Money supply

Did you know...

This Schools selection was originally chosen by SOS Children for schools in the developing world without internet access. It is available as a intranet download. Click here for more information on SOS Children.

|

|||||

The money supply, or money stock, refers to the total amount of money held by the nonbank public at a point in time in an economy. There are several ways to measure such an amount (called a monetary aggregate), but each includes currency in circulation plus demand deposits (checking-account money).

Purpose

Money supply data is recorded and published in order to monitor the growth of the money supply. Public- and private-sector analysts have long monitored this growth because of the effects that it is believed to have on real economic activity and on the price level. The money supply is considered an important instrument for controlling inflation by economists who say that growth in money supply will only lead to inflation if money demand is stable.

Convention

Because (in principle) money is anything that can be used in settlement of a debt, there are varying measures of money supply. Since most modern economic systems are regulated by governments through monetary policy, the supply of money is broken down into types of money based on how much of an effect monetary policy can have on that type of money. Narrow money is the type of money that is more easily affected by monetary policy whereas broad money is more difficult to affect through monetary policy. Narrow money exists in smaller quantities while broad money exists in much larger quantities. Each type of money can be classified by placing it along a spectrum between narrow (easily affected) and broad (difficult to affect) money. The different types of money are typically classified as M's. The number of M's usually range from M0 (most narrow) to M3 (broadest) but which M's are actually used depends on the system. The typical layout for each of the M's is as follows:

- M0: Physical currency. A measure of the money supply which combines any liquid or cash assets held within a central bank and the amount of physical currency circulating in the economy. M0 (M-zero) is the most liquid measure of the money supply. It only includes cash or assets that could quickly be converted into currency. This measure is known as narrow money because it is the smallest measure of the money supply.

- M1: M0 + demand deposits, which are checking accounts. This is used as a measurement for economists trying to quantify the amount of money in circulation. The M1 is a very liquid measure of the money supply, as it contains cash and assets that can quickly be converted to currency.

- M2: M1 + small time deposits (less than $100,000), savings deposits, and non-institutional money-market funds. M2 is a broader classification of money than M1. Economists use M2 when looking to quantify the amount of money in circulation and trying to explain different economic monetary conditions. M2 is key economic indicator used to forecast inflation.

- M3: M2 + all large time deposits, institutional money-market funds, short-term repurchase agreements, along with other larger liquid assets. The broadest measure of money; it is used by economists to estimate the entire supply of money within an economy.

Fractional-reserve banking

The different forms of money in government money supply statisitics arise from the practice of fractional-reserve banking. Whenever a bank gives out a loan in a fractional-reserve banking system, a new type of money is created. This new type of money is what makes up the non-M0 components in the M1-M3 statistics. In short, there are two types of money in a fractional-reserve banking system:

-

- central bank money (physical currency)

- commercial bank money (money created through loans) - sometimes referred to as checkbook money

In the money supply statistics, central bank money is M0 while the commercial bank money is divided up into the M1-M3 components. Generally, the types of commercial bank money that tend to be valued at lower amounts are classified in the narrow category of M1 while the types of commercial bank money that tend to exist in larger amounts are categorized in M2 and M3, with M3 having the largest.

Money supplies around the world

United States

The Federal Reserve previously published data on three monetary aggregates, but now it only publishes data on 2 of them. The first, M1, is made up of types of money commonly used for payment, basically currency (M0) and checking deposits. The second, M2, includes M1 plus balances that generally are similar to transaction accounts and that, for the most part, can be converted fairly readily to M1 with little or no loss of principal. The M2 measure is thought to be held primarily by households. The third aggregate, M3, which is no longer published, included M2 plus certain accounts that are held by entities other than individuals and are issued by banks and thrift institutions to augment M2-type balances in meeting credit demands; it also includes balances in money market mutual funds held by institutional investors. The aggregates have had different roles in monetary policy as their reliability as guides has changed. The following details their principal components:

- M0: The total of all physical currency, plus accounts at the central bank that can be exchanged for physical currency.

- M1: M0 - those portions of M0 held as reserves or vault cash + the amount in demand accounts ("checking" or "current" accounts).

- M2: M1 + most savings accounts, money market accounts, and small denomination time deposits ( certificates of deposit of under $100,000).

- M3: M2 + all other CDs (large time deposits, institutional money market mutual fund balances), deposits of eurodollars and repurchase agreements.

The Federal Reserve ceased publishing M3 statistics in March 2006, claiming that M3 did not appear to convey additional information about economic activity compared to M2, had not been used in determining economic policy, and that the costs to collect M3 data outweighed the benefits. Some politicians have spoken out against the Federal Reserve's decision to cease publishing M3 statistics and have urged the U.S. Congress to take steps requiring the Federal Reserve to do so. Congressman Ron Paul claimed that "M3 is the best description of how quickly the Fed is creating new money and credit. Common sense tells us that a government central bank creating new money out of thin air depreciates the value of each dollar in circulation.". Some of the data used to calculate M3 are still collected and published on a regular basis. Current alternate sources of M3 data are available from the private sector.

