The balance of trade is the difference between the monetary value of exports and imports of output in an economy over a certain period, measured in the currency of that economy. It is the relationship between a nation's imports and exports. It is measured by finding the country's net exports. A positive balance is known as a trade surplus if it consists of exporting more than is imported; a negative balance is referred to as a trade deficit or, informally, a trade gap.

Factors that can affect the balance of trade include:

- The cost of production (land, labor, capital, taxes, incentives, etc.) in the exporting economy compared to those in the importing economy

- The cost and availability of raw materials, intermediate goods, and other inputs

- Currency exchange rate

- Multilateral, bilateral, and unilateral taxes or restrictions on trade

- Non-tariff barriers such as environmental, health, or safety standards

- The availability of adequate foreign exchange with which to pay for imports

- Prices of goods manufactured at home

In addition, the trade balance is likely to differ across the business cycle. In export-led growth (such as oil and early industrial goods), the balance of trade will improve during an economic expansion. However, with domestic demand led growth (as in the United States and Australia) the trade balance will worsen at the same stage in the business cycle.

Twin Deficits Hypothesis

The twin deficits hypothesis is a concept from macroeconomics that contends that there is a strong link between a national economy's current account balance and its government budget balance. This link can be seen from considering the national accounting model of the economy:

Y=C+I+G+(NX

Y represents national income or GDP, C is consumption, I is investment, G is government spending, and NX stands for net exports (exports minus imports). This represents GDP because all the production in an economy (the left hand side of the equation) is used as consumption (C), investment (I), or government spending (G), and the leftover production is exported (NX).

Another equation defining GDP using alternative terms (which in theory results in the same value) is:

Y=C+S+T

Y is again GDP, C is consumption, S is savings, and T is taxes. This is because national income is also equal to output, and all individual income either goes to pay for consumption (C), to pay taxes (T), or becomes savings (S).

Since Y=C+I+G+NX, and Y-C-T=S, then S=G-T+NX+I, which simplifies to:

(S-I)+(T-G)=(NX)

If (T-G) is negative, we have a budget deficit. Assuming that the economy is at potential output (meaning Y is fixed), if the budget deficit increases and savings and investment remain the same, then net exports must fall, causing a trade deficit. Thus, budget deficits and trade deficits go hand-in-hand .

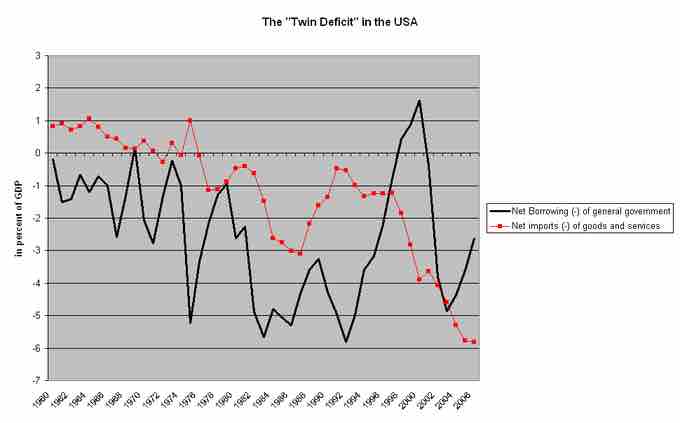

Twin Deficits in the US

In the U.S., net borrowing has tended to have a direct relationship with net imports. The red line represents net imports, which is equivalent to the negative balance of trade, and the black line represents net borrowing, which is equivalent to the government budget deficit. Although the two are not identical, a rise in one tends to accompany a rise in the other, and vice versa.

The twin deficits hypothesis implies that as the budget deficit grows, net capital outflow from a country falls. This is because the nation is financing its spending by selling assets to foreigners. The total rate of national savings falls, which may lead to an increase in the interest rate as lending to the country (i.e. buying bonds and other financial assets) becomes more risky.