Assets can have varying maturity dates and potential for default, the attribution of time to maturity and timely payments involve an assessment of risk. Risk is pervasive in the economy and is an essential component in the derivation of an asset's investment return.

Time and Risk

Time is a component of risk for varying reasons; however, the two most common are related to the increase in general uncertainty rising with the time horizon and reinvestment risk.

In our everyday lives, we are faced with momentary uncertainties that become increasingly harder to predict as we move from a five minute horizon to a five day, five month, or even five year period. This same phenomenon is true of financial assets. Though the attribution of acceptable inflation can be incorporated into an investment return, the actual pricing and resulting purchasing power of the investment at maturity is unknown and the uncertainty increases with time. Therefore, investment returns compensate holders for the time to maturity via a risk premium .

Return expectations are based on risk analysis

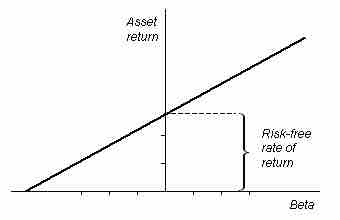

In finance and economics, as depicted in the graph above of the capital asset pricing model, risk is evaluated to set the boundary for acceptable return.

Risk premium compensates holders for risks inherent to an investment and are incorporated in the rate of return quoted for an investment. For example, if asset A and asset B both pay a 5% coupon on an annual basis, but asset B matures in 5 years and asset A matures in 1 year, all else equal (asset quality and issuer solvency), we would expect asset A to trade at a higher price than asset B. Remembering that yield and price are inversely related, the higher price on A implies that it has a lower yield than B. The differential in yield can be attributed to a risk premium for time to maturity.

Another aspect of time horizon is reinvestment risk. For some investments, there is a potential for an issuer to call or redeem a security prior to maturity. Given that at the time that the investment is called prevailing rates may be lower than at the purchase of the asset, the holder is taking a reinvestment risk at the time of purchase. To compensate investors for taking on this type of risk, the issuer will provide a risk premium to incentivize the investor to purchase the investment.