This is “The Economics of Financial Regulation”, chapter 11 from the book Finance, Banking, and Money (v. 1.0).

For more information on the source of this book, or why it is available for free, please see the project's home page. You can browse or download additional books there. You may also download a PDF copy of this book (8 MB) or just this chapter (392 KB), suitable for printing or most e-readers, or a .zip file containing this book's HTML files (for use in a web browser offline).

Chapter 11 The Economics of Financial Regulation

Chapter Objectives

By the end of this chapter, students should be able to:

- Explain why the government can’t simply legislate bad things out of existence.

- Describe the public interest and private interest models of government and explain why they are important.

- Explain how asymmetric information interferes with regulatory efforts.

- Describe how government regulators exacerbated the Great Depression.

- Describe how government regulators made the Savings and Loan Crisis worse.

- Assess recent regulatory reforms in the United States and both Basel accords.

11.1 Public Interest versus Private Interest

Learning Objective

- Why can’t the government legislate bad things out of existence and which model of government, public interest or private interest, is the most accurate depiction of reality?

Whenever anything seemingly bad happens in the world, many people today immediately clamor for the government to do something about it. That is sometimes an appropriate response, but many times it is not. For starters, government can’t fix the world by decree. Simply making an activity illegal does not mean that it will stop. Because the government faces a budget constraint and opportunity costs, it can’t afford to monitor everyone all the time. What’s bad for some is often good for others, so many people willingly supply illegal goods or activities. As a result, many illegal activities are commonplace; in no particular order, sodomy, drug use, reckless use of automobiles, and music piracy come to mind.

The second problem with relying on government to fix bad things is that government officials are not the angels many people assume they are. It’s not your fault. Especially if you went through the U.S. public school system, you likely learned an interpretation of government called the public interest model. As its name suggests, the public interest modelA model of government developed by political scientists that posits that politicians, bureaucrats, and other government workers serve the public in lieu of themselves. posits that government officials work in the interests of the public, of “the people,” if you will. It’s the sort of thing Abraham Lincoln had in mind in his famous Gettysburg Address when he said “that government of the people, by the people, for the people, shall not perish from the earth.”http://showcase.netins.net/web/creative/lincoln/speeches/gettysburg.htm That’s outstanding political rhetoric, better than anything current spin artists concoct, but is it a fair representation of reality?

Many economists think not. They believe that private interest prevails, even in the government. According to their model, called the public choiceSee private interest model. or, less confusingly, the private interest modelA model of government developed by economists that posits that politicians, bureaucrats, and other government workers serve themselves in lieu of the citizens or public., politicians and bureaucrats often behave in their own interests rather than those of the public. Of course, they don’t go around saying that we need law X or regulation Y to help me to get rich via bribes, to bailout my brother-in-law, or to ensure that I soon receive a cushy job in the private sector. Rather, they say that we need law X or regulation Y to protect widows and orphans, to stymie the efforts of bad guys, or to make the rich pay for their success.

In many countries, the ones we will call “predatory” in the context of the Growth Diamond model discussed in Chapter 23 "Aggregate Supply and Demand, the Growth Diamond, and Financial Shocks", the private interest model clearly holds sway. In rich countries, the public interest model becomes more plausible. Nevertheless, many economic regulations, though clothed in public interest rhetoric, appear on close inspection to conform to the private interest model. As University of Chicago economist and Nobel Laureate George Stiglerhttp://www.econlib.org/LIBRARY/Enc/bios/Stigler.html pointed out decades ago, regulators are often “captured”http://en.wikipedia.org/wiki/Regulatory_capture by the industry they regulate. In other words, the industry establishes regulations for itself by influencing the decisions of regulators. Financial regulators, as we’ll see, are no exception.

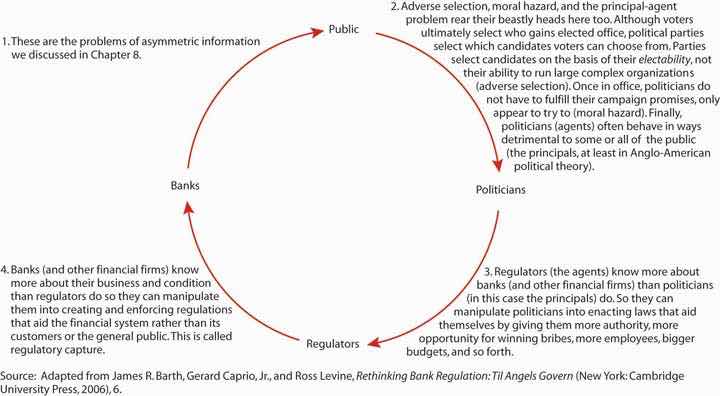

Regardless of regulators’ and politicians’ motivations, another very sticky question arises: could regulators stop bad activities, events, and people even if they wanted to? The answer in many contexts appears to be an unequivocal “No!” The reason is our old nemesis, asymmetric information. That horrible hellhound, readers should recall, inheres in nature and pervades all. It flummoxes governments as much as markets and intermediaries. The implications of this insight are devastating for the effectiveness of regulators and their regulations, as Figure 11.1 "Asymmetric information and regulation" makes clear.

