Introduction

The Budget of the United States Government often begins as the President's proposal to the U.S. Congress which recommends funding levels for the next fiscal year, beginning October 1. However, Congress is the body required by law to pass a budget annually and to submit the budget passed by both houses to the President for signature. Congressional decisions are governed by rules and legislation regarding the federal budget process. Budget committees set spending limits for the House and Senate committees and for Appropriations subcommittees, which then approve individual appropriations bills to allocate funding to various federal programs.

Understanding Deficits and Debt

The annual budget deficit is the difference between actual cash collections and budgeted spending (a partial measure of total spending) during a given fiscal year, which runs from October 1 to September 30. Since 1970, the U.S. federal government has run deficits for all but four years (1998–2001) contributing to a total debt of $16.1 trillion as of September 2012 .

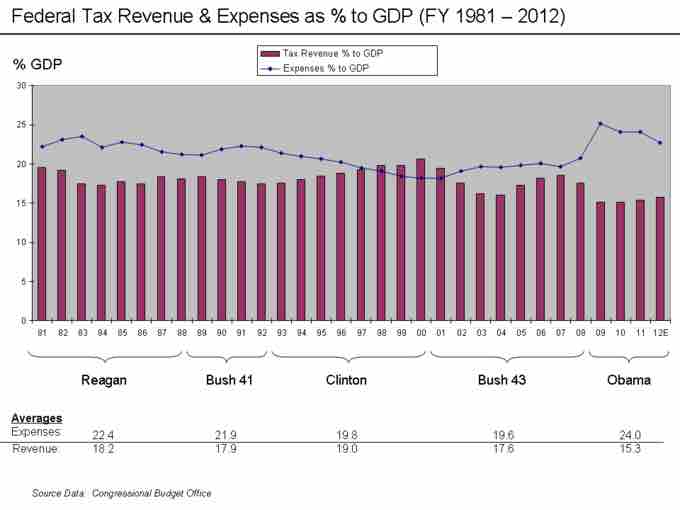

Revenue and Expense to GDP Chart 1993 - 2008

Tax and Spend percent GDP in United States 1981-2012,

Many of the debates surrounding the United States federal budget center around competing macroeconomic schools of thought. In general, Democrats favor the principles of Keynesian economics to encourage economic growth via a mixed economy of both private and public enterprise, a welfare state, and strong regulatory oversight. Conversely, Republicans generally support applying the principles of either laissez-faire or supply-side economics to grow the economy via small government, low taxes, limited regulation, and free enterprise.

Election-Year Budgets

The 1996 United States federal budget was the United States federal budget to fund government operations for the fiscal year 1996, which was October 1995 – September 1996. This budget was the first to be submitted after the Republican Revolution in the 1994 midterm elections. Disagreements between Democratic President Bill Clinton and Republicans led by Speaker of the House Newt Gingrich led to the United States federal government shutdown of 1995 and 1996.

U.S. President Bill Clinton

Official White House photo of President Bill Clinton, President of the United States.

The failure of Congress and the President to enact the remaining appropriations legislation led to government shutdowns during November 13–19, 1995 and December 15, 1995 through January 6, 1996. The shutdowns were triggered by the expiration of continuing resolutions. The first shutdown caused the furlough of about 800,000 federal employees, while the second affected 284,000 due to additional appropriations bills enacted in the interim.

Paul Ryan

Rep. Paul Ryan is former head of the House Budget Committee, but now serves as the Speaker of the House.

The Obama Administration's Budget Plans

The Obama administration's 2012 budget request focused on reducing annual deficits to more sustainable levels by making certain cuts in spending while continuing to support areas that would promote long-term economic growth, such as education and clean energy. The plan did not contain proposals to rein in spending on entitlement programs expected to increase the deficit in future years, like Medicare, Medicaid, and Social Security. The 2012 budget plan was a shift from the Obama administration's previous strategy of using increased government spending to stimulate the economy. Instead, the budget request was projected to reduce government deficits by 1.1 trillion dollars over the next ten years. Republicans have criticized the president's plan for not going far enough to reduce future deficits.

The 2016 budget plan President Obama proposed requested 4 trillion in fiscal year 2016. His proposal called for 74 billion in additional discretionary spending above the sequestration caps set in place. The additional spending would be about evenly split between defense and non-defense discretionary programs.

This budget request is President Obama’s first on-time budget proposal since 2011. It included more than $1.15 trillion in discretionary spending, an increase of about 2 percent relative to 2015 enacted levels.

The president proposed $60 billion over 10 years for a new initiative that would allow students to attend community college for up to two years tuition free and would again provide expanded Head Start and universal pre-kindergarten.

The budget also includes $478 billion in additional infrastructure spending over the next six years, which would pay for surface transportation improvements such as roads and bridges. The president proposes to pay for this through various tax reforms.