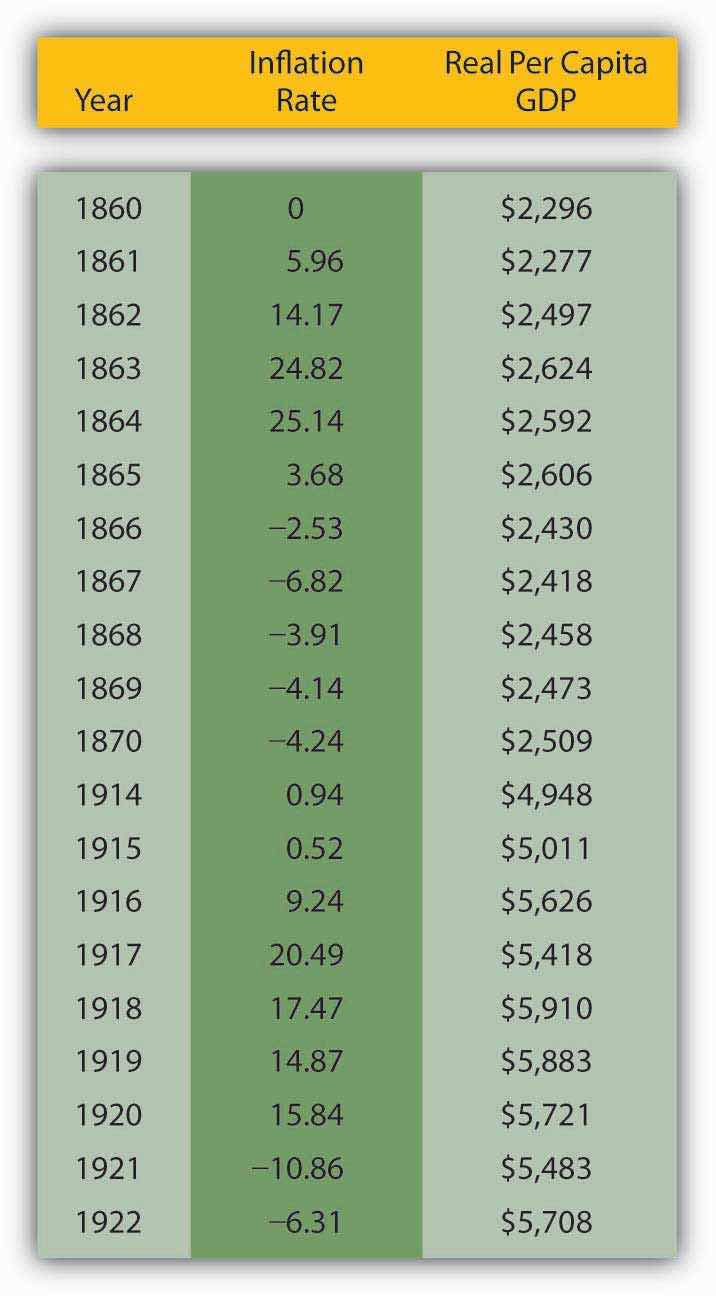

People often believe that wars induce long-term economic growth; however, they are quite wrong. Use Figure 23.7 "Inflation and output during and after two major U.S. wars, the Civil War (1861–1865) and World War I (1917–1918)" and the AS-AD model to explain why people think wars induce growth and why they are wrong.

