Individual Taxes

In the United States, there are an assortment of federal, state, local, and special purpose taxes that are imposed by such jurisdictions on individuals in order to finance government operations. These taxes may be imposed on the same income, property, or activity, often without offset of one tax against another. Taxes may be based on property, income, transactions, importation of goods, business activity, or a variety of factors, and are generally imposed on the type of taxpayer for whom such tax base is relevant.

Direct Versus Indirect Taxes

Individual taxes can generally be defined as either direct or indirect. A direct tax is one imposed upon an individual person or on property, as opposed to a tax imposed upon a transaction. In U.S. constitutional law, direct taxes refer to poll taxes and property taxes, which are based on simple existence or ownership. Indirect taxes, such as sales or value-added tax, are imposed only when a taxable transaction occurs. People have the freedom to engage in or refrain from such transactions, whereas a direct tax is typically imposed upon an individual in an unconditional manner.

Individual Tax Categories

Federal Tax Receipts

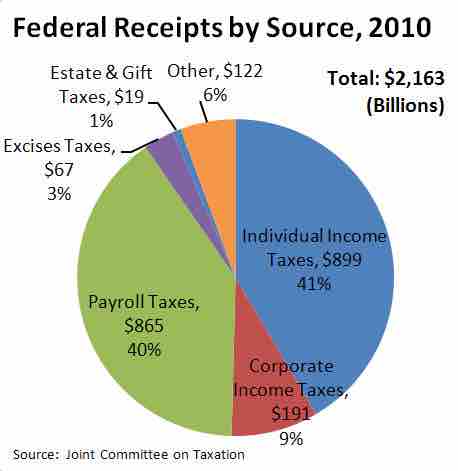

This chart depicts the level of tax received by the United States federal government from each source in 2010.

Income Tax

Personal income tax is generally the largest source of tax revenue in the United States. Taxes based on income are imposed at the federal, most state, and some local levels. Income tax is levied on the total income of the individual, less deductions, reducing an individual's taxable income, and credits, a dollar-for-dollar reduction of total tax liability. The tax system allows for personal exemptions, as well as certain "itemized deductions," including:

- Medical expenses (over 7.5% of adjusted gross income)

- State and local income and property taxes

- Interest expense on certain home loans

- Gifts of money or property to qualifying charitable organizations, subject to certain maximum limitations

- Losses on non-income-producing property due to casualty/theft

- Contribution to certain retirement or health savings plans

- Certain educational expenses

Income tax is often collected on a pay-as-you-earn basis (i.e., witholding taxes from wages). Small corrections are usually made after the end of the tax year. These corrections take one of two forms: payments to the government for taxpayers who have not paid enough during the tax year; and government tax refunds for those who have overpaid.

Total Effective Tax Rates

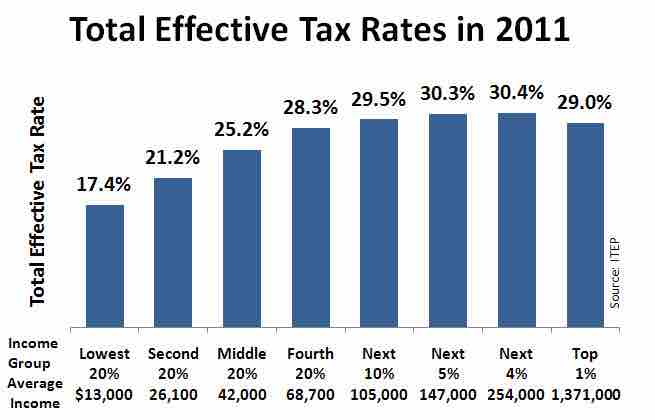

This graph shows the total effective tax rates for each earning class in 2011.

Federal and many state income tax rates are graduated or progressive–they are higher (graduated) at higher levels of income. The income level at which various tax rates apply for individuals varies by filing status. The income level at which each rate starts generally is higher, therefore, tax is lower for married couples filing a joint return or single individuals filing as head of household. Individuals are subject to federal graduated tax rates from 10% to 35%. State income tax rates vary from 1% to 16%, including local income tax where applicable.

Payroll Tax

Payroll taxes are imposed on employers and employees and on various compensation bases. These include income tax witholding, social security and medicare taxes, and unemployment taxes.

Sales Tax

Sales tax is an indirect tax levied on the state level, including taxes on retail sale, lease and rental of goods, as well as some services. Many cities, counties, transit authorities, and special purpose districts impose an additional local sales tax. Sales tax is calculated as the purchase price times the appropriate tax rate. Tax rates vary widely by jurisdiction from less than 1% to over 10%. Nearly all jurisdictions provide numerous categories of goods and services that are exempt from sales tax or taxed at a reduced rate.

Sales Tax Rates

This graph shows the effective sales tax rates for the 50 states.

In addition to sales tax, excise taxes are imposed at the federal and state levels on a goods, including alcohol, tobacco, tires, gasoline, diesel fuel, coal, firearms, telephone service, air transportation, unregistered bonds, etc.

Property Tax

Most jurisdictions below the state level impose a tax on interests in real property (land, buildings, and permanent improvements). Property tax is based on fair market value the subject property. The amount of tax is determined annually based on the market value of each property on a particular date. The tax is computed as the determined market value times an assessment ratio times the tax rate.

Estate and Gift Tax

The estate tax is an excise tax levied on the right to pass property at death. It is imposed on the estate, not the beneficiary. Gift taxes are levied on the giver (donor) of property where the property is transferred for less than adequate consideration. The Federal gift tax is computed based on cumulative taxable gifts, and is reduced by prior gift taxes paid. The Federal estate tax is computed on the sum of taxable estate and taxable gifts, and is reduced by prior gift taxes paid. These taxes are computed as the taxable amount times a graduated tax rate (up to 35%). Taxable values of estates and gifts are the fair market value.