United Kingdom

There are just two official UK measures. M0 is referred to as the "wide monetary base" or "narrow money" and M4 is referred to as " broad money" or simply "the money supply".

- M0: Cash outside Bank of England + Banks' operational deposits with Bank of England.

- M4: Cash outside banks (ie. in circulation with the public and non-bank firms) + private-sector retail bank and building society deposits + Private-sector wholesale bank and building society deposits and Certificate of Deposit.

European Union

The European Central Bank's definition of euro area monetary aggregates:

- M1: Currency in circulation + overnight deposits

- M2: M1 + Deposits with an agreed maturity up to 2 years + Deposits redeemable at a period of notice up to 3 months

- M3: M2 + Repurchase agreements + Money market fund (MMF) shares/units + Debt securities up to 2 years

Australia

The Reserve Bank of Australia defines the monetary aggregates as:

- M1: currency + bank current deposits of the private non-bank sector

- M3: M1 + all other bank deposits of the private non-bank sector

- Broad Money: M3 + borrowings from the private sector by NBFIs, less the latter's holdings of currency and bank deposits

- Money Base: holdings of notes and coins by the private sector plus deposits of banks with the Reserve Bank of Australia (RBA) and other RBA liabilities to the private non-bank sector

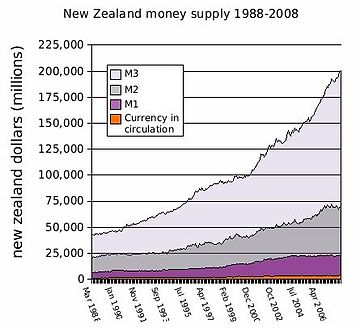

New Zealand

The Reserve Bank of New Zealand defines the monetary aggregates as:

- M1: notes and coin held by the public plus chequeable deposits, minus inter-institutional chequeable deposits, and minus central government deposits

- M2: M1 + all non-M1 call funding (call funding includes overnight money and funding on terms that can of right be broken without break penalties) minus inter-institutional non-M1 call funding

- M3: the broadest monetary aggregate. It represents all New Zealand dollar funding of M3 institutions and any Reserve Bank repos with non-M3 institutions. M3 consists of notes & coin held by the public plus NZ dollar funding minus inter-M3 institutional claims and minus central government deposits

India

The Reserve Bank of India defines the monetary aggregates as:

- Reserve Money (M0): Currency in circulation + Bankers’ deposits with the RBI + ‘Other’ deposits with the RBI = Net RBI credit to the Government + RBI credit to the commercial sector + RBI’s claims on banks + RBI’s net foreign assets + Government’s currency liabilities to the public – RBI’s net non-monetary liabilities.

- M1: Currency with the public + Demand deposits with the banking system + ‘Other’ deposits with the RBI.

- M2: M1 + Savings deposits of post office savings banks.

- M3: M1+ Time deposits with the banking system. = Net bank credit to the Government + Bank credit to the commercial sector + Net foreign assets of the banking sector + Government’s currency liabilities to the public – Net non-monetary liabilities of the banking sector.

- M4: M3 + All deposits with post office savings banks (excluding National Savings Certificates).

Link with inflation

Monetary exchange equation

Money supply is important because it is linked to inflation by the "monetary exchange equation":

MV = PQ

• M is the total dollars in the nation’s money supply • V is the number of times per year each dollar is spent • P is the average price of all the goods and services sold during the year • Q is the quantity of goods and services sold during the year

where:

- velocity = the number of times per year that money turns over in transactions for goods and services (if it is a number it is always simply nominal GDP / money supply)

- nominal GDP = real Gross Domestic Product × GDP deflator

- GDP deflator = measure of inflation. Money supply may be less than or greater than the demand of money in the economy

In other words, if the money supply grows faster than real GDP growth (described as "unproductive debt expansion"), inflation is likely to follow ("inflation is always and everywhere a monetary phenomenon"). This statement must be qualified slightly, due to changes in velocity. While the monetarists presume that velocity is relatively stable, in fact velocity exhibits variability at business-cycle frequencies, so that the velocity equation is not particularly useful as a short run tool. Moreover, in the US, velocity has grown at an average of slightly more than 1% a year between 1959 and 2005 (which is to be expected due to the increase in population, unless money supply grows very rapidly).

Another aspect of money supply growth that has come under discussion since the collapse of the housing bubble in 2007 is the notion of "asset classes." Economists have noted that M3 growth may not affect all assets equally. For example, following the stock market run up and then decline in 2001, home prices began an historically unusual climb that then dropped sharply in 2007. The dilemma for the Federal Reserve in regulating the money supply is that lowering interest rates to slow price declines in one asset class, e.g. real estate, may cause prices in other asset classes to rise, e.g. commodities.