Figure 23.7 Inflation and output during and after two major U.S. wars, the Civil War (1861–1865) and World War I (1917–1918)

Y* often increases during wars because AD shifts right because of increases in G (tanks, guns, ships, etc.) and I (new or improved factories to produce tanks, guns, ships, etc.) that exceed decreases in C (wartime rationing) and possibly NX (trade level decreases and/or subsidies provided to or by allies). Due to the right shift in AD, P* also rises, perhaps giving the illusion of wealth. After the war, however, two things occur: AD shifts back left as war production ceases and, to the extent that the long run comes home to roost, AS shifts left. Both lower Y* and the AD leftward shift decreases the price level. Empirically, wars are indeed often followed by recessions and deflation. Figure 23.7 "Inflation and output during and after two major U.S. wars, the Civil War (1861–1865) and World War I (1917–1918)" shows what happened to prices and output in the United States during and after the Civil War (1861–1865) and World War I (1914–1918; direct U.S. involvement, 1917–1918), respectively. The last bastion of the warmongers is the claim that, by inducing technological development, wars cause Ynrl to shift right. Wars do indeed speed research and development, but getting a few new gizmos a few years sooner is not worth the wartime destruction of great masses of human and physical capital.

Key Takeaways

- The ASL is the amount of output that is obtainable in the long run given the available labor, technology, and physical capital set.

- It is vertical because it is insensitive to changes in the price level.

- Economists are not entirely certain why ASL shifts. Some point to hysteresis, others to real business cycles, still others to institutional improvements like the growth diamond.

- Nobody knows how long the long term is, but the answer is important for one’s attitude toward economic policymaking.

- Those who favor activist policies think the long term is a long way off indeed, so policymakers can benefit the economy by shifting AD and AS to the right.

- Those who are suspicious of interventionist policies think that the long run will soon be upon us, so interventionist policies cannot help the economy for long because output must soon return to Ynrl.

23.4 The Growth Diamond

Learning Objective

- What is the growth diamond and why is it important?

Over the last two decades or so, many scholars, including one of the authors of this textbook (Wright), have examined the link between financial development and economic growth. They have found that financial repression, severe underdevelopment of financial intermediaries and markets, can stymie growth and that financial development paves the way for growth. The reason is clear: by reducing asymmetric information and tapping economies of scale (and scope), the financial system efficiently links investors to entrepreneurs, ensuring that society’s scarce resources are allocated to their highest valued uses and that innovative ideas get a fair trial.