Figure 11.1 Asymmetric information and regulation

Although Figure 11.1 "Asymmetric information and regulation" is esthetically pleasing (great job, guys!) it does not paint a pretty picture. Due to multiple levels of nearly intractable problems of asymmetric information, democracyA type of government that is of, for, and by the people because it allows citizens to choose candidates and policies via elections. is no guarantee that government will serve the public interest. Matters are even worse in societies still plagued by predatory governmentA type of government that is of, for, and by the ruling elite and that fails to supply basic public goods like life, liberty, and property., where corruption further fouls up the works by giving politicians, regulators, and bankers (and other financiers) incentives to perpetuate the current system, no matter how suboptimal it may be from the public’s point of view.

And if you really want to get your head spinning, consider this: agency problems within the government, within regulatory bureaucracies, and within banks abound. Within banks, traders and loan officers want to keep their jobs, earn promotions, and bring home large bonuses. They can do the latter two by taking large risks, and sometimes they choose to do so. Sometimes shareholders want to take on much larger risks than managers or depositors or other debt holders do. Sometimes it’s the managers who have incentives to place big bets, to get their stock options “in the money.”http://www.investorwords.com/2580/in_the_money.html Within bureaucracies, regulators have incentives to hide their mistakes and to take credit for good outcomes, even if they had little or nothing to do with them. The same is true for the government, where the legislature may try to discredit the executive’s policies, or vice versa, and withhold information or even spread disinformation to “prove” its case.

Stop and Think Box

In the 1910s and early 1920s, a majority of U.S. states passed securities regulations called Blue Sky Laws that ostensibly sought to prevent slimy securities dealers from selling nothing but the blue sky to poor, defenseless widows and orphans. Can you figure out what was really going on? (Hint: Recall that this was a period of traditional banking, unit banks, the 3-6-3 rule, and all that. Recall, too, that securities markets are an alternative method of linking investors to borrowers.)

We probably gave it away with that last hint. Blue Sky Laws, scholars now realize, were veiled attempts to protect the monopolies of unit bankers upset about losing business to the securities markets. Unable to garner public sympathy for their plight, the bankers instead spoke in terms of public interest, of defrauded widows and orphans. There were certainly some scams about, but not enough to warrant the more virulent Blue Sky Laws, which actually gave state officials the power to forbid issuance of securities they didn’t like, and in some states, that was most of them!

It’s okay if you feel a bit uneasy with these new ideas. We think that as adults you can handle straight talk. It’ll be better for everyone—you, me, our children and grandchildren—if you learn to look at the government’s actions with a jaundiced eye. Regulators have failed in the past and will do so again unless we align the interests of all the major parties depicted in Figure 11.1 "Asymmetric information and regulation" more closely, empowering market forces to do most of the heavy lifting.

Key Takeaways

- The government can’t legislate bad things away because it can’t be every place at once. Like the rest of us, government faces budget constraints and opportunity costs. Therefore, it cannot stop activities that some people enjoy or find profitable.

- According to the public interest model, government tries to enact laws, regulations, and policies that benefit the public.

- The private interest (or public choice) model, by contrast, suggests that government officials enact laws that are in their own private interest.

- It is important to know which model is a more accurate description of reality because the models have very different implications for our attitudes toward regulation.

- If one believes the public interest model is usually correct, then one will be more likely to call for government regulation, even if one admits that regulatory goals may in fact be difficult to achieve regardless of the intentions of politicians and bureaucrats.

- If one believes the private interest model is a more accurate depiction of the real world, one will be more skeptical of government regulation.

- Asymmetric information creates a principal-agent problem between the public and elected officials, another principal-agent problem between those officials and regulators, and yet another principal-agent problem between regulators and banks (and other financial firms) because in each case, one party (politicians, regulators, banks) knows more than the other (public, politicians, regulators).

- So there are at least three places where the public’s interest can be stymied: in political elections, in the interaction between Congress and the president and regulatory agencies, and in the interaction between regulators and the regulated. And that’s ignoring the often extensive agency problems found within governments, regulatory agencies, and financial institutions!

11.2 The Great Depression as Regulatory Failure

Learning Objective

- How did the government exacerbate the Great Depression?

Time again, government regulators have either failed to stop financial crises or have exacerbated them. Examples are too numerous to discuss in detail here, so we will address only two of the more egregious cases, the Great Depression of the 1930s and the Savings and Loan (S&L) Crisis of the 1980s.

Generally when economic matters go FUBAR (Fouled Up Beyond All Recognition in polite circles), observers blame either “market failures” like asymmetric information and externalitiesCosts or benefits of an economic activity that are not included in the price, that are not internalized by the buyer and/or seller. Negative externalities, like pollution, impose costs on society; positive externalities, like education, provide societal benefits., or they blame the government. Reality is rarely that simple. Most major economic foul-ups stem from a combination of market and government failures, what we like to call hybrid failures. So while it would be an exaggeration to claim that government policies were the only causes of the Great Depression or the Savings and Loan Crisis, it is fair to say that they made matters worse, much worse.

