Economic Growth

Economists can measure the performance of an economy by looking at gross domestic product (GDP), a widely used measure of total output. GDP is defined as the market value of all goods and services produced by the economy in a given year. In the United States, it is calculated by the Department of Commerce. GDP includes only those goods and services produced domestically; goods produced outside the country are excluded. GDP also includes only those goods and services that are produced for the final user; intermediate products are excluded. For example, the silicon chip that goes into a computer (an intermediate product) would not count, even though the finished computer would.

By itself, GDP doesn't necessarily tell us much about the state of the economy, but change in GDP does. If GDP (after adjusting for inflation) goes up, the economy is growing; if it goes down, the economy is contracting.

Economic growth is the increase in the amount of the goods and services produced by an economy over time. It is conventionally measured as the percent rate of increase in real GDP.

Growth is usually calculated in real terms, i.e. inflation-adjusted terms, in order to net out the effect of inflation on the price of the goods and services produced. In economics, "economic growth" or "economic growth theory" typically refers to growth of potential output, i.e., production at "full employment," which is caused by growth in aggregate demand or observed output.

Measuring economic growth

Economic growth is measured as a percentage change in the GDP or Gross National Product (GNP). These two measures, which are calculated in slightly different ways, total the amounts paid for the goods and services that a country produced.

As an example of measuring economic growth, a country that creates $9,000,000,000 in goods and services in 2010 and then creates $9,090,000,000 in 2011 has a nominal economic growth rate of 1% for 2011.

A single currency may be quoted to compare per capita economic growth among several countries. This requires converting the value of currencies of various countries into a selected currency, for example U.S. dollars. One way to do this conversion is to rely on exchange rates among the currencies, for example how many Mexican pesos buy a single U.S. dollar? Another approach is to use the purchasing power parity method. This method is based on how much consumers must pay for the same "basket of goods" in each country.

Inflation and Deflation can make it difficult to measure economic growth

Inflation or deflation can make it difficult to measure economic growth. For example, if GDP goes up in a country by 1% in a year, economists must ask if this was due solely to rising prices (inflation) or if it was because more goods and services were produced and saved.

To express real growth rather than changes in prices for the same goods, statistics on economic growth are often adjusted for inflation or deflation. For example, a table may show changes in GDP in the period 1990 to 2000, as expressed in 1990 U.S. dollars. This means that the U.S. dollar with the purchasing power it had in the U.S. in 1990 is the only currency being used for the comparison. The table might mention that the figures are "inflation-adjusted," or real. If no adjustment was made for inflation, the table might make no mention of inflation-adjustment, or might mention that the prices are nominal.

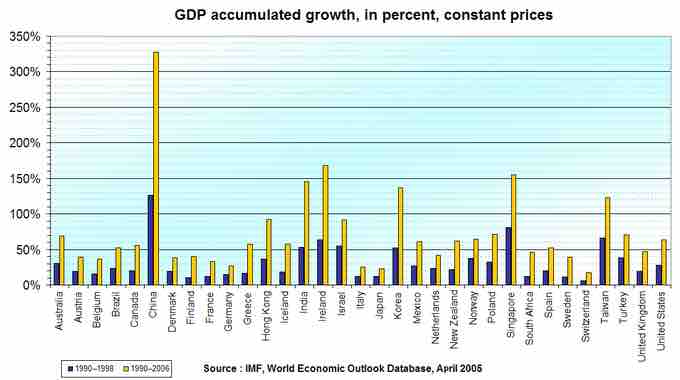

GDP Accumulated Change

Gross domestic product growth in the advanced economies, accumulated for the periods 1990-1999, and 1990-2006.