Fiscal Policy

In economics and political science, fiscal policy is the use of government revenue collection or taxation, and expenditure (spending) to influence the economy. Changes in the level and composition of taxation and government spending can impact the following variables in the economy: aggregate demand and the level of economic activity; the pattern of resource allocation; and the distribution of income.

Stances of Fiscal Policy

There are three main stances of fiscal policy:

- Neutral fiscal policy is usually undertaken when an economy is in equilibrium. Government spending is fully funded by tax revenue and overall the budget outcome has a neutral effect on the level of economic activity.

- Expansionary fiscal policy involves government spending exceeding tax revenue, and is usually undertaken during recessions.

- Contractionary fiscal policy occurs when government spending is lower than tax revenue, and is usually undertaken to pay down government debt.

However, these definitions can be misleading as, even with no changes in spending or tax laws at all, cyclic fluctuations of the economy cause cyclic fluctuations of tax revenues and of some types of government spending, altering the deficit situation; these are not considered to be policy changes. Thus, for example, a government budget that is balanced over the course of the business cycle is considered to represent a neutral fiscal policy stance.

Methods of Funding

Governments spend money on a wide variety of things, from the military and police to services like education and healthcare, as well as transfer payments such as welfare benefits. This expenditure can be funded in a number of different ways: taxation, printing money, borrowing money from the population or from abroad, consumption of fiscal reserves, or sale of fixed assets (land).

Borrowing

A fiscal deficit is often funded by issuing bonds. These pay interest, either for a fixed period or indefinitely. If the interest and capital requirements are too large, a nation may default on its debts, usually to foreign creditors, while public debt or borrowing refers to the government borrowing from the public.

Economic Effects of Fiscal Policy

Governments use fiscal policy to influence the level of aggregate demand in the economy, in an effort to achieve economic objectives of price stability, full employment, and economic growth. One school of fiscal policy developed by John Maynard Keynes suggests that increasing government spending and decreasing tax rates are the best ways to stimulate aggregate demand, and only to decrease spending & increase taxes after the economic boom begins. Keynesian Economics argues this method be used in times of recession or low economic activity as an essential tool for building the framework for strong economic growth and working towards full employment. In theory, the resulting deficits would be paid for by an expanded economy during the boom that would follow; this was the reasoning behind the New Deal.

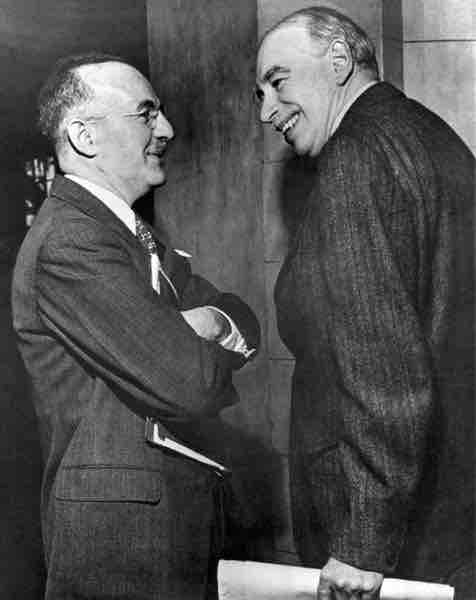

John Maynard Keynes and Harry Dexter White

Keynes (right) was the father and founder of Keynesian economics.

Governments can use a budget surplus to do two things: to slow the pace of strong economic growth and to stabilize prices when inflation is too high. Keynesian theory posits that removing spending from the economy will reduce levels of aggregate demand and contract the economy, thus stabilizing prices.

However, economists debate the effectiveness of fiscal stimulus. The argument mostly centers on crowding out; whether government borrowing leads to higher interest rates that may offset the stimulative impact of spending. When the government runs a budget deficit, funds will need to come from public borrowing (government bonds), overseas borrowing, or monetizing the debt. When governments fund a deficit with the issuing of government bonds, interest rates can increase across the market, because government borrowing creates higher demand for credit in the financial markets. This causes a lower aggregate demand for goods and services, contrary to the objective of a fiscal stimulus. Neoclassical economists generally emphasize crowding out while Keynesians argue that fiscal policy can still be effective especially in a liquidity trap where, they argue, crowding out is minimal.

In the classical view, the expansionary fiscal policy also decreases net exports, which has a mitigating effect on national output and income. When government borrowing increases interest rates it attracts foreign capital from foreign investors. This is because, all other things being equal, the bonds issued from a country executing expansionary fiscal policy now offer a higher rate of return. To purchase bonds originating from a certain country, foreign investors must obtain that country's currency. Therefore, when foreign capital flows into the country undergoing fiscal expansion, demand for that country's currency increases. The increased demand causes that country's currency to appreciate. Once the currency appreciates, goods originating from that country now cost more to foreigners than they did before and foreign goods now cost less than they did before. Consequently, exports decrease and imports increase.