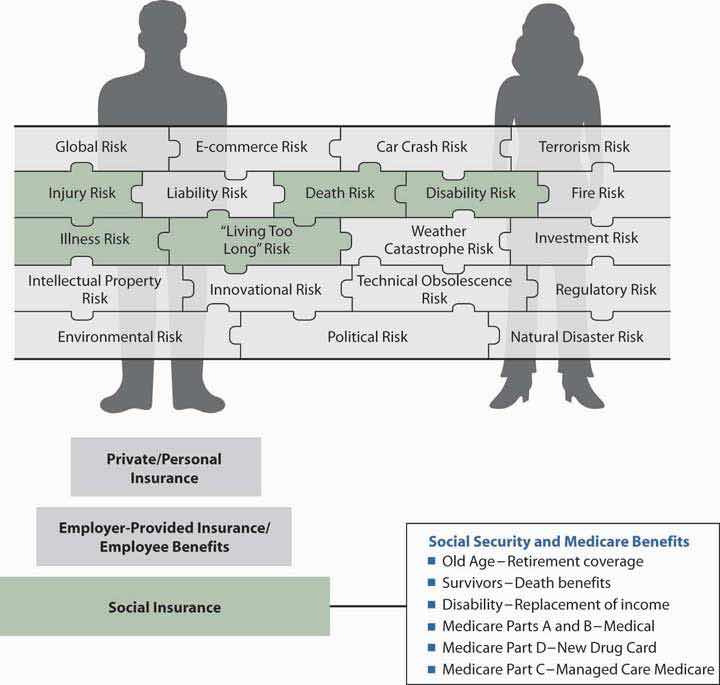

The mandatory coverage for life cycle events risk is Social Security. As noted in Chapter 16 "Risks Related to the Job: Workers’ Compensation and Unemployment Compensation", Social Security is a major social insurance program that was created in 1935 as an outcome of the Great Depression. Originally, this program was a compulsory pension plan known as Old Age Insurance (OAI). Later, survivors’ benefits were added and the program became known as Old Age and Survivors’ Insurance (OASI). When disability benefits were added, it became Old Age, Survivors’, and Disability Insurance (OASDI), and, with the addition of hospital and medical benefits, it became the Old Age, Survivors’, Disability, and Hospital Insurance (OASDHI) program. Social Security is not need-based and depends on a person’s employment history. Its objective is to provide a “floor of protection” or a “reasonable level of living.” Figure 18.1 "The Links between Life Cycle Risks and Social Security Benefits" illustrates the idea of a “floor of protection.” Social Security is the foundation on which retirement, survivors’, and disability benefits should be designed. In addition, the program is the foundation for health benefits for the retired population under Medicare Part A (hospitals), Part B (doctors), Part C (managed care medicine), and Part D (the new drug program). The discussion of Social Security is positioned here, in this chapter of the text, to emphasize the importance of Social Security as the foundation for employer-provided benefits, such as group life, disability, and health insurance and retirement programs.

Most U.S. workers—full-time, part-time, self-employed, and temporary employees—are part of the Social Security program. Every employer and employee is required to contribute in the form of payroll taxes. Social Security provides income in the event of retirement, disability, or death. It also provides medical expense benefits for disabled or retired persons and their specified dependents.All statistics in this chapter are from the Social Security Administration (http://www.ssa.gov) and the Department of Health and Human Service’s Medicare site (http://www.medicare.gov). The 2008 Social Security Trustees reported that income to the combined OASDI Trust Funds amounted to $785 billion in 2007. During that year, an estimated 163 million people had earnings covered by Social Security and paid payroll taxes, and the trust funds paid benefits of more than $585 billion to almost 50 million beneficiaries.OASDI Board of Trustees, “Status of the Social Security Program: A Summary of the 2008 Annual Social Security,” http://ssa.gov/OACT/TR/TR08/II_highlights.html#76455 (accessed April 4, 2009).

The Medicare program is the second largest social insurance program in the United States, with 44.1 million beneficiaries and total expenditures of $432 billion in 2007.Boards of Trustees, Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, 2008, Annual Report, http://www.cms.hhs.gov/ReportsTrustFunds/ (accessed April 4, 2009).

This chapter includes the following discussion points:

Figure 18.1 The Links between Life Cycle Risks and Social Security Benefits

At this point in our study, we get into the foundation of different types of coverage for many of the life cycle, injury, and illness risks. In Chapter 19 "Mortality Risk Management: Individual Life Insurance and Group Life Insurance" to Chapter 20 "Employment-Based Risk Management (General)" we will talk about the risk management of all life cycle risks, but in this chapter, we will discuss a basic mandatory package of coverages that is tied to belonging to the work force in the United States. Social Security’s mandatory coverages comprise the first step in building the pyramid of coverages to ensure our complete holistic risk management process. Figure 18.1 "The Links between Life Cycle Risks and Social Security Benefits" depicts Social Security as the basic foundation of coverages for life cycle risks, which are part of our holistic risk picture.

As before, for our holistic risk management we need to look at all sources of coverage available. Understanding each component of the coverages from the various sources is critical to completing the picture and ensuring that we have adequately managed all our risks. Social insurance programs (including workers’ compensation and unemployment compensation discussed in Chapter 16 "Risks Related to the Job: Workers’ Compensation and Unemployment Compensation") play an important role in financial planning and should be considered when assessing the risk of economic loss due to premature death, disability, or retirement. The amount each individual must save for such situations is effectively reduced by the expected benefits from social insurance programs. The Social Security Administration (SSA) sends an annual statement to all workers that includes earnings history and projected future benefits. Table 18.1 "Estimated Average Monthly Benefits Payable as of December 2008" provides the estimated average income by beneficiary category as of December 2008.

Table 18.1 Estimated Average Monthly Benefits Payable as of December 2008

| Estimated Effect of a 5.8% COLA on Average Benefits | ||||

|---|---|---|---|---|

| Type of Benefit or Family | Before 5.8% COLA | After 5.8% COLA | Increase | |

| Benefit type | All retired workers | $1,090 | $1,153 | $63 |

| All disabled workers | 1,006 | 1,064 | 58 | |

| Family type | Aged couple | 1,773 | 1,876 | 103 |

| Surviving child(ren) onlyFamily with one or more children excludes surviving parent or guardian who is ineligible to receive benefits. | 936 | 991 | 55 | |

| Widowed mother and 2 children | 2,268 | 2,399 | 131 | |

| Aged widow(er) alone | 1,051 | 1,112 | 61 | |

| Disabled worker, spouse, and one or more children | 1,695 | 1,793 | 98 | |

| Note: The above estimates are based on actual benefit data through September 2008. | ||||

Source: Social Security Administration, October 16, 2008, Accessed April 5, 2009, http://www.ssa.gov/OACT/COLA/colaeffect.html.