Once decision alternatives have been identified and analyzed, the decision maker is ready to make a choice. To do so it is important to have a set of criteria against which to evaluate and even rank the alternatives. Selection criteria might include total cost, time to implement, risk, and the organization's ability to successfully implement the decision. Categorizing criteria in terms of importance helps to differentiate between options that might have similar disadvantages but different advantages, or vice versa. For example, consider two alternatives that are equally risky, but one will cost more and the other will take longer to implement. In this case, the decision would depend on whether cost or time is more important. On occasion, decision makers may believe they do not have sufficient information about a particular alternative, so additional analysis may be needed.

Decision makers should do their best to minimize their biases, or preconceived ideas about which alternative is preferable, until they complete the analysis. The benefit of using data to support decisions is that when analysis is done correctly it is objective and factual, not based on emotions or subjective preferences. While it is natural to have biases based on experience or feelings, it is important for managers and leaders to recognize them and take steps to keep them from butting their judgment. People may be unable to eliminate all of their biases, especially when it comes to their tolerance for risk. It is therefore important to be explicit about assumptions and biases to the extent possible, so that people involved in making the decision are aware of them and can adjust their deliberations accordingly.

Bias and Prospect Theory

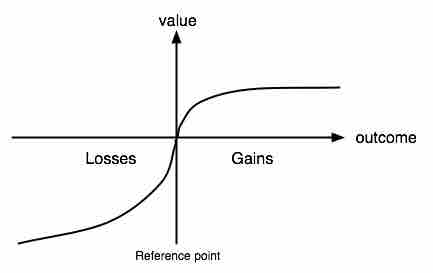

One of the best-known theories about bias in decision making is Kahneman and Tversky's prospect theory. Prospect theory is based on the notion that people think about decisions in terms of potential gains and losses and tend to be more averse to losses than they are favorable to gains. This means that decision makers may overstate the downside of an alternative, since they have a greater fear of negative consequences. As a result, people are biased toward less risky decisions, even when the benefits of a different alternative would outweigh the risks of the chosen one. Prospect theory also suggests that people consider how others would benefit or be hurt by the outcome of their decision. This contradicts traditional economic theory, which states that individuals make decisions based only on their own well-being.

Prospect theory and risk aversion

This graph represents Kahneman and Tversky's theory. The distance between the x-axis and the curve is smaller in the positive direction (i.e., for positive outcomes, or gains) than it is in the negative direction (i.e., for negative outcomes, or losses). This means that people's positive value of gains is less than people's negative value of losses. In other words, people are more sensitive to possible risk than to possible gain.