Major Components of the International Monetary Structure

The main components in the international monetary structure are global institutions (such as the International Monetary Fund and Bank for International Settlements), national agencies and government departments (such as central banks and finance ministries), private institutions acting on the global scale (such as banks and hedge funds), and regional institutions (like the Eurozone or NAFTA).

International Institutions

The most prominent international institutions are the International Monetary Fund (IMF) , the World Bank, and the World Trade Organization (WTO). The IMF keeps account of the international balance of payments accounts of member states, but also lends money as a last resort for members in financial distress. Membership is based on the amount of money a country provides to the fund relative to the size of its role in the international trading system.

IMF Headquarters

The headquarters of the International Monetary Fund in Washington, DC.

The World Bank aims to provide funding, takes up credit risk, or offers favorable terms to developing countries for development projects that couldn't be obtained by the private sector.

The World Trade Organization settles trade disputes and negotiates international trade agreements in its rounds of talks (currently the Doha Round) .

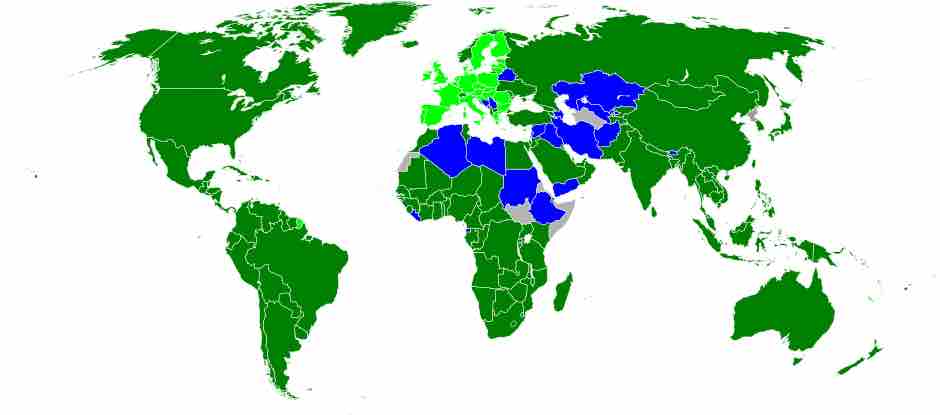

Members of the WTO

This map depicts the member states of the World Trade Organization (WTO). Dark green states are members; light green are members of the EU and thus members of the WTO as well; blue states are observer states; and gray states have no official interaction with the WTO. Notice the global reach of organizations like the WTO.

Private Participants

Also important to the international monetary structure are private participants, such as players active in the markets of stocks, bonds, foreign exchange, derivatives, and commodities, as well as investment banking. This includes commercial banks, hedge funds and private equity, pension funds, insurance companies, mutual funds, and sovereign wealth funds.

Regional Institutions

Certain regional institutions also play a role in the structure of the international monetary system. For example, the Commonwealth of Independent States (CIS), the Eurozone, Mercosur, and North American Free Trade Agreement (NAFTA) are all examples of regional trade blocs, which are very important to the international monetary structure .

Bill Clinton Signs NAFTA

In this picture, President Bill Clinton signs the North American Free Trade Agreement into law. NAFTA, a free trade area between Canada, the U.S., and Mexico, is an example of the importance of regional trade blocs to the international monetary structure. NAFTA is also an example of the U.S.' s disproportionate power in determining the direction of the international monetary structure.

Government Institutions

Governments are also a part of the international monetary structure, primarily through their finance ministries: they pass the laws and regulations for financial markets, and set the tax burden for private players such as banks, funds, and exchanges. They also participate actively through discretionary spending. They are closely tied to central banks that issue government debt, set interest rates and deposit requirements, and intervene in the foreign exchange market.

Perspectives on the International Monetary Structure

The liberal view of the international monetary structure holds that the exchange of currencies should be determined not by state institutions but instead individual players at a market level. This view has been labelled as the Washington Consensus. The social democratic view challenges the liberal view, advocating for the tempering of market mechanisms and the institution of economic safeguards in an attempt to ensure financial stability and redistribution. Besides the liberal and social democratic views, neo-Marxists are highly critical of the modern financial system in that it promotes inequality between state players, particularly holding the view that the wealthier countries abuse the financial system to exercise control of developing countries' economies.

U.S. Influence on the International Monetary Structure

The most important American contribution to the global financial system is perhaps the introduction of the Bretton Woods system. The Bretton Woods system of monetary management, created at a conference in 1944, established the rules for commercial and financial relations among the world's major industrial states in the mid-20th century. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent nation-states. Setting up a system of rules, institutions, and procedures to regulate the international monetary system, the planners at Bretton Woods established the IMF and the International Bank for Reconstruction and Development (IBRD), which today is part of the World Bank Group.

Besides the influence of the U.S. on the Bretton Woods system, it is often claimed that the United States's transition to neoliberalism and global capitalism also led to a change in the identity and functions of international financial institutions like the IMF. Because of the high involvement and voting power of the United States, the global economic ideology could effectively be transformed to match that of the U.S. This is consistent with the IMF's function change during the 1970s after a change in President Nixon's policies (when the Nixon Shock ended the Bretton Woods gold standard). Others also claim that, because of the disproportionate economic power of the United States, allies of the United States are able to receive bigger loans with fewer conditions.