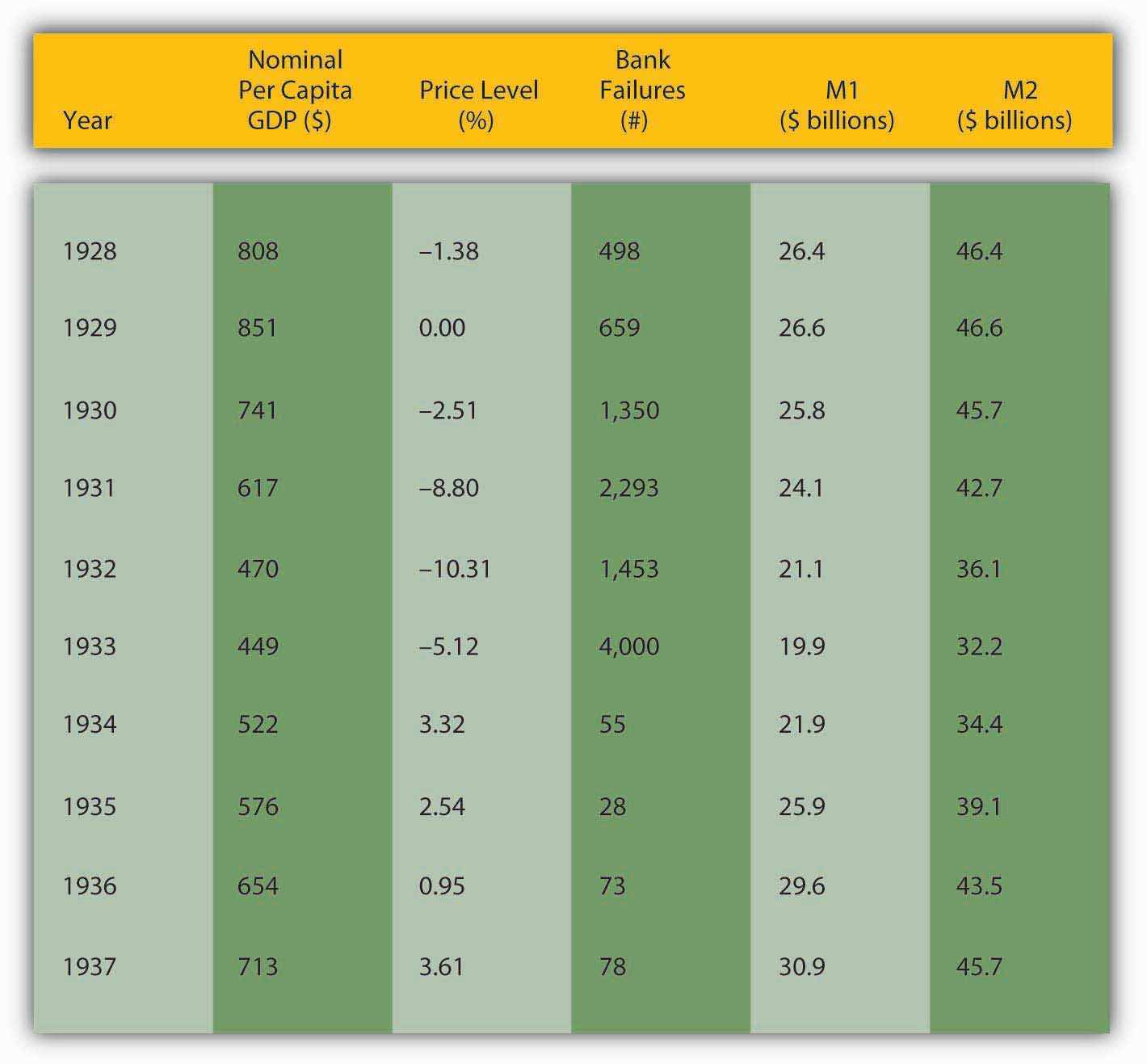

Everyone knows that the stock market crash of 1929 started the Great Depression. As we will learn in Chapter 23 "Aggregate Supply and Demand, the Growth Diamond, and Financial Shocks", a precipitous decline in stock prices can cause uncertainty to increase and balance sheets to deteriorate, worsening asymmetric information problems and leading to a decline in economic activity. That, in turn, can cause bank panics, further increases in asymmetric information, and yet further declines in economic activity followed by an unanticipated decline in the price level. As Figure 11.2 "Major macro variables during the Great Depression" shows, that is precisely what happened during the Great Depression— per capita gross domestic product (GDP) shrank, the number of bankruptcies soared, M1 and M2 (measures of the money supply) declined, and so did the price level.

Figure 11.2 Major macro variables during the Great Depression

Weren’t evil financiers completely responsible for this mess, as nine out of ten people thought at the time? Absolutely not. For starters, very few financiers benefited from the depression and they certainly did not have the ability to cause such a mess. Most would have stopped the downward spiral if it was in their power to do so, as J. P. Morgan did when panic seized the financial system in 1907.http://www.bos.frb.org/about/pubs/panicof1.pdf In fact, only the government had the resources and institutions to stop the Great Depression and it failed to do so. Mistake number one occurred during the 1920s, when the government allowed stock prices to rise to dizzying heights. (The Dow Jones Industrial Average started the decade at 108.76, dropped to the around 60, then began a slow climb to 200 by the end of 1927. It hit 300 by the end of 1928 and 350 by August 1929.)http://www.measuringworth.org/DJA/ By slowly raising interest rates beginning in, say, mid-1928, the Federal Reserve could have deflated the asset bubble before it grew to enormous proportions and burst in 1929.

Mistake number two occurred after the crash, in late 1929 and 1930, when the Federal Reserve raised interest rates. As we’ll see in Chapter 17 "Monetary Policy Targets and Goals", the correct policy response at that point was to lower interest rates. The government’s third mistake was its banking policy. As described in Chapter 10 "Innovation and Structure in Banking and Finance", the United States was home to tens of thousands of tiny unit banks that simply were not large or diversified enough to ride out the depression. If a factory or other major employer succumbed, the local bank too was doomed. Depositors understood this, so at the first sign of trouble they ran on their banks, pulling out their deposits before they went under. Their actions guaranteed that their banks would indeed fail. Meanwhile, across the border in Canada, which was home to a few large and highly diversified banks, few bank disturbances took place. California also weathered the Great Depression relatively well, in part because its banks, which freely branched throughout the large state, enjoyed relatively well-diversified assets and hence avoided the worst of the bank crises.

