This is “The Monetary Policy Tools of Other Central Banks”, section 16.3 from the book Finance, Banking, and Money (v. 1.0).

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. You may also download a PDF copy of this book (8 MB) or just this chapter (238 KB), suitable for printing or most e-readers, or a .zip file containing this book's HTML files (for use in a web browser offline).

16.3 The Monetary Policy Tools of Other Central Banks

Learning Objective

- In what ways are the monetary policy tools of central banks worldwide similar to those of the Fed? In what ways do they differ?

The European Central Bank (ECB) also uses open market operations to move the market for overnight interbank lending toward its target. It too uses repos and reverse repos for reversible, defensive OMO and outright purchases for permanent additions to MB. Unlike the Fed, however, the ECB spreads the love around, conducting OMO in multiple cities throughout the European Union. The ECB’s national central banks (NCBs,) like the Fed’s district banks, also lend to banks at a so-called marginal lending rate, which is generally set 100 basis points above the overnight cash rate. The ECB pays interest on reserves, a practice the Fed took up only recently.

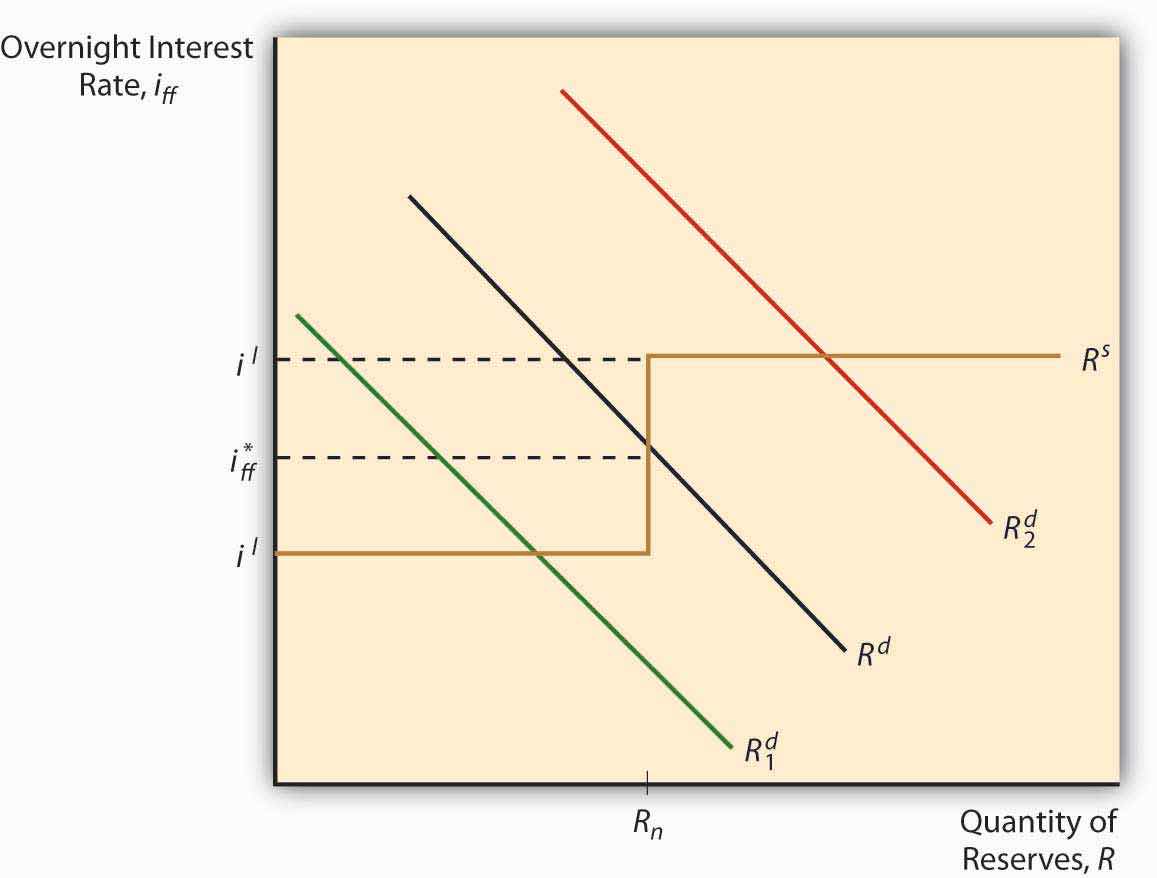

Canada, New Zealand, and Australia do likewise and have eliminated reserve requirements, relying instead on what is called the channel, or corridor, system. As Figure 16.6 "Paying interest on reserves puts a floor under the overnight interest rate" depicts, the supply curve in the corridor system looks like a backward Z. The vertical part of the supply curve represents the area in which the central bank engages in OMO to influence the market rate, i*, to meet its target rate, it. The top horizontal part of the supply curve, il for the Lombard rate, is the functional equivalent of the discount rate in the American system. The ECB and other central banks using this system, like the Fed, will lend at this rate whatever amount banks with good collateral desire to borrow. Under normal circumstances, that quantity is nil because it (and i*) will be 25, 50, or more basis points lower, depending on the country. The innovation is the lower horizontal part of the supply curve, ir, or the rate at which the central bank pays banks to hold reserves. That sets a floor on i* because no bank would lend in the overnight market if it could earn a higher return by depositing its excess funds with the central bank. Using the corridor system, a central bank can keep the overnight rate within the bands set by il and ir and use OMO to keep i* near it.

Figure 16.6 Paying interest on reserves puts a floor under the overnight interest rate

In response to the financial crisis of 2008, the Fed began to pay interest rates on reserves and will likely continue to do so because it appears to have become central bank best practicePolicies generally considered to be state of the art in a given industry, to be something that nonconforming organizations ought to emulate..

Key Takeaways

- Most central banks now use OMO instead of discount loans or reserve requirement adjustments for conducting day-to-day monetary policy.

- Some central banks, including those of the euro zone and the British Commonwealth (Canada, Australia, and New Zealand) have developed an ingenious new method called the channel or corridor system.

- Under that system, the central bank conducts OMO to get the overnight interbank lending rate near the central bank’s target, as the Fed does in the United States.

- That market rate is capped at both ends, however: on the upper end by the discount (aka Lombard) rate, and at the lower end by the reserve rate, the interest rate the central bank pays to banks for holding reserves.

- The market overnight rate can never dip below that rate because banks would simply invest their extra funds in the central bank rather than lend them to other banks at a lower rate.

- During the financial crisis of 2008, the Fed adopted the corridor system by paying interest on reserves.