Percentage

In terms of percentage changes (to a small approximation, the percentage change in a product, say XY is equal to the sum of the percentage changes %X + %Y). So:

- %P + %Y = %M + %V

That equation rearranged gives the "basic inflation identity":

- %P = %M + %V - %Y

Inflation (%P) is equal to the rate of money growth (%M), plus the change in velocity (%V), minus the rate of output growth (%Y).

Bank reserves at central bank

When a central bank is "easing", it triggers an increase in money supply by purchasing government securities on the open market thus increasing available funds for private banks to loan through fractional-reserve banking (the issue of new money through loans) and thus grows the money supply. When the central bank is "tightening", it slows the process of private bank issue by selling securities on the open market and pulling money (that could be loaned) out of the private banking sector. It reduces or increases the supply of short term government debt, and inversely increases or reduces the supply of lending funds and thereby the ability of private banks to issue new money through debt. Note that while the terms "easing" and "tightening" are commonly used to describe the central bank's stated interest rate policy, a central bank has the ability to influence the money supply in a much more direct fashion, as explained earlier in this paragraph.

The operative notion of easy money is that the central bank creates new bank reserves (in the US known as " federal funds"), which let the banks lend out more money. These loans get spent, and the proceeds get deposited at other banks. Whatever is not required to be held as reserves is then lent out again, and through the "multiplying" effect of the fractional-reserve system, loans and bank deposits go up by many times the initial injection of reserves.

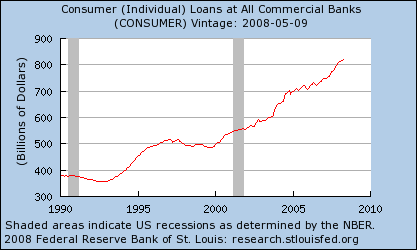

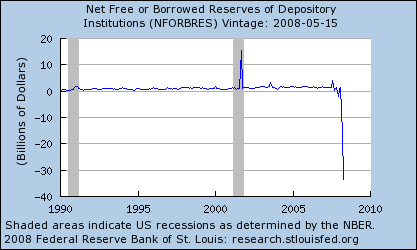

However, in the 1970s the reserve requirements on deposits started to fall with the emergence of money market funds, which require no reserves. Then in the early 1990s, reserve requirements were dropped to zero on savings deposits, CDs, and Eurodollar deposit. At present, reserve requirements apply only to " transactions deposits" – essentially checking accounts. The vast majority of funding sources used by private banks to create loans are not limited by bank reserves. Most commercial and industrial loans are financed by issuing large denomination CDs. Money market deposits are largely used to lend to corporations who issue commercial paper. Consumer loans are also made using savings deposits, which are not subject to reserve requirements. These loans can be bunched into securities and sold to somebody else, taking them off of the bank's books.

Therefore, neither commercial nor consumer loans are any longer limited by bank reserves. Since 1995 the amount of consumer loans has steadily increased, while bank reserves have generally remained constant:

In recent years, the irrelevance of open market operations has also been argued by academic economists renown for their work on the implications of rational expectations, including Robert Lucas, Jr., Thomas Sargent, Neil Wallace, Finn E. Kydland, Edward C. Prescott and Scott Freeman.

Arguments

Assuming that prices do not instantly adjust to equate supply and demand, one of the principal jobs of central banks is to ensure that aggregate (or overall) demand matches the potential supply of an economy. Central banks can do this because overall demand can be controlled by the money supply. By putting more money into circulation, the central bank can stimulate demand. By taking money out of circulation, the central bank can reduce demand.

For instance, if there is an overall shortfall of demand relative to supply (that is, a given economy can potentially produce more goods than consumers wish to buy) then some resources in the economy will be unemployed (i.e., there will be a recession). In this case the central bank can stimulate demand by increasing the money supply. In theory the extra demand will then lead to job creation for the unemployed resources (people, machines, land), leading back to full employment (more precisely, back to the natural rate of unemployment, which is basically determined by the amount of government regulation and is different in different countries).

However, central banks have a difficult balancing act because, if they put too much money into circulation, demand will outstrip an economy's ability to supply so that, even when all resources are employed, demand still cannot be satisfied. In this case, unemployment will fall back to the natural rate and there will then be competition for the last remaining labour, leading to wage rises and inflation. This can then lead to another recession as the central bank takes money out of circulation (raising interest rates in the process) to try to damp down demand.

The main debate amongst economists in the second half of the twentieth century concerned the central banks ability to know how much money to inject into or take out of circulation under different circumstances. Some economists like Milton Friedman believed that the central bank would always get it wrong, leading to wider swings in the economy than if it were just left alone. That is why they advocated a non-interventionist approach.

Current Chairman of the U.S. Federal Reserve, Ben Bernanke, has suggested that over the last 10 to 15 years, many modern central banks have become relatively adept at manipulation of the money supply, leading to a smoother business cycle, with recessions tending to be smaller and less frequent than in earlier decades, a phenomenon he terms " The Great Moderation" .