The government’s fourth failure was to raise tariffs in a misguided attempt to “beggar thy neighbor.”http://www.state.gov/r/pa/ho/time/id/17606.htm Detailed analysis of this failure, which falls outside the bailiwick of finance, we’ll leave to your international economics textbook and a case in Chapter 21 "IS-LM". Here, we’ll just paraphrase Mr. Mackey from South Park: “Tariffs are bad, mmmkay?”http://en.wikipedia.org/wiki/List_of_staff_at_South_Park_Elementary#Mr._Mackey

But what about Franklin Delano Roosevelt (FDR)http://www.whitehouse.gov/history/presidents/fr32.html and his New Deal?http://newdeal.feri.org/Didn’t the new administration stop the Great Depression, particularly via deposit insurance, Glass-Steagall, securities market reforms, and reassuring speeches about having nothing to fear but fear itself?http://historymatters.gmu.edu/d/5057/ The United States did suffer its most acute banking crisis in March 1933, just as FDR took office on March 4.http://www.bartleby.com/124/pres49.html (The Twentieth Amendment, ratified in 1938, changed the presidential inauguration date to January 20, which it is to this day.) But many suspect that FDR himself brought the crisis on by increasing uncertainty about the new administration’s policy path. Whatever the cause of the crisis, it shattered confidence in the banking system. FDR’s creation of a deposit insurance scheme under the aegis of a new federal agency, the Federal Deposit Insurance Corporation (FDIC), did restore confidence, inducing people to stop running on the banks and thereby stopping the economy’s death spiral. Since then, bank runs have been rare occurrences directed at specific shaky banks and not system-wide disturbances as during the Great Depression and earlier banking crises.

But as with everything in life, deposit insurance is far from cost-free. In fact, the latest research suggests it is a wash. Deposit insurance does prevent bank runs because depositors know the insurance fund will repay them if their bank goes belly up. (Today, it insures $250,000 per depositor per insured bank. For details, browse http://www.fdic.gov/deposit/deposits/insured/basics.html.) However, insurance also reduces depositor monitoring, which allows bankers to take on added risk. In the nineteenth century, depositors disciplined banks that took on too much risk by withdrawing their deposits. As we’ve seen, that decreases the size of the bank and reduces reserves, forcing bankers to decrease their risk profile. With deposit insurance, depositors (quite rationally) blithely ignore the adverse selection problem and shift their funds to wherever they will fetch the most interest. They don’t ask how Shaky Bank is able to pay 15 percent for six-month certificates of deposit (CDs) when other banks pay only 5 percent. Who cares, they reason, my deposits are insured! Indeed, but as we’ll learn below, taxpayers insure the insurer.

Another New Deal financial reform, Glass-Steagall, in no way helped the U.S. economy or financial system and may have hurt both. As we learned in Chapter 10 "Innovation and Structure in Banking and Finance", for over half a century, Glass-Steagall prevented U.S. banks from simultaneously engaging in commercial and investment banking activities. Only two groups clearly gained from the legislation, politicians who could thump their chests on the campaign stump and claim to have saved the country from greedy financiers and, ironically enough, big investment banks. The latter, it turns out, wrote the act and did so in such a way that it protected their oligopoly from the competition of commercial banks and smaller, more retail-oriented investment banks. The act was clearly unnecessary from an economic standpoint because most countries had no such legislation and suffered no ill effects because of its absence.

The Security and Exchange Commission’s (SEC) genesis is almost as tawdry and its record almost as bad. The SEC’s stated goal, to increase the transparency of America’s financial markets, was a laudable one. Unfortunately, the SEC simply does not do its job very well. As the late, great, free-market proponent Milton Friedman put it:

“You are not free to raise funds on the capital marketsThis part is inaccurate. Just as we would expect from the discussion in Chapter 10 "Innovation and Structure in Banking and Finance", financiers went loophole mining and found a real doozy called a private placement. As opposed to a public offering, in a private placement, securities issuers can avoid SEC disclosure requirements by selling directly to institutional investors like life insurance companies and other “accredited investors” (legalese for “rich people”). unless you fill out the numerous pages of forms the SEC requires and unless you satisfy the SEC that the prospectus you propose to issue presents such a bleak picture of your prospects that no investor in his right mind would invest in your project if he took the prospectus literally.This part is all too true. Check out the prospectus of Internet giant Google at http://www.sec.gov/Archives/edgar/data/1288776/000119312504142742/ds1a.htm. If you don’t dig Google, check out any company you like via Edgar, the SEC’s filing database, at http://www.sec.gov/edgar.shtml. And getting SEC approval may cost upwards of $100,000—which certainly discourages the small firms our government professes to help.”

Stop and Think Box

As noted above, the FDIC insures bank deposits up to $250,000 per depositor per insured bank. What if an investor wants to deposit $1 million or $1 billion? Must the investor put most of her money at risk?

Depositors can loophole mine as well as anyone. And they did, or, to be more precise, intermediaries known as deposit brokers did. Deposit brokers chopped up big deposits into insured-sized chunks, then spread them all over creation. The telecommunications revolution made this relatively easy and cheap to do, and the S&L crisis created many a zombie bank willing to pay high interest for deposits.