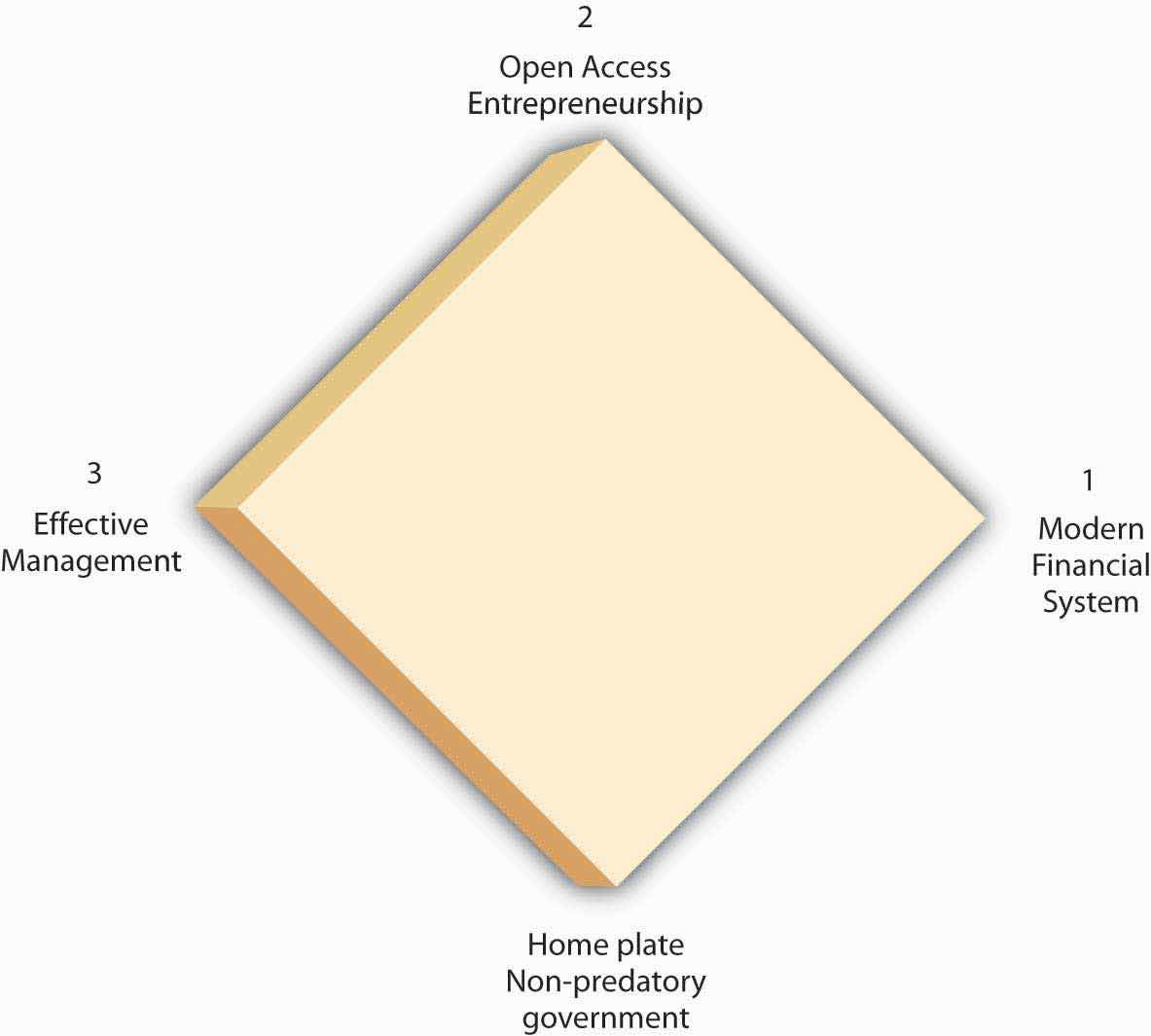

The research agenda of some of those scholars, including the author of this textbook, has recently broadened to include more of the institutional factors that enhance or reduce economic growth, sustained rightward movements of Ynrl. A leading model, set forth by three economic historians who teach economics at New York University’s Stern School of Business,http://w4.stern.nyu.edu/economics/facultystaff.cfm?doc_id=1019 is called the growth diamond or diamond of sustainable growth.http://w4.stern.nyu.edu/sternbusiness/spring_2007/sustainableGrowth.html Imagine a baseball or softball diamond. At the bottom of the diamond is home plate, the most important base in the game, where the player both begins and, if successful, ends his or her journey. Looking out from home, first base is at the right corner; second base is at the top of the diamond, dead ahead; and third base is at the diamond’s left corner. To score a run, a player must return to home plate after touching first, second, and third base, in that order. Countries are no different than ballplayers in this regard. For a country to get rich, it needs to progress from base to base in the proper order.

In the growth diamond, home plate is represented by government, first base by the financial system, second base by entrepreneurs, and third base by management. To succeed economically, as depicted in Figure 23.8 "The growth diamond", a country must first possess a solid home plate, a government that at a minimum protects the lives, liberty, and property of its citizens. Next, it must develop an efficient financial system capable of linking savers/investors to people with good business ideas, the entrepreneurs at second base. The managers at third take over after a product has emerged and matured.

Figure 23.8 The growth diamond

The growth diamond is a powerful model because it can be applied to almost every country on earth. The poorest countries never left home plate because their governments killed and robbed their citizens. Poor but not destitute countries never made it to first base, often because their governments, while not outright predatory, restricted economic liberty to the point that financiers and entrepreneurs could not thrive. In many such countries, the financial system is the tool of the government (indeed many banks in poor countries are owned by the state outright), so they allocate resources to political cronies rather than to the best entrepreneurs. Countries with middling income rounded the bases once or twice but found that managers, entrepreneurs, and financiers co-opted the government and implemented self-serving policies that rendered it difficult to score runs frequently. Meanwhile the rich countries continue to rack up the runs, growing stronger as players circle the bases in a virtuous or self-reinforcing cycle.

