Chapter 19

Overview of Short-Term Financing

By Boundless

Short-term loans offer individuals and businesses borrowing options to meet financial obligations.

Credit cards allow users to pay for goods and services based on the promise to pay for them later and the immediate provision of cash by the card provider.

Factoring makes it possible for a business to readily convert a substantial portion of its accounts receivable into cash.

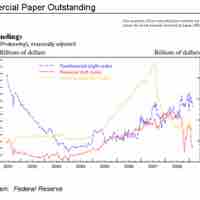

Commercial paper is a money-market security issued (sold) by large corporations to get money to meet short term debt obligations.

A secured loan is a loan in which the borrower pledges an asset (e.g. a car or property) as collateral, while an unsecured loan is not secured by an asset.

Asking friends and families to invest is one way that start-ups are funded.

A commercial bank lends money, accepts time deposits, and provides transactional, savings, and money market accounts.

Trade credit is the largest use of capital for a majority of B2B sellers; Accounts Payable is money owed by a firm to its suppliers.