Tax Deductions

A tax deduction is a sum that can be removed from tax calculations. Specifically, it is a reduction of the income subject to tax. Often these deductions are subject to limitations or conditions. Nearly all jurisdictions that tax business income allow tax deductions for expenses incurred in trading or carrying on the trade or business. However, to be deducted, the expenses must be incurred in furthering the business, such as it must contribute to profit.

Deduction of Expenses

Expenses incurred in order to generate profit for a company are referred to as business expenses. These can be categorized into cost of goods sold and ordinary expenses--also knowns as trading or necessary expenses.

Cost of Goods Sold

Nearly all income tax systems allow a deduction for cost of goods sold. This can be considered an expense or simply a reduction in gross income, which is the starting point for determining Federal and state income tax. Several complexities must be factored in when determining cost of goods sold, including:

- assigning costs to particular goods when specific identification is not feasible;

- attributing common costs, such as factory burden, to particular goods;

- determining when costs are recognized;

- recognizing costs of goods that will not be sold or have declined in value.

Ordinary Expenses

According to tax law, the United States allows as a deduction "all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business..." Generally, this business must be regular, continuous, substantial, and entered into with an expectation of profit. Ordinary and necessary expenses tend to be those that are appropriate to the nature of the business, the sort expected to help produce income and promote the business, and those that are not lavish and extravagant.

An example of an ordinary expense is interest paid on debt, or interest expense incurred by a corporation in carrying out its trading activities. Such an expense comes with limitations, though, such as limiting the amount of deductible intrest that can be paid to related parties.

Non-Business Expenses

Expenses incurred from holding assets expected to produce income may also be deductible. For example, a deduction may be allowed for loss on sale, exchange, or abandonment of both business and non-business income producing assets. In the United States, a loss on non-business assets is considered a capital loss and deduction of the loss is limited to capital gains.

Marginal Tax Rate

Corporate taxes in the United States are considered to be progressive. That is to say, taxes are charged at a higher rate as income grows. To fully understand the effect of tax deductions, we must consider the marginal tax rate, which is the rate of tax paid on the next or last unit of currency of taxable income. The marginal tax rate is dependent upon a jurisdiction's tax structure, usually referred to as tax brackets. To determine the after-tax cost of a deductible expense, we simply multiply the cost by one minus the appropriate marginal tax rate .

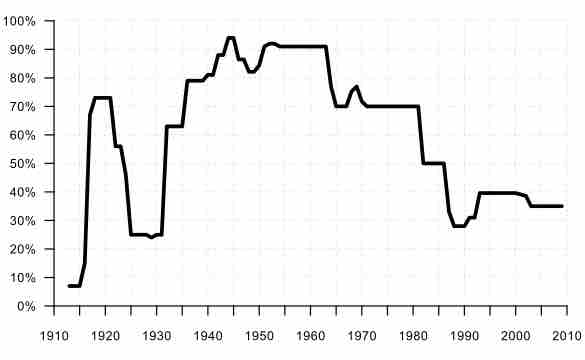

Marginal Income Tax Rates

This graph plots the marginal income tax rates for the top tax bracket in the US from 1913 to 2009.

Deductions Versus Credits

Tax deductions and tax credits are often incorrectly equated. While a deduction is a reduction of the level of taxable income, a tax credit is a sum deducted from the total amount of tax owed. It is a dollar-for-dollar tax saving. For example, a tax credit of $1,000 reduced taxes owed by $1,000, regardless of the marginal tax rate. A tax credit may be granted in recognition of taxes already paid, as a subsidy, or to encourage investment or other behaviors.