Stop and Think Box

In the early nineteenth century, Ontario, Canada (then a colony of Great Britain), and New York State (then part of a fledgling but independent United States) enjoyed (perhaps hated is a better word here!) a very similar climate, soil type, and flora and fauna (plants and animals). Yet the population density in New York was much higher, farms (ceteris paribus) were worth four times more there than on the north side of Lake Ontario, and per capita incomes in New York dwarfed those of Ontario. What explains those differences?

The growth diamond does. By the early 1800s, the United States, of which New York State was a part, had put in place a nonpredatory government and a financial system that, given the technology of the day, was quite efficient at linking investors to entrepreneurs, the activities of whom received governmental sanction and societal support. A nascent management class was even forming. Ontario, by contrast, was a colony ruled by a distant monarch. Canadians had little incentive to work hard or smart, so they didn’t, and the economy languished, largely devoid of banks and other financial intermediaries and securities markets. As late as the 1830s, New York was sometimes “a better market for the sale of Canada exchange on London than Canada itself.”(T. R. Preston, Three Years’ Residence in Canada, from 1837 to 1839, 2 vols., (London: Richard Bentley 1840), 185). Only after they shed their imperial overlords and reformed their domestic governments did Canadians develop an effective financial system and rid themselves of anti-entrepreneurial laws and sentiments. The Canadian economy then grew with rapidity, making Canada one of the world’s richest countries.

A narrower and more technical explanation of the higher value of New York farms comparable to Canadian farms in size, soil quality, rainfall, and so forth is that interest rates were much lower in New York. Valuing a farm is like valuing any income-producing asset. All it takes is to discount the farm’s expected future income stream. Holding expected income constant, the key to the equation becomes the interest rate, which was about four times lower in New York (say, 6 percent per year versus 24 percent). Recall that PV = FV/(1 + i). If FV (next year’s income) in both instances is 100, but i = .24 in Canada and .06 in New York, an investor would be willing to lease the New York farm for a year for 100/1.06 = $94.34, but the Canadian farm for only 100/1.24 = $80.65. The longer the time frame, the more the higher Canadian interest rate will bite. In the limit, we could price the farms as perpetuities using the equation PV = FV/i from Chapter 4 "Interest Rates". That means the New York farm would be worth PV = 100/.06 = $1,666.67, while the Canadian farm would be worth a mere PV = 100/.24 = $416.67 (which, of course, times 4 equals the New York farm price). Canadian land values increased when Canadian interest rates decreased after about 1850.

One important implication of the growth diamond is that emerging (from eons of poverty) or transitioning (from communism) economies that are currently hot, like those of China and India, may begin to falter if they do not strengthen their governance, financial, entrepreneurial, and management systems. Some of today’s basket-case economies, including that of Argentina, were once high fliers that ran into an economic brick wall because they inadequately protected property rights, impeded financial development, and squelched entrepreneurship.

Although currently less analytically rigorous than the AS-AD model, the growth diamond is more historically grounded than the AS-AD model or any other macro model and that is important. As storied economist Will Baumol once put it,

We cannot understand current phenomena . . . without systematic examination of earlier events which affect the present and will continue to exercise profound effects tomorrow . . . [T]he long run is important because it is not sensible for economists and policymakers to attempt to discern long-run trends and their outcomes from the flow of short-run developments, which may be dominated by transient conditions.Will Baumol, “Productivity Growth, Convergence, and Welfare: What the Long-Run Data Show,” American Economic Review 76 (December 1986): 1072–1086, as quoted in Peter L. Bernstein, Against the Gods: The Remarkable Story of Risk (New York: John Wiley & Sons, 1996), 181.

