Depreciation

Many tax systems require that the cost of items likely to produce future benefits be capitalized. Such assets include property and capital equipment that represent a commitment of resources over several periods. In accounting, the profits (net income) from an activity must be reduced by the costs associated with that activity. When an asset will be used in operations for several periods, tax systems often allow the allocation of the costs to periods in which the assets are used. In the U.S., this allocation is known as depreciation expense. It is important to reasonably estimate the useful life of the asset under depreciation in time-units. Then it is important to calculate the corresponding depreciation rate that will result in extinguishing the value of the asset from the books when the estimated useful life ends. There are several methods for achieving this goal.

Straight-Line Method

The straight-line method of depreciation reduces the book value of an asset by the same amount each period. This amount is determined by dividing the total value of the asset, less its salvage value, by the number of periods in its useful life. This amount is then deducted from income in each applicable period. Straight-line depreciation is the simplest and most-often-used technique .

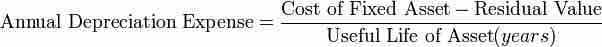

Straight-Line Depreciation

Annual depreciation expense is equal to the original cost of the asset minus its salvage value, divided by the useful life of the asset.

The economic reasoning behind the straight-line method involves the acceptance that depreciation is an approximation of the rate at which an asset transfers value to the operations of a business. As a result, we should use the most economical, or simplest, method to calculate and incorporate its costs.

Declining Balance Method

The declining balance method of depreciation provides for a higher depreciation expense in the first year of an asset's life and gradually decreases expenses in subsequent years. This may be a more realistic reflection of the actual expected benefit from the use of the asset because many assets are most useful when they are new. Under this method, the annual depreciation expense is found by multiplying book value of the asset each year by a fixed rate. Since this book value will differ from year to year, the annual depreciation expense will subsequently differ. The most commonly used rate is double the straight-line rate. Since the declining balance method will never fully amortize the original cost of the asset, the salvage value is not considered in determining the annual depreciation.

Activity Depreciation Methods

Activity depreciation methods are not based on time, but on a level of activity. When the asset is acquired, its life is estimated in terms of this level of activity. This could be miles driven for a vehicle or a cycle count for a machine. Each year, the depreciation expense is calculated by multiplying the rate by the actual activity level.

Effect of Depreciation on Taxes

Depreciation expense affects net income in each period of an asset's useful life. Therefore, it can be deducted from taxes owed in each of these periods. In other words, depreciation allows a company to properly identify the amount of income it generates in a given period. As with all expenses, a dollar of taxes that a company can defer until later is a dollar that can be used in profit generating operations today.