Key Takeaways

- In addition to imposing high tariffs, the government exacerbated the Great Depression by (1) allowing the asset bubble of the late 1920s to continue; (2) responding to the crash inappropriately by raising the interest rate and restricting M1 and M2; and (3) passing reforms of dubious long-term efficacy, including deposit insurance, Glass-Steagall, and the SEC.

11.3 The Savings and Loan Regulatory Debacle

Learning Objective

- How did regulators exacerbate the Savings and Loan Crisis of the 1980s?

Although the economy improved after 1933, regulatory regimes did not. Ever fearful of a repeat of the Great Depression, U.S. regulators sought to make banks highly safe and highly profitable so none would ever dare to fail. We can move quickly here because most of this you read about in Chapter 10 "Innovation and Structure in Banking and Finance". Basically, the government regulated the interest rate, assuring banks a nice profit—that’s what the 3-6-3 rule was all about. Regulators also made it difficult to start a new bank to keep competition levels down, all in the name of stability. The game worked well until the late 1960s, then went to hell in a handbasket as technological breakthroughs and the Great Inflation conspired to destroy traditional banking.

Here’s where things get interesting. Savings and loan associations were particularly hard hit by the changed financial environment because their gaps were huge. The sources of their funds were savings accounts and their uses were mortgages, most of them for thirty years at fixed rates. Like this:

| Typical Savings and Loan Bank Balance Sheet (Millions USD) | |

|---|---|

| Assets | Liabilities |

| Reserves $10 | Deposits $130 |

| Securities $10 | Borrowings $15 |

| Mortgages $130 | Capital $15 |

| Other assets $10 | |

| Totals $160 | $160 |

Along comes the Great Inflation and there go the deposits. We know from Chapter 9 "Bank Management" what happened next:

| Typical Savings and Loan Bank Balance Sheet (Millions USD) | |

|---|---|

| Assets | Liabilities |

| Reserves $1 | Deposits $100 |

| Securities $1 | Borrowings $30 |

| Mortgages $130 | Capital $10 |

| Other assets $8 | |

| Totals $140 | $140 |

This bank is clearly in deep doodoo. Were it alone, it would have failed. But there were some 750 of them in like situation. So they went to the regulators and asked for help. The regulators were happy to oblige. They did not want to have a bunch of failed banks on their hands after all, especially given that the deposits of those banks were insured. So they eliminated the interest rate caps and allowed S&Ls to engage in a variety of new activities, like making commercial real estate loans, hitherto forbidden. Given the demise of traditional banking, that was a reasonable response. The problem was that most S&L bankers didn’t have a clue about how to do anything other than traditional banking. Most of them got chewed. Their balance sheets then began to resemble a train wreck:

| Typical Savings and Loan Bank Balance Sheet (Millions USD) | |

|---|---|

| Assets | Liabilities |

| Reserves $1 | Deposits $120 |

| Securities $1 | Borrowings $22 |

| Mortgages $130 | Capital $0 |

| Other assets $10 | |

| Totals $142 | $142 |

Now comes the most egregious part. Fearful of losing their jobs, regulators kept these economically dead (capital = $0) banks alive. Instead of shutting them down, they engaged in what is called regulatory forbearanceWhenever regulators, for whatever reason, consciously decide not to enforce one or more regulations.. Specifically, they allowed S&Ls to add “goodwill” to the asset side of their balance sheets, restoring them to life—on paper. (Technically, they allowed the banks to switch from generally accepted accounting principles [GAAP] to regulatory accounting principles [RAP].) Seems like a cool thing for the regulators to do, right? Wrong! A teacher can pass a kid who can’t read, but the kid still can’t read. Similarly, a regulator can pass a bank with no capital, but still can’t make the bank viable. In fact, the bank situation is worse because the kid has other chances to learn to read. By contrast zombie banks, as these S&Ls were called, have little hope of recovery. Regulators should have shot them in the head instead, which as any zombie-movie fan knows is the only way to stop the undead dead in their tracks.http://www.margrabe.com/Devil/DevilU_Z.html;http://ericlathrop.com/notld/

Recall that if somebody has no capital, no skin in the game, to borrow Warren Buffett’s phrase again, moral hazard will be extremely high because the person is playing with other people’s money. In this case, the money wasn’t even that of depositors but rather of the deposit insurer, a government agency. The managers of the S&Ls did what anyone in the same situation would do: they rolled the dice, engaging in highly risky investments funded with deposits and borrowings for which they paid a hefty premium. In other words, they borrowed from depositors and other lenders at high rates and invested in highly risky loans. A few got lucky and pulled their banks out of the red. Most of the risky loans, however, quickly turned sour. When the whole thing was over, their balance sheets looked like this:

| Typical Savings and Loan Bank Balance Sheet (Millions USD) | |

|---|---|

| Assets | Liabilities |

| Reserves $10 | Deposits $200 |

| Securities $10 | Borrowings $100 |

| Mortgages $100 | Capital −$60 |

| Goodwill $30 | |

| Crazy, risky loans $70 | |

| Other assets $20 | |

| Totals $240 | $240 |

The regulators could no longer forbear. The insurance fund could not meet the deposit liabilities of the thousands of failed S&Ls, so the bill ended up in the lap of U.S. taxpayers.

Stop and Think Box

In the 1980s, in response to the Great Inflation and the technological revolution, regulators in Scandinavia (Sweden, Norway, and Finland) deregulated their heavily regulated banking systems. Bankers who usually lent only to the best borrowers at government mandated rates suddenly found themselves competing for both depositors and borrowers. What happened?