Key Takeaways

- The growth diamond is a model of economic growth (increases in real per capita aggregate output) being developed by economic historians at the Stern School of Business.

- It posits that sustained, long-term economic growth is predicated on the existence of a nonpredatory government (home plate), an efficient financial system (first base), entrepreneurs (second base), and modern management (third base).

- It is important because it explains why some countries are very rich and others are desperately poor.

- It also explains why some countries, like Argentina, grew rich, only to fall back into poverty.

- Finally, it warns investors that the growth trends of current high fliers like China could reverse if they do not continue to strengthen their governance, financial, entrepreneurial, and management systems.

23.5 Financial Shocks

Learning Objective

- How do financial shocks and crises affect the real economy?

Another important implication of the growth diamond is that financial crises can have extremely negative consequences for economic growth. Five shocksIn economics, sudden, unexpected changes. They usually have adverse consequences, but some shocks can be salutary. The ones discussed here are all bad for the financial system and hence the economy., alone or in combination, have a strong propensity to initiate financial crises:

Increases in uncertainty. When companies cannot plan for the future and when investors feel they cannot estimate future corporate earnings or interest, inflation, or default rates, they tend to play it safe. They hold cash instead of investing in a new factory or equipment. That, of course, reduces aggregate economic activity.

Increases in interest rates. Higher interest rates make business projects less profitable and hence less likely to be completed, a direct blow to gross domestic product (GDP). Also, higher interest rates tend to exacerbate adverse selection by discouraging better borrowers but having little or no effect on the borrowing decisions of riskier companies and individuals. As a result, lenders are saddled with higher default rates in high interest-rate environments. So, contrary to what one would think, high rates reduce their desire to lend. To the extent that businesses own government or other bonds, higher interest rates decrease their net worth, leading to balance sheet deterioration, of which we will learn more below. Finally, higher interest rates hurt cash flow (receipts minus expenditures), rendering firms more likely to default.

Government fiscal problems. Governments that expend more than they take in via taxes and other revenues have to borrow. The more they borrow, the harder it is for them to service their loans, raising fears of a default, which decreases the market price of their bonds. That hurts the balance sheets of firms that invest in government bonds and may lead to an exchange rate crisis as investors sell assets denominated in the local currency in a flight to safety. Precipitous declines in the value of local currency causes enormous difficulties for firms that have borrowed in foreign currencies, like dollars, sterling, euro, or yen, because they have to pay more units of local currency than expected for each unit of foreign currency. Many are unable to do so and they default, increasing uncertainty and asymmetric information.

Balance sheet deterioration. Whenever a firm’s balance sheet deteriorates, which is to say, whenever its net worth falls because the value of its assets decreases and/or the value of its liabilities increases, or because stock market participants value the firm less highly, the Cerberus of asymmetric information rears its trio of ugly, fang-infested faces. The company now has less at stake, so it might engage in riskier activities, exacerbating adverse selection. As its net worth declines, moral hazard increases because it grows more likely to default on existing obligations, in turn because it has less at stake. Finally, agency problems become more prevalent as employee bonuses shrink and stock options become valueless. As employees begin to shirk, steal, and look for other work on company time, productivity plummets, and further declines in profitability cannot be far behind. The same negative cycle can also be jump-started by an unanticipated deflation, a decrease in the aggregate price level, because that will make the firm’s liabilities (debts) more onerous in real terms (i.e., adjusted for lower prices).

