Term structure is a phrase used to describe how a given quantity or variable changes with time. In the case of bonds, time to maturity, or terms, vary from short-term - usually less than a year - to long-term - 10, 20, 30, 50 years, etc. Term structure of interest rates is often referred to as the yield curve.

In finance, the yield curve is a curve showing several yields or interest rates across different contract lengths (2 month, 2 year, 20 year, etc...) for a similar debt contract. The curve shows the relationship between the interest rate (or cost of borrowing) and the time to maturity - known as the "term" - of the debt for a given borrower in a given currency. ""

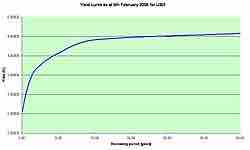

Yield curve for USD

The US dollar yield curve as of February 9, 2005. The curve has a typical upward sloping shape.

The curve allows an interest rate pattern to be determined, which can then be used to discount cash flows appropriately. Unfortunately, most bonds carry coupons, so the term structure must be determined using the prices of these securities. There are three main economic theories attempting to explain different term structures of interest rates. Two of the theories are extreme positions, while the third attempts to find a middle ground between two extremes.

The expectation hypothesis of the term structure of interest rates is the proposition that the long-term rate is determined by the market's expectation for the short-term rate plus a constant risk premium. Shortcomings of the expectations theory is that it neglects the risks inherent in investing in bonds, namely interest rate risk and reinvestment rate risk.

The liquidity premiumtheory asserts that long-term interest rates not only reflect investors' assumptions about future interest rates but also include a premium for holding long-term bonds (investors prefer short-term bonds to long-term bonds). This is called the term premium or the liquidity premium. This premium compensates investors for the added risk of having their money tied up for a longer period, including the greater price uncertainty. Because of the term premium, long-term bond yields tend to be higher than short-term yields, and the yield curve slopes upward. Long-term yields are also higher not just because of the liquidity premium, but also because of the risk premium added by the risk of default from holding a security over the long-term.

In the segmented market hypothesis, financial instruments of different terms are not substitutable. As a result, the supply and demand in the markets for short-term and long-term instruments is determined largely independently. Prospective investors decide in advance whether they need short-term or long-term instruments. If investors prefer their portfolio to be liquid, they will prefer short-term instruments to long-term instruments. Therefore, the market for short-term instruments will receive a higher demand. Higher demand for the instrument implies higher prices and lower yield. This explains the stylized fact that short-term yields are usually lower than long-term yields. This theory explains the predominance of the normal yield curve shape. However, because the supply and demand of the two markets are independent, this theory fails to explain the observed fact that yields tend to move together (i.e., upward and downward shifts in the curve).