Scandinavia suffered from worse banking crises than the United States. In particular, Scandinavian bankers were not very good at screening good from bad borrowers because they had long been accustomed to lending to just the best. They inevitably made many mistakes, which led to defaults and ultimately asset and capital write-downs.

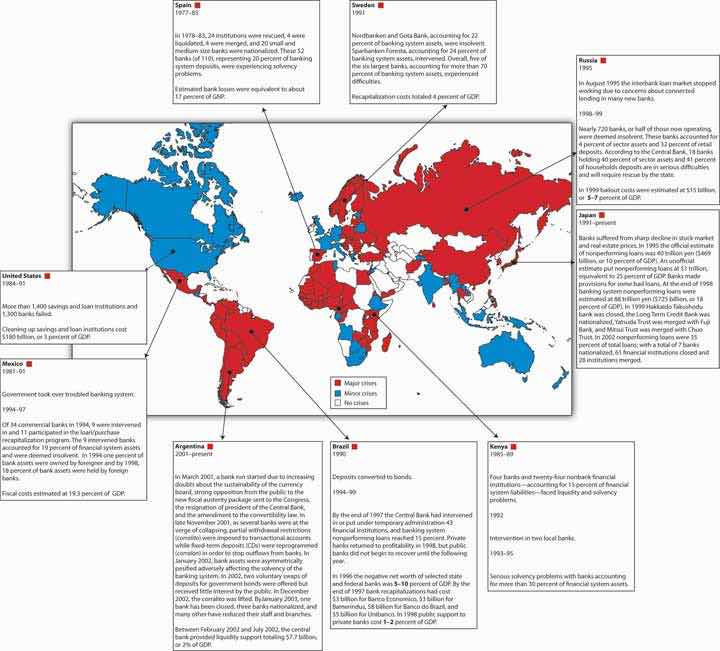

The most depressing aspect of this story is that the United States has unusually good regulators. As Figure 11.3 "Banking crises around the globe through 2002" shows, other countries have suffered through far worse banking crises and losses. Note that at 3 percent of U.S. GDP, the S&L crisis was no picnic, but it pales in comparison to the losses in Argentina, Indonesia, China, Jamaica and elsewhere.

Figure 11.3 Banking crises around the globe through 2002

Episodes of Systematic and Borderline Financial Crises, Gerald Caprio and Daniela Klingebiel.

Key Takeaways

- First, regulators were too slow to realize that traditional banking—the 3-6-3 rule and easy profitable banking—was dying due to the Great Inflation and technological improvements.

- Second, they allowed the institutions most vulnerable to the rapidly changing financial environment, savings and loan associations, too much latitude to engage in new, more sophisticated banking techniques, like liability management, without sufficient experience or training.

- Third, regulators engaged in forbearance, allowing essentially bankrupt companies to continue operations without realizing that the end result, due to very high levels of moral hazard, would be further losses.

11.4 Better but Still Not Good: U.S. Regulatory Reforms

Learning Objective

- Have regulatory reforms and changes in market structure made the U.S. banking industry safer?

The S&L crisis and the failure of a few big commercial banks induced a series of regulatory reforms in the United States. The first such act, the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA), became law in August 1989. That act canned the old S&L regulators, created new regulatory agencies, and bailed out the bankrupt insurance fund. In the end, U.S. taxpayers reimbursed depositors at the failed S&Ls. FIRREA also re-regulated S&Ls, increasing their capital requirements and imposing the same risk-based capital standards that commercial banks are subject to. Since passage of the act, many S&Ls have converted to commercial banks and few new S&Ls have been formed.

In 1991, the government enacted further reforms in the Federal Deposit Insurance Corporation Improvement Act (FDICIA), which continued the bailout of the S&Ls and the deposit insurance fund, raised deposit insurance premiums, and forced the FDIC to close failed banks using the least costly method. (Failed banks can be dismembered and their pieces sold off one by one. That often entails selling assets at a discount. Or an entire bank can be sold to a healthy bank, which, of course, wants a little sugar [read, “cash”] to induce it to embrace a zombie!) The act also forced the FDIC to charge risk-based insurance premiums instead of a flat fee. The system it developed, however, resulted in 90 percent of banks, accounting for 95 percent of all deposits, paying the same premium. The original idea of taxing risky banks and rewarding safe ones was therefore subverted.

