The inflation rate is widely calculated by calculating the movement or change in a price index, usually the consumer price index (CPI) The consumer price index measures movements in prices of a fixed basket of goods and services purchased by a "typical consumer".

CPI is usually expressed as an index, which means that one year is the base year. The base year is given a value of 100. The index for another year (say, year 1) is calculated by

The percent change in the CPI over time is the inflation rate.

For example, assume you spend your money on bread, jeans, DVDs, and gasoline, and you'd like to measure the inflation that you experience with this basket of goods. In the base period you purchased three loaves of bread ($4 each), two pairs of jeans ($30 each), five DVDs ($20 each), and 10 gallons of gasoline ($3.50 each). The price of the basket of goods in the base period is the total money spent on this quantity of items at the base period prices; in this case, this equals $207.

Now imagine that in the current period, bread still costs $4, jeans are $35, DVDs are $18, and gasoline is $4. Using the quantities from the base period, the total cost of the market basket in the current period is $212. The price index is (212/207)*100, or 102.4. This means that the inflation rate between the base period and the current period was 2.4%.

In everyday life, we experience inflation as a loss in the purchasing power of money. When the inflation rate is 2.4%, it means that a dollar can buy 2.4% fewer goods and services than it could in the previous period. When inflation is steady, incomes will generally compensate for the effects of inflation by rising or falling at approximately the same rate as the general price level. Money saved as currency, however, will lose its value if inflation occurs .

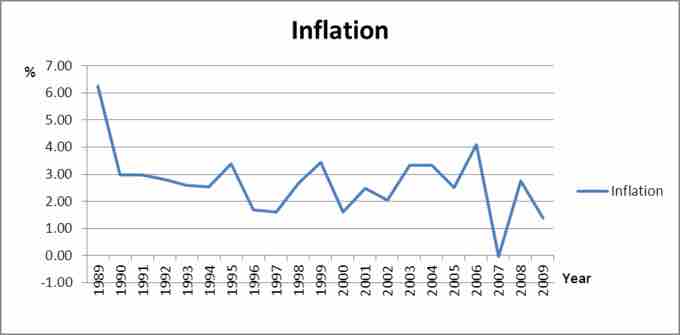

U.S. Inflation Rate

The U.S. inflation rate is measured by comparing the price of goods in one year to the price of goods in a previous base year.