The Basics of Supply and Demand

In a market characterized by perfect competition, price is determined through the mechanisms of supply and demand. Prices are influenced both by the supply of products from sellers and by the demand for products by buyers.

Demand and the Demand Curve

Demand is the quantity of a product that buyers are willing to purchase at various prices.

The quantity of a product that people are willing to buy depends on its price. You're typically willing to buy less of a product when prices rise and more of a product when prices fall. Generally speaking, we find products more attractive at lower prices, and we buy more at lower prices because our income goes further. Using this logic, we can construct a demand curve that shows the quantity of a product that will be demanded at different prices.

The red curve in the diagram represents the daily price and quantity of apples sold by farmers at a local market. Note that as the price of apples goes down, buyers' demand goes up. Thus, if a pound of apples sells for $0.80, buyers will be willing to purchase only 1,500 pounds per day. But if apples cost only $0.60 a pound, buyers will be willing to purchase 2,000 pounds. At $0.40 a pound, buyers will be willing to purchase 25,000 pounds.

Supply and the Supply Curve

Supply is the quantity of a product that sellers are willing to sell at various prices.

The quantity of a product that a business is willing to sell depends on its price. Businesses are more willing to sell a product when the price rises and less willing to sell it when prices fall. This fact makes sense: Businesses are set up to make profits, and there are larger profits to be made when prices are high. Now, we can construct a supply curve that shows the quantity of apples that farmers would be willing to sell at different prices, regardless of demand.

The supply curve goes in the opposite direction from the demand curve: As prices rise, the quantity of apples that farmers are willing to sell also goes up.

The supply curve shows that farmers are willing to sell only a 1,000 pounds of apples when the price is $0.40 a pound, 2,000 pounds when the price is $0.60, and 3,000 pounds when the price is $0.80.

Equilibrium Price

We can now see how the market mechanism works under perfect competition.

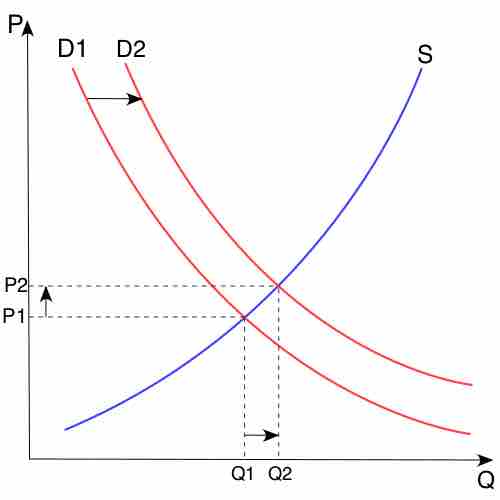

We do this by plotting both the supply curve and the demand curve on one graph. The point at which the two curves intersect is the equilibrium price. At this point, buyers' demand for apples and sellers' supply of apples is in equilibrium.

Supply and Demand

Supply and Demand: P - price Q - quantity of good S - supply D - demand

The supply and demand curves intersect at the price of $0.60 and quantity of 2,000 pounds. Thus, $0.60 is the equilibrium price: At this price, the quantity of apples demanded by buyers equals the quantity of apples that farmers are willing to supply.

If a farmer tries to charge more than $0.60 for a pound of apples, he won't sell very many, and his profits will go down. If, on the other hand, a farmer tries to charge less than the equilibrium price of $0.60 a pound, he will sell more apples but his profit per pound will be less than at the equilibrium price.

Lessons Learned

We've learned that without outside influences, markets in an environment of perfect competition will arrive at an equilibrium point at which both buyers and sellers are satisfied.

But we must be aware that this is a very simplistic example. Things are much more complex in the real world. For one thing, markets rarely operate without outside influences. Circumstances also have a habit of changing.

What would happen, for example, if income rose and buyers were willing to pay more for apples? The demand curve would change, resulting in an increase in equilibrium price. This outcome makes intuitive sense: As demand increases, prices will go up. What would happen if apple crops were larger than expected because of favorable weather conditions? Farmers might be willing to sell apples at lower prices. If so, the supply curve would shift, resulting in another change in equilibrium price: The increase in supply would bring down prices.

The model is commonly applied to wages, in the market for labor. The typical roles of supplier and demander are reversed. The suppliers are individuals, who try to sell their labor for the highest price. The demanders of labor are businesses, which try to buy the type of labor they need at the lowest price. The equilibrium price for a certain type of labor is the wage rate.