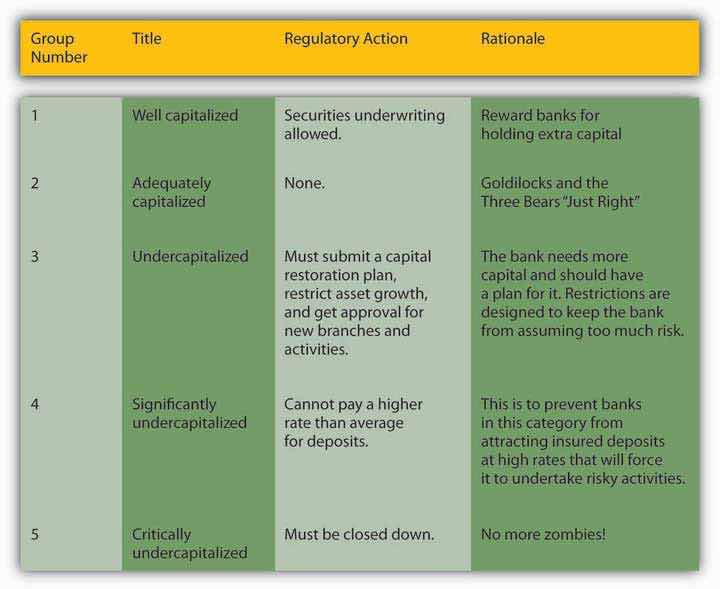

FDICIA’s crowning glory is that it requires regulators to intervene earlier and more stridently when banks first get into trouble, well before losses eat away their capital. The idea is to close banks before they go broke, and certainly before they arise from the dead. See Figure 11.4 "Regulation of bank capitalization" for details. Of course, banks can go under, have gone under, in a matter of hours, well before regulators can act or even know what is happening. Regulators do not and, of course, cannot monitor banks 24/7/365. And despite the law, regulators might still forbear, just like your neighbor might still smoke pot, even though it’s illegal.

Figure 11.4 Regulation of bank capitalization

The other problem with FDICIA is that it weakened but ultimately maintained the too-big-to-fail (TBTF) policyThe explicit or implicit promise of regulators that they will not allow a given financial institution to fail because to do so would cause too large of a shock for the financial system to handle. While that sounds reassuring and noble, the policy increases moral hazard, encouraging large financial institutions to take on large risks.. Regulators cooked up TBTF during the 1980s to justify bailing out a big shaky bank called Continental Illinois. Like deposit insurance, TBTF was ostensibly a noble notion. If a really big bank failed and owed large sums to lots of other banks and nonbank financial institutions, it could cause a domino effect that could topple numerous companies very quickly. That, in turn, would cause uncertainty to rise, stock prices to fall . . . you get the picture. The problem is that if a bank thinks it is too big to fail, it has an incentive to take on a lot of risk, confident that the government will have its back if it gets into trouble. (Banks in this respect are little different from drunken frat boys, or so I’ve heard.) Financier Henry Kaufman has termed this problem the Bigness DilemmaThe dilemma is that big banks in other regards are stabilizing rather than destabilizing because they have clearly achieved efficient scale and maintain a diversified portfolio of assets. and long feared that it could lead to a catastrophic economic meltdown, a political crisis, or a major economic slump. His fears came to fruition during the financial crisis of 2007–2008, of which we will learn more in Chapter 12 "The Financial Crisis of 2007–2008". Similarly some analysts believe that Japan’s TBTF policy was a leading cause of its recent fifteen-year economic funk.

In 1994, the Riegle-Neal Interstate Banking and Branching Efficiency Act finally overturned most prohibitions on interstate banking. As discussed in Chapter 10 "Innovation and Structure in Banking and Finance", that law led to considerable consolidation, the effects of which are still unclear. Nevertheless, the act was long overdue, as was the Gramm-Leach-Bliley Financial Services Modernization Act of 1999, which repealed Glass-Steagall, allowing the same institutions to engage in both commercial and investment banking activities. The act has led to some conglomeration, but not as much as many observers expected. Again, it may be some time before the overall effects of the reform become clear. So far, both acts appear to have strengthened the financial system by making banks more profitable and diversified. So far, some large complex banking organizations and large complex financial institutions (LCBOs and LCFIs, respectively) have held up well in the face of the subprime mortgage crisis, but others have failed. The crisis appears rooted in more fundamental issues, like TBTF and a dearth of internal incentive alignment within financial institutions, big and small.

Key Takeaways

- To some extent, it is too early to tell what the effects of financial consolidation, concentration, and conglomeration will be.

- Overall, it appears that recent U.S. financial reforms range from salutary (repeal of branching restrictions and Glass-Steagall) to destabilizing (retention of the too-big-to-fail policy).

11.5 Basel II’s Third Pillar

Learning Objective

- Will Basel II render the banking industry safe? If not, what might?

Due to the prevalence of banking crises worldwide and the financial system’s increasingly global and integrated nature, international regulators, especially the Bank for International Settlements in Basel, Switzerland, have also been busy. Their recommendations are not binding on sovereign nations, but to date they have obtained significant buy-in worldwide. America’s financial reforms in the 1990s, for example, were influenced by the so-called Basel I recommendations of 1988. Almost all countries have complied, on paper anyway, with Basel I rules on minimum and risk-weighted capitalization. Risk-weighting was indeed an improvement over the older capitalization requirements, which were simply a minimum leverage ratio:

So the leverage ratio of the following bank would be 6 percent (6/100 = .06, or 6%), which in the past was generally considered adequate.

| Some Bank Balance Sheet (Millions USD) | |

|---|---|

| Assets | Liabilities |

| Reserves $10 | Deposits $80 |

| Securities $10 | Borrowings $14 |

| Loans $70 | Capital $6 |

| Other assets $10 | |

| Totals $100 | $100 |

Of course, leverage ratios are much too simplistic because a bank with capital of only 4 percent but with a diversified portfolio of very safe loans would be much safer than one with capital of 10 percent but whose assets were invested entirely in lottery tickets!