Banking problems and panics. If anything hurts banks’ balance sheets (like higher than expected default rates on loans they have made), banks will reduce their lending to avoid going bankrupt and/or incurring the wrath of regulators. As we have seen, banks are the most important source of external finance in most countries, so their decision to curtail will negatively affect the economy by reducing the flow of funds between investors and entrepreneurs. If bank balance sheets are hurt badly enough, some may fail. That may trigger the failure of yet more banks for two reasons. First, banks often owe each other considerable sums. If a big one that owes much to many smaller banks were to fail, it could endanger the solvency of the creditor banks. Second, the failure of a few banks may induce the holders of banks’ monetary liabilities (today mostly deposits, but in the past, as we’ve seen, also bank notes) to run on the bank, to pull their funds out en masse because they can’t tell if their bank is a good one or not. The tragic thing about this is that, because all banks engage in fractional reserve banking (which is to say, that no bank keeps enough cash on hand to meet all of its monetary liabilities), runs often become self-fulfilling prophecies, destroying even solvent institutions in a matter of days or even hours. Banking panics and the dead banks they leave in their wake causes uncertainty, higher interest rates, and balance sheet deterioration, all of which, as we’ve seen, hurt aggregate economic activity.

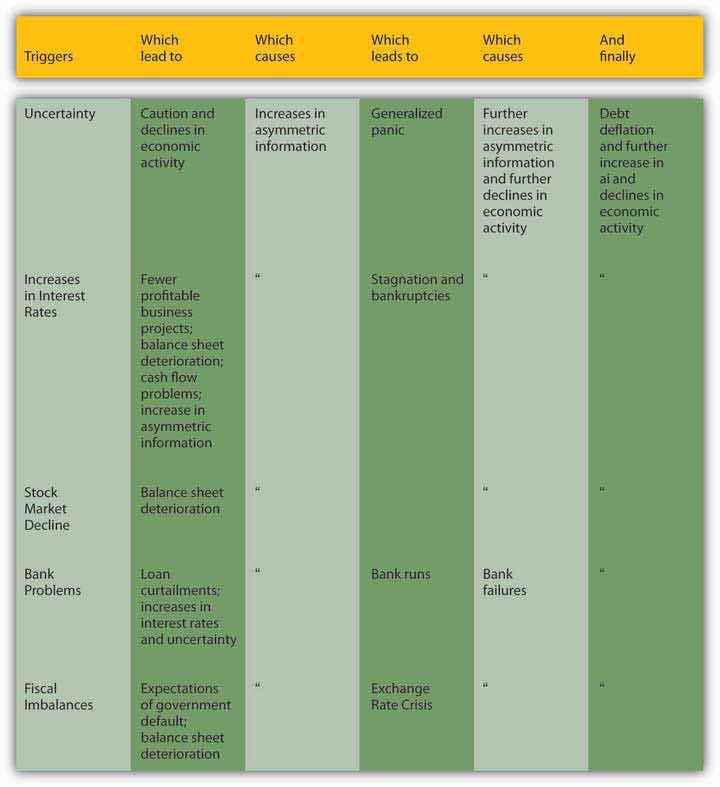

A downward spiral often ensues. Interest rate increases, stock market declines, uncertainty, balance sheet deterioration, and fiscal imbalances, as detailed above, all tend to increase asymmetric information. That, in turn, causes economic activity to decline, triggering more crises, including bank panics and/or foreign exchange crises, which increase asymmetric information yet further. Economic activity again declines, perhaps triggering more crises or an unanticipated decline in the price level. That is the point, traditionally, where recessions turn into depressions, unusually long and steep economic downturns.

Stop and Think Box

In early 1792, U.S. banks curtailed their lending. That caused a securities speculator and shyster by the name of William Duer to go bankrupt owing large sums of money to hundreds of investors. The uncertainty caused by Duer’s sudden failure caused people to panic, inducing them to sell securities, even government bonds, for cash. By mid-summer, though, the economy was again humming along nicely. In 1819, banks again curtailed lending, leading to a rash of mercantile failures. People again panicked, this time running on banks (but clutching their government bonds for dear life). Many banks failed and unemployment soared. Economic activity shrank, and it took years to recover. Why did the economy right itself quickly in 1792 but only slowly in 1819?