The concept of weighting risks is therefore a solid one. A bank holding nothing but reserves would need very little capital compared to one holding mostly high-risk loans to biotech and nanotech startups. Bankers, however, consider the Basel I weights too arbitrary and too broad. For example, Basel I suggested weighting sovereign bonds at zero. That’s great for developed countries, but plenty of poorer nations regularly default on their bonds. Some types of assets received a weighting of .5, others 1, others 1.5, and so forth, as the asset grew riskier. So, for example, the following assets would be weighted according to their risk before being put into a leverage ratio:

| Reserves | $100,000,000 × 0 = 0 |

| Governments | $50,000,000 × 0 = 0 |

| Commercial loans | $600,000,000 × 1 = 600,000,000 |

| Mortgages | $100,000,000 × 1.5 = 150,000,000 |

And so forth. But the weights were arbitrary. Are mortgages exactly half again as risky as commercial loans? Basel I basically encouraged banks to decrease their holdings of assets that the regulations overweighted and to stock up on assets that it underweighted. Not a pretty sight.

In response to such criticism, the Basel Committee on Banking Supervision announced in June 2004 a new set of guidelines, called Basel II, for implementation in 2008 and 2009 in the G10 countries. Basel II contains three pillars: capital, supervisory review process, and market discipline. According to the latest and greatest research, Rethinking Bank Regulation by James Barth, Gerard Caprio, and Ross Levine, the first two pillars are not very useful ways of regulating banks. The new risk weighting is an improvement, but it still grossly oversimplifies risk management and is not holistic enough. Moreover, supervisors cannot monitor every aspect of every bank all the time. Banks have to make periodic call reports on their balance sheets, income, and dividends but, like homeowners selling their homes, they pretty up the place before the prospective buyers arrive. In more developed countries, regulators also conduct surprise on-site examinations during which the examiners rate banks according to the so-called CAMELS formulation:

C = capital adequacy

A = asset quality

M = management

E = earnings

L = liquidity (reserves)

S = sensitivity to market risk.

A, M, and S are even more difficult to ascertain than C, E, and L and, as noted above, any or all of the variables can change very rapidly. Moreover, as discussed in Chapter 10 "Innovation and Structure in Banking and Finance", much banking activity these days takes place off the balance sheet, where it is even more difficult for regulators to find and accurately assess. Finally, in many jurisdictions, examiners are not paid well and hence do not do a very thorough job.

Barth, Caprio, and Levine argue that the third pillar of Basel II, financial market monitoring, is different. In aggregate, market participants can and in fact do monitor banks and bankers much more often and much more astutely than regulators can because they have much more at stake than a relatively low-paying job. Barth, Caprio, and Levine argue persuasively that instead of conceiving of themselves as police officers, judges, and juries, bank regulators should see themselves as aides, as helping bank depositors (and other creditors of the bank) and stockholders to keep the bankers in line. After all, nobody gains from a bank’s failure. The key, they believe, is to ensure that debt and equity holders have incentives and opportunities to monitor bank management to ensure that they are not taking on too much risk. That means reducing asymmetric information by ensuring reliable information disclosure and urging that corporate governance best practices be followed.Frederick D. Lipman, Corporate Governance Best Practices: Strategies for Public, Private, and Not-for-Profit Organizations (Hoboken, N.J.: Wiley, 2006).

Regulators can also provide banks with incentives to keep their asset bases sufficiently diversified and to prevent them from engaging in inappropriate activities, like building rocket ships or running water treatment plants. Screening new banks and bankers, if regulators do it to reduce adverse selection (omit shysters or inexperienced people) rather than to aid existing banks (by blocking all or most new entrants and hence limiting competition) or to line their own pockets (via bribes), is another area where regulators can be effective. By focusing on a few key reachable goals, regulators can concentrate their limited resources and get the job done, the job of letting people look after their own property themselves. The market-based approach, scholars note, is most important in less-developed countries where regulators are more likely to be on the take (to enact and enforce regulations simply to augment their incomes via bribes).

Key Takeaways

- Basel I and II have provided regulators with more sophisticated ways of analyzing the adequacy of bank capital.

- Nevertheless, it appears that regulators lag behind banks and their bankers, in part because of agency problems within regulatory bureaucracies and in part because of the gulf of asymmetric information separating banks and regulators, particularly when it comes to the quality of assets and the extent and risk of off-balance-sheet activities.

- If scholars like Barth, Caprio, and Levine are correct, regulators ought to think of ways of helping financial markets, particularly bank debt and equity holders, to monitor banks.

- They should also improve their screening of new bank applicants without unduly restricting entry, and set and enforce broad guidelines for portfolio diversification and admissible activities.

11.6 Suggested Reading

Arner, Douglas. Financial Stability, Economic Growth, and the Role of Law. New York: Cambridge University Press, 2007.

Barth, James, Gerard Caprio, and Ross Levine. Rethinking Bank Regulation. New York: Cambridge University Press, 2006.

Barth, James, S. Trimbath, and Glenn Yago. The Savings and Loan Crisis: Lessons from a Regulatory Failure. New York: Springer, 2004.

Benston, George. Regulating Financial Markets: A Critique and Some Proposals. Washington, DC: AEI Press, 1999.

Bernanke, Ben S. Essays on the Great Depression. Princeton, NJ: Princeton University Press, 2000.

Gup, Benton. Too Big to Fail: Policies and Practices in Government Bailouts. Westport, CT: Praeger, 2004.

Stern, Gary, and Ron Feldman. Too Big to Fail: The Hazards of Bank Bailouts. Washington, DC: Brookings Institution Press, 2004.

Tullick, Gordon, Arthur Seldon, and Gordon Brady. Government Failure: A Primer in Public Choice. Washington, DC: Cato Institute, 2002.

Winston, Clifford. Government Failure Versus Market Failure: Microeconomics Policy Research and Government Performance. Washington, DC: AEI-Brookings Joint Center for Regulatory Studies, 2006.