In 1792, America’s central bank (then the Secretary of the Treasury, Alexander Hamilton, working in conjunction with the Bank of the United States) acted as a lender of last resort. By adding liquidity to the economy, the central bank calmed fears, reduced uncertainty and asymmetric information, and kept interest rates from spiking and balance sheets from deteriorating further. In 1819, the central bank (with a new Treasury secretary and a new bank, the Second Bank of the United States) crawled under a rock, allowing the initial crisis to increase asymmetric information, reduce aggregate output, and ultimately cause an unexpected debt deflation. Since 1819, America has suffered from financial crises on numerous occasions. Sometimes they have ended quickly and quietly, as when Alan Greenspan stymied the stock market crash of 1987. Other times, like after the stock market crash of 1929, the economy did not fare well at all.http://www.amatecon.com/gd/gdcandc.html

Assuming the growth diamond has not been destroyed by the depression, economies will eventually reverse themselves after many companies have gone bankrupt; the balance sheets of surviving firms improve; and uncertainty, asymmetric information, and interest rates decrease (see Chapter 5 "The Economics of Interest-Rate Fluctuations"). It is better for everyone, however, if financial crises can be nipped in the bud before they turn ugly. This, as we learned in Chapter 17 "Monetary Policy Targets and Goals", is one of the major functions of central banks like the European Central Bank (ECB) and the Fed. Generally, all that the central bank needs to do at the outset of a crisis is to restore confidence, reduce uncertainty, and keep interest rates in line by adding liquidity (cash) to the economy by acting as a lender of last resort, helping out banks and other financial intermediaries with loans and buying government bonds in the open market. As we learned in Chapter 12 "The Financial Crisis of 2007–2008", however, sometimes a bailout becomes necessary. Figure 23.9 "Anatomy of a financial crisis and economic decline" summarizes this discussion of the ill consequences of financial shocks.

Figure 23.9 Anatomy of a financial crisis and economic decline

Note: At any point the downward spiral can be stopped by adequate central bank intervention.

Source: Text.

But in case you didn’t get the memo, nothing is ever really free. (Well, except for free goods.)http://en.wikipedia.org/wiki/Free_good When central banks stop financial panics, especially when they do so by bailing out failed companies, they risk creating moral hazard by teaching market participants that they will shield them from risks. That is why some economists, like Allan Meltzer, said “Let ’Em Fail,” in the op-ed pages of the Wall Street JournalJuly 21, 2007. http://online.wsj.com/article/SB118498744630073854.html when some hedge funds ran into trouble due to the unexpected deterioration of the subprime mortgage market in 2007. Hamilton’s Law (née Bagehot’s Law which, as described in Chapter 16 "Monetary Policy Tools", urges lenders of last resort to lend at a penalty rate on good security) is so powerful precisely because it minimizes moral hazard by providing relief only to the more prudent and solvent firms while allowing the riskiest ones to go under.

Key Takeaways

- Financial shocks and crises affect the real economy by increasing asymmetric information.

- That, in turn, reduces the amount of funds channeled from investors to entrepreneurs.

- Starved of external finance, businesses cut back production, decreasing aggregate economic activity.

- The conduits include rapidly rising interest rates, foreign exchange crises, and bank panics.

23.6 Suggested Reading

Baumol, William, Robert Litan, and Carl Schramm. Good Capitalism, Bad Capitalism, and the Economics of Growth and Prosperity. New Haven, CT: Yale University Press, 2007.

Haber, Stephen, Douglass North, and Barry Weingast. Political Institutions and Financial Development. Stanford, CA: Stanford University Press, 2008.

Powell, Benjamin. Making Poor Nations Rich: Entrepreneurship and the Process of Economic Development. Stanford, CA: Stanford University Press, 2008.

Wright, Robert E. One Nation Under Debt: Hamilton, Jefferson, and the History of What We Owe. New York: McGraw